Update gold price today 4/24/2025 latest in domestic market

At 3:00 p.m. on April 24, 2025, the domestic gold price today, April 24, 2025, increased sharply, SJC gold bars, gold rings, and jewelry all increased, reflecting the optimistic sentiment from international market signals. At the end of the gold price session on April 24, 2025, PNJ, DOJI, SJC, Bao Tin Minh Chau, Phu Quy, and Mi Hong recorded significant price increases.

PNJ listed SJC gold bars in Ho Chi Minh City, Hanoi, Da Nang, and the West at 118.5-121.5 million VND/tael, up 2.0 million VND/tael in both directions. PNJ gold (bars, plain rings) reached 113.5-116.8 million VND/tael, up 0.8 million VND for buying, 0.9 million VND for selling. 999.9 jewelry gold (plain rings, Kim Bao, Phuc Loc Tai) reached 113.5-116.8 million VND/tael, up 0.8-0.9 million VND. 999.9 jewelry gold: 113.5-116.0 million VND, up 0.8 million VND. 999 gold: 113.38-115.88 million VND, up 0.79 million VND. 750 gold (18K): 79.65-87.15 million, up 0.6 million. 585 gold (14K): 60.51-68.01 million, up 0.47 million. 416 gold (10K): 40.91-48.41 million, up 0.34 million. 916 gold (22K): 103.86-106.36 million, up 0.74 million.

DOJI announced SJC gold bars in Hanoi, Ho Chi Minh City, Da Nang: 118.5-121.0 million VND/tael, up 2.0 million for buying, 1.5 million for selling. 9999 gold material: 113.3-115.4 million, up 1.0 million. 999 gold: 113.2-115.3 million, up 1.0 million.

Saigon Jewelry Company listed SJC gold bars: 118.5-121.0 million VND/tael, up 2.0 million for buying, 1.5 million for selling. SJC 99.99% gold rings (0.3-5 taels): 113.5-116.5 million, up 1.0 million. 99.99% jewelry gold: 113.5-115.9 million, up 1.0 million.

99% gold: 109.75-114.75 million, up 0.99 million. Bao Tin Minh Chau: SJC gold bars 118.5-121.5 million VND/tael, up 2.0 million for buying, 1.5 million for selling. Phu Quy: SJC gold bars 118.0-121.0 million VND/tael, up 1.5 million for both directions.

Mi Hong: SJC gold bars 119.0-121.5 million VND/tael, up 2.0 million in both directions. Vietinbank Gold: Gold sold 121.0 million VND/tael, up 1.5 million.

The closing price of gold on April 24, 2025 shows that the market is growing strongly. Investors should monitor closely to make the right decision. Update gold price today April 24, 2025 at PNJ, DOJI, SJC.

At the end of the gold price session on April 24, 2025, the domestic gold market witnessed a strong recovery, causing investors and consumers to consider carefully before making a decision. The upward trend of gold prices today, April 24, 2025, reflects pressure from the international market, where gold prices are being affected by macroeconomic factors and supply fluctuations. Investors need to closely monitor the gold price movements today, April 24, 2025, to seize opportunities in this challenging market context.

As of 3:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 113.5-116.3 million VND/tael (buy - sell); an increase of 1 million VND/tael in both buying and selling directions compared to early this morning. The difference between buying and selling prices is at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.0-120.0 million VND/tael (buy - sell); an increase of 2 million VND/tael in both buying and selling prices compared to early this morning. The difference between buying and selling prices is 3 million VND/tael.

Gold price list today April 24, 2025 new in the country details:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.5 | ▲2000 | 121.0 | ▲1500 |

| DOJI Group | 118.5 | ▲2000 | 121.0 | ▲1500 |

| Red Eyelashes | 119.0 | ▲2000 | 121.5 | ▲2000 |

| PNJ | 113.5 | ▲800 | 116.8 | ▲900 |

| Vietinbank Gold | 121.0 | ▲1500 | ||

| Bao Tin Minh Chau | 118.5 | ▲2000 | 121.5 | ▲1500 |

| Phu Quy | 118.0 | ▲1500 | 121.0 | ▲1500 |

| 1. DOJI - Updated: April 24, 2025 15:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,500 ▲2000 | 121,000 ▲1500 |

| AVPL/SJC HCM | 118,500 ▲2000 | 121,000 ▲1500 |

| AVPL/SJC DN | 118,500 ▲2000 | 121,000 ▲1500 |

| Raw material 9999 - HN | 113,300 ▲1000 | 115,400 ▲1000 |

| Raw material 999 - HN | 113,200 ▲1000 | 115,300 ▲1000 |

| 2. PNJ - Updated: April 24, 2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 113,500 ▲800K | 116,800 ▲900K |

| HCMC - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Hanoi - PNJ | 113,500 ▲800K | 116,800 ▲900K |

| Hanoi - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Da Nang - PNJ | 113,500 ▲800K | 116,800 ▲900K |

