Recently, the Ho Chi Minh City State Treasury held a media conference to report on the results of Ho Chi Minh City's state budget revenue and expenditure in 2024. The report said that the city's total budget revenue in 2024 exceeded the estimate, reaching nearly VND 510,000 billion. Of the 89 collectives commended for their contributions to the city, 59 were enterprises. In this enterprise sector, 33 enterprises contributed over VND 1,000 billion in taxes to the city, with many familiar names in the trade, manufacturing, finance, and insurance sectors.

|

| Prudential Vietnam representative received a certificate of merit at the event. (Source: Prudential Vietnam) |

Notably, in the finance-insurance group, there are 8 domestic and international banks, and a life insurance unit participating in the "Thousand Billion Taxpayer Club" in Ho Chi Minh City, Prudential Vietnam. This is considered one of the bright spots of the insurance market, in the current difficult context.

Bright spot in insurance market

According to Prudential representative, in the period from 2020-2023, the unit has fulfilled its tax obligation to pay nearly 4,000 billion VND in taxes to the state budget, of which 1,231 billion VND in 2023 alone.

Associate Professor, Dr. Dinh Trong Thinh, an economic expert, also said that the tax revenue of insurance companies, especially Prudential, has created a bright spot for the insurance market after many difficulties in confidence index and challenges of the market economy.

In fact, data from the General Statistics Office shows that in 2024, the total premium revenue of the entire insurance market is estimated to reach VND 227,500 billion, down slightly by 0.25% over the same period. Of which, life insurance premium revenue, although reaching VND 149,200 billion, has decreased by 5% compared to last year.

Thus, if we look at the whole industry picture, this is a positive signal to create growth momentum for 2025.

|

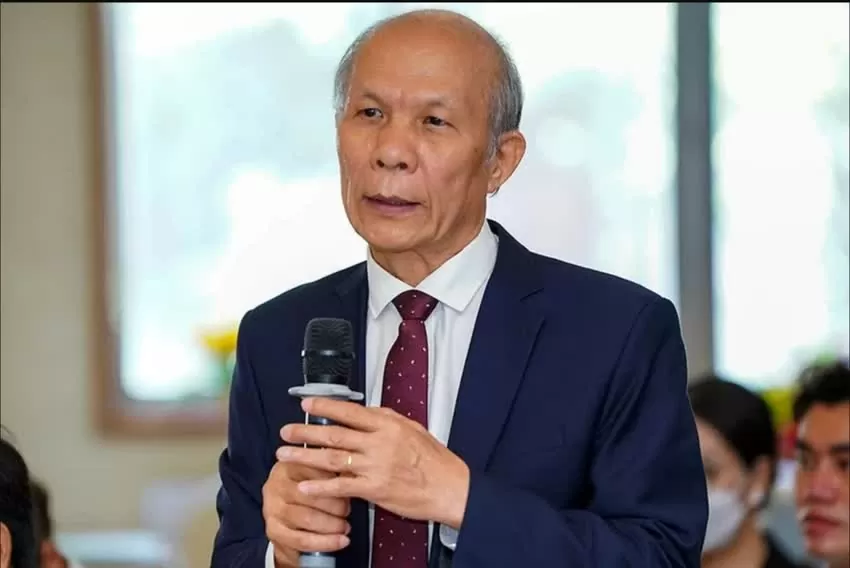

| Economist, Associate Professor, Dr. Dinh Trong Thinh said that tax revenue of insurance companies, especially Prudential, has created a bright spot for the insurance market. (Source: Prudential Vietnam) |

The insurance industry still has a lot of potential for development.

Looking at the list of 33 enterprises paying over 1,000 billion VND in taxes in 2024, Dr. Huynh Thanh Dien, an economic expert, also expressed his joy that most of the enterprises are in the fields of trade, services, finance, and insurance.

Accordingly, these units have brought in a large budget source for the city, contributing to increasing the city's general budget revenue, far exceeding the estimate. Specifically, by the end of 2024, the budget revenue of Ho Chi Minh City has approached VND 510,000 billion, while the plan assigned by the Ho Chi Minh City People's Committee is VND 482,851 billion.

“This is really an advantage for Ho Chi Minh City, showing that the economy is recovering, especially by the end of 2024,” commented Dr. Huynh Thanh Dien.

According to Dr. Huynh Thanh Dien, businesses face difficulties at the beginning of the year, but good growth at the end of the year will create the premise for a breakthrough in 2025. The same is true in the insurance industry. Dr. Huynh Thanh Dien also believes that when industries recover, especially manufacturing, it will lead to growth in the finance - insurance industry, thereby creating a new growth cycle.

From a business perspective, a Prudential representative informed that in 2025, the unit will continue to maintain the highest standards of governance and operations, ensuring compliance with industry changes. This will create a foundation to continue to create momentum for development, not only in products and services but also in the core team, ready to seize opportunities and overcome challenges in the future.

Associate Professor, Dr. Dinh Trong Thinh also said that with the legal framework and management of business changes in new products, the insurance industry will have a lot of room for development. Accordingly, the Ministry of Finance also predicted that total insurance premium revenue is expected to increase by 0.05% compared to the same period last year. Of which, insurance premium revenue in the non-life insurance sector will increase by 9.77% and life insurance sector is estimated to increase by 3%.

Comment (0)