That was one of the resolutions passed at LPBank's 2025 Annual General Meeting of Shareholders held on April 27 in Ninh Binh.

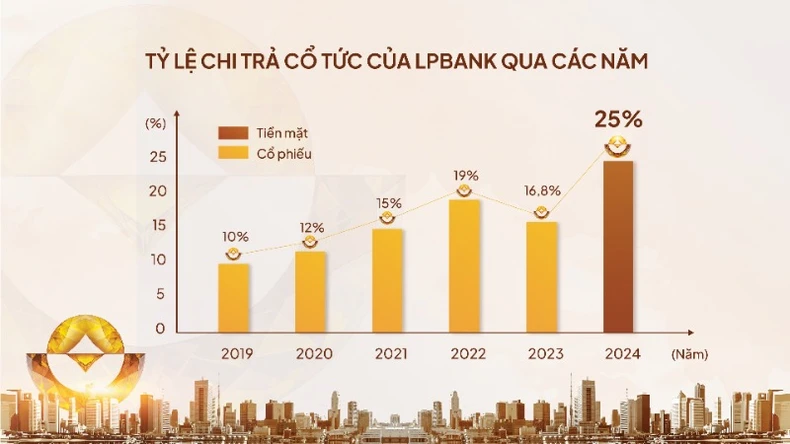

LPBank's dividend policy is always one of the factors that attracts special attention from shareholders. According to the resolution passed at the General Meeting, LPBank will pay cash dividends at the rate of 25%.

Chairman of the Board of Directors Nguyen Duc Thuy affirmed: LPBank always wants to bring maximum benefits to customers, shareholders and partners. “We want to pay the highest annual dividend possible. However, due to the unpredictable developments of the world and Vietnam's economic situation, we will submit to the General Meeting of Shareholders to pay dividends based on actual annual business results.

The Board of Directors also hopes that customers, shareholders and partners will continue to support and accompany the Bank to complete all set goals, as a basis for dividend payment," Mr. Nguyen Duc Thuy emphasized.

With attractive dividends and a sustainable development strategy, LPBank not only strengthens the trust of current shareholders but also opens up opportunities to attract new investors, thereby creating more momentum for the bank's development in the coming years.

LPBank's dividend payout ratio over the years. |

At the Congress, the Board of Directors' report also showed that LPBank had a breakthrough year in 2024 in many aspects. Notably, the bank's profit grew significantly faster than the growth rate of total assets and credit, clearly reflecting the quality of sustainable growth.

Operating costs are effectively controlled, while safety indicators still ensure compliance with the requirements of the State Bank. Return on equity (ROE) reached 25.1%, bringing LPBank to the leading group in the industry in terms of equity efficiency.

Along with positive business results, 2024 also marks a turning point in LPBank's digital transformation journey. The successful deployment of the T24 Core Banking system - recognized as the fastest in Asia - not only upgrades the core technology platform but also paves the way for a series of modern digital financial services.

Products such as LPBank Biz and the keyless switchboard… have helped the bank significantly enhance customer experience. This is an important premise for LPBank to consolidate its position in the era of comprehensive digitalization of the financial industry.

The congress also approved the 2025 business plan with many ambitious growth targets. Total assets are expected to reach VND 525,890 billion, up 3.5% over the same period, pre-tax profit is targeted at VND 14,868 billion, corresponding to a growth rate of 22.2% compared to the actual achievement in 2024.

Regarding the medium and long-term strategy, Mr. Ho Nam Tien, Permanent Vice Chairman of the Board of Directors, said that LPBank aims to become the leading retail bank in rural areas and type 2 urban areas, and at the same time be in the Top 5 in priority banking services in large cities.

For rural areas, LPBank aims to provide financial products and services that meet the needs of customers in these areas, contributing to promoting socio-economic development. In urban areas, the Bank focuses on improving its competitiveness to become one of the top choices for customers with high-quality and diverse services.

Board of Directors and Executive Board of Loc Phat Bank. |

Another strategic content approved by the Congress is the establishment of LPBank Debt Management and Asset Exploitation Company Limited (LPBank AMC). According to Mr. Bui Thai Ha, Vice Chairman of the Board of Directors, AMC will play an important role in handling bad debts, while becoming a flexible tool to exploit assets and enhance the financial capacity of the bank.

“AMC is not only a tool to reduce the burden on the bank but also a strategic lever to help LPBank strengthen its competitive position and expand its operations in the long term,” Mr. Ha emphasized.

Source: https://nhandan.vn/lpbank-danh-hon-7000-ty-dong-chia-co-tuc-bang-tien-mat-post875632.html

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

![[Photo] Art performance at the 50th Anniversary of Southern Liberation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/4/30/0141ab4d795b46529ba1f1db886eb53c)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

Comment (0)