| Da Nang - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Western Region - PNJ | 113,500 ▲800K | 116,800 ▲900K |

| Western Region - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Jewelry gold price - PNJ | 113,500 ▲800K | 116,800 ▲900K |

| Jewelry gold price - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Jewelry gold price - Southeast | PNJ | 113,500 ▲800K |

| Jewelry gold price - SJC | 118,500 ▲2000K | 121,500 ▲2000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 113,500 ▲800K |

| Jewelry gold price - Kim Bao Gold 999.9 | 113,500 ▲800K | 116,800 ▲900K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 113,500 ▲800K | 116,800 ▲900K |

| Jewelry gold price - Jewelry gold 999.9 | 113,500 ▲800K | 116,000 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 113,380 ▲790K | 115,880 ▲790K |

| Jewelry gold price - Jewelry gold 9920 | 112,670 ▲790K | 115,170 ▲790K |

| Jewelry gold price - Jewelry gold 99 | 112,440 ▲790K | 114,940 ▲790K |

| Jewelry gold price - 750 gold (18K) | 79,650 ▲600K | 87,150 ▲600K |

| Jewelry gold price - 585 gold (14K) | 60,510 ▲470K | 68,010 ▲470K |

| Jewelry gold price - 416 gold (10K) | 40,910 ▲340K | 48,410 ▲340K |

| Jewelry gold price - 916 gold (22K) | 103,860 ▲740K | 106,360 ▲740K |

| Jewelry gold price - 610 gold (14.6K) | 63,410 ▲490K | 70,910 ▲490K |

| Jewelry gold price - 650 gold (15.6K) | 68,050 ▲520K | 75,550 ▲520K |

| Jewelry gold price - 680 gold (16.3K) | 71,530 ▲540K | 79,030 ▲540K |

| Jewelry gold price - 375 gold (9K) | 36,150 ▲300K | 43,650 ▲300K |

| Jewelry gold price - 333 gold (8K) | 30,930 ▲260K | 38,430 ▲260K |

| 3. SJC - Updated: 04/24/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,500 ▲2000K | 121,000 ▲1500K |

| SJC gold 5 chi | 118,500 ▲2000K | 121,020 ▲1500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,500 ▲2000K | 121,030 ▲1500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,500 ▲1000K | 116,500 ▲1000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,500 ▲1000K | 116,600 ▲1000K |

| Jewelry 99.99% | 113,500 ▲1000K | 115,900 ▲1000K |

| Jewelry 99% | 109,752 ▲990K | 114,752 ▲990K |

| Jewelry 68% | 72,969 ▲680K | 78,969 ▲680K |

| Jewelry 41.7% | 42,485 ▲417K | 48,485 ▲417K |

Update gold price today 4/24/2025 latest in the world

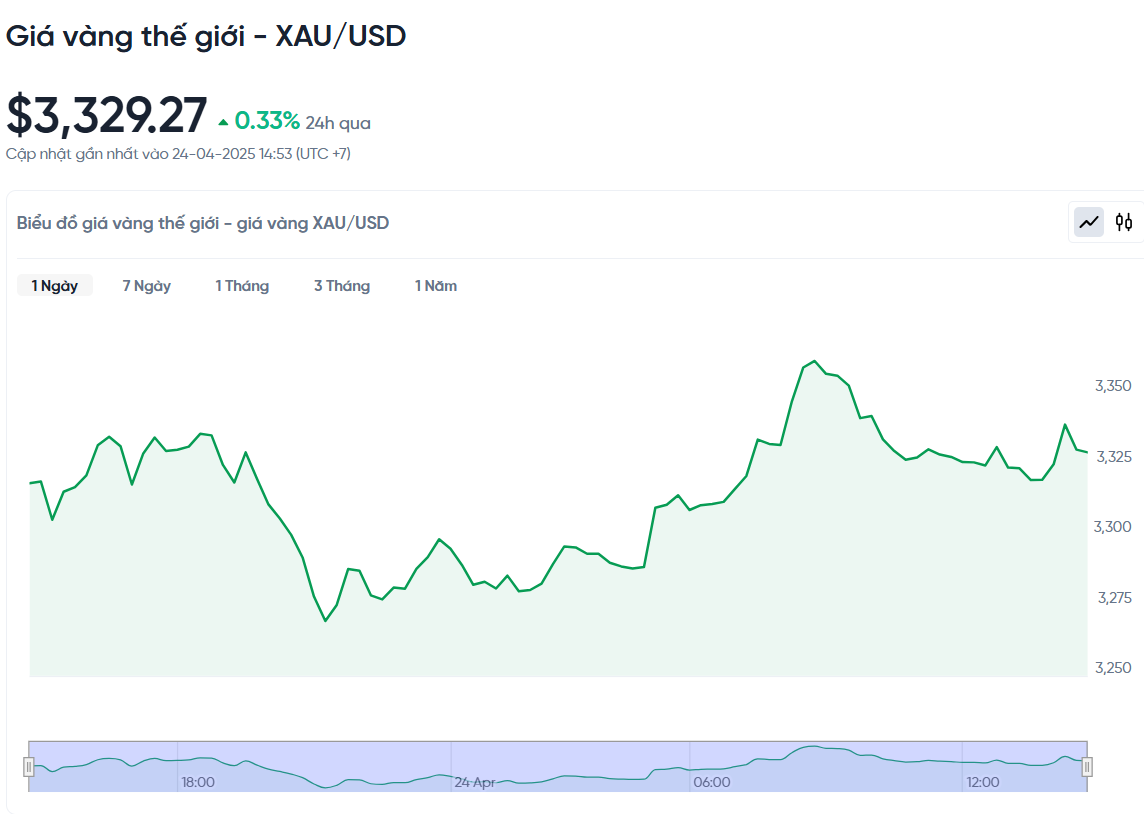

At the time of trading at 3:30 p.m. on April 24, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,329.27 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 105.33 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (118.5-121.0 million VND/tael), the SJC gold price is currently about 15.67 million higher than the international gold price.

The price of gold on the world market today, April 24, 2025, is at a very high level, reaching about 3,329.27 USD/ounce, equivalent to more than 105 million VND/tael of gold, not including taxes or fees. The price of gold today, April 24, 2025, on the world market increased by more than 1% compared to the previous day, while the price of US gold futures also increased similarly, to 3,330.20 USD. This increase in price comes from many investors taking advantage of buying when the price of gold fell to its lowest level of the week, especially after there were positive signals about the trade agreement between the US and China. For those who are not familiar with economics, it can be simply understood that when the price of gold falls, many people see this as an opportunity to buy, helping the price of gold increase again.

Gold has long been seen as a safe place to park your money, especially when the world is in turmoil. Although gold prices hit a record high of $3,500.05 on Tuesday, they fell below $3,300 just a day later. This week’s volatility in gold prices has been driven largely by technical factors and major news, according to Capital.com expert Kyle Rodda. However, he stressed that demand for gold remains strong because the fundamentals of the market favor gold. In other words, while gold prices may fluctuate in the short term, many investors believe in the long-term value of gold.

Some information related to US trade policy also affected the gold price today. US Treasury Secretary Scott Bessent said that the current high tariffs between the US and China cannot last forever and need to be reduced so that the two countries can negotiate trade. However, President Donald Trump has no intention of unilaterally reducing tariffs on Chinese goods. In addition, Mr. Trump is considering exempting some taxes for the auto manufacturing industry after receiving lobbying from businesses. These moves have caused volatility in the gold market, as trade policies can affect the global economy and increase demand for gold to protect assets.

Finally, the US dollar fell slightly by 0.2% against other currencies today, making gold cheaper for foreign buyers. This also contributed to the increase in gold prices today. Meanwhile, other precious metals such as silver, platinum and palladium had less positive developments, with silver falling 0.8% to $33.29 per ounce, platinum falling slightly and palladium remaining virtually unchanged. For non-economists, it is understandable that today's gold price increase is mainly due to the buying sentiment on dips, along with developments related to international trade and the value of the dollar.

News, gold price trends today April 25, 2025 domestic and world gold prices

At the close of trading on April 25, the world gold price increased to 3,288 USD/ounce. However, in the morning session on April 24, the precious metal increased to 3,329.27 USD. The market has been under pressure in the past few days as demand for risky assets recovered, after US President Donald Trump affirmed that he has no plans to fire Fed Chairman Jerome Powell and signaled that trade tensions with China have cooled down. Since reaching a peak of 3,500 USD on April 22, the gold price has decreased by more than 3%.

"The market is starting to get over the shock caused by import tariffs. Soon, money will withdraw from some safe-haven assets and return to hunting for stocks like Apple and Tesla," said Phillip Streible, chief strategist at Blue Line Futures.

The U.S. dollar also rose, helping to push gold lower. It rose more than 1% against major currencies including the yen, euro and Swiss franc. A stronger dollar makes gold more expensive for buyers using other currencies.

US Treasury Secretary Scott Bessent said on April 23 that he believes high tariffs between the US and China will come down to allow trade talks to proceed. A spokesman for the Chinese Foreign Ministry also said that China is open to negotiations with the US. However, the country warned that it would not negotiate under the threat of the White House.

Gold prices have risen more than 26% this year, driven by central bank buying, a tariff war and strong investment demand. "The sharp decline in the price from the peak of $3,500 on the technical charts suggests a deep correction in the short term," said Ole Hansen, head of commodity strategy at Saxo Banks.

Meanwhile, silver rose 3% to $33.40 an ounce. Platinum rose 1% to $969 and palladium was steady around $935.

Source: https://baodaknong.vn/gia-vang-hom-nay-24-4-2025-gia-vang-trong-nuoc-va-gia-vang-the-gioi-tiep-tuc-tang-cao-250481.html

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] People choose places to watch the parade from noon on April 29](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/3f7525d7a7154d839ff9154db2ecbb1b)

Comment (0)