Coc Coc's report focused on assessing changes in user behavior, opinions, benefits and concerns after a period of practical experience with the new security measures.

According to Decision No. 2345/QD-NHNN of the State Bank, from July 1, 2024, all transactions over VND 10 million/time or over VND 20 million/day are required to be authenticated by biometrics to enhance security and protect consumers from fraud risks.

Nearly 1 month after the regulation was officially applied, to update users' views on biometric authentication in online money transfer transactions, Coc Coc conducted a large-scale online survey with users on this platform.

Hanoi and Ho Chi Minh City have the highest installation success rates

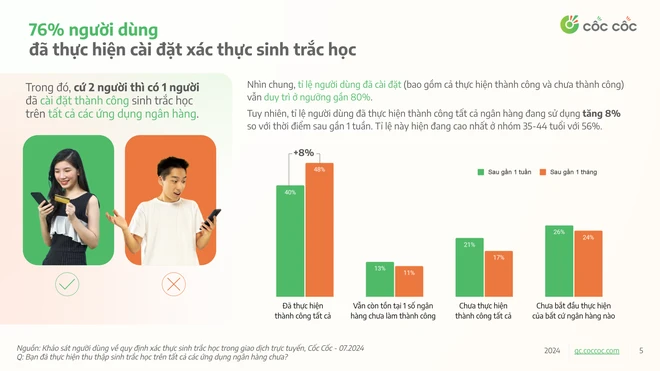

According to Coc Coc representative, 76% of surveyed users have installed biometric authentication, including both successful and unsuccessful implementation. Of which, 1 in 2 people have successfully installed biometrics on all banking applications they are using.

Overall, at the two survey points, the percentage of users who had completed the installation remained at nearly 80%. However, the percentage of users who had successfully completed all the banks they were using increased by 8% compared to the time point after nearly a week earlier. This percentage is currently highest in the 35-44 age group at 56%.

Hanoi and Ho Chi Minh City are still the two regions with the highest rate of successful installation of all banks in use. The Central region also quickly caught up with the highest successful authentication rate compared to the whole country with an increase of 11% compared to the time after nearly 1 week of applying the regulation.

The survey results show that the authentication experience is getting easier for the majority of users. With 45% of users rating the collection process as easy/very easy, up 7% from the previous survey. At the same time, the percentage of users finding it difficult decreased from 31% to 22%.

Users under 45 years old showed that they are adapting faster to the new regulations, with 48% finding it easy/very easy to update their biometrics, while the rate for users over 45 years old was 38%.

However, there are still some difficulties in the implementation process. For the current large-scale survey, "Difficulty in facial recognition" and "Incompatible devices" are the problems that affect the user authentication experience with increasing rates.

"Unable to read NFC," "Difficult to take a photo of ID card/read QR code," "Required to update ID card information at the bank" are problems that seem to have been gradually resolved with a lower rate than before.

How has user perception changed?

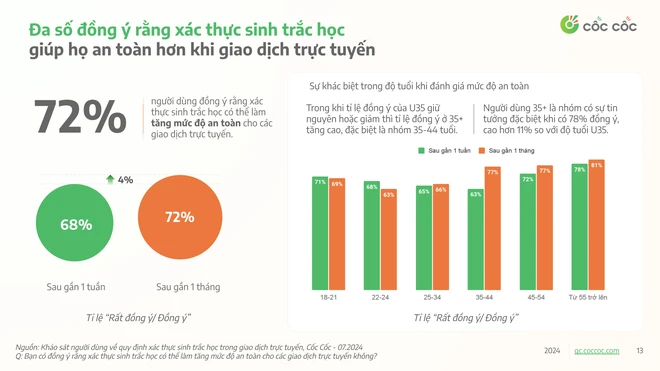

The majority of users agree that biometric authentication makes them safer when transacting online, with 72% of users agreeing, up 4% from the previous survey. Among users over 35, there is a particular trust, with 78% of respondents agreeing, 11% higher than those under 35.

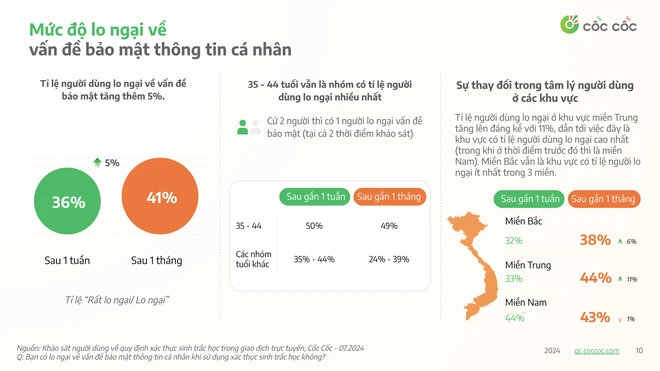

However, 41% of respondents still said they were concerned about personal information security when performing biometrics, a 5% increase compared to the previous period. Specifically, at the two survey times, the age group of 35 - 44 years old was still the group with the highest percentage of users concerned with approximately 50%.

There are also some changes in the user sentiment on this issue in different regions. The percentage of users who are concerned in the Central region has increased significantly by 11%, making it the region with the highest percentage of users who are concerned. Meanwhile, the North is still the region with the lowest percentage of users who are concerned among the three regions.

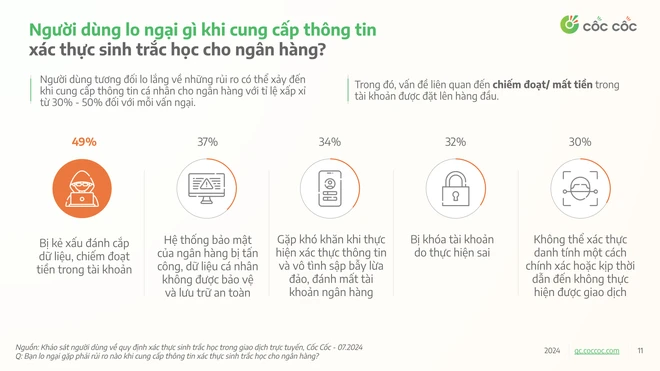

When asked about concerns about risks encountered during the biometric implementation process, users were relatively worried about the risks that could occur when providing personal information to banks, with a rate of approximately 30% - 50% for each concern.

Among them, the issue of account theft/loss of money is at the top of the list. Young users and women show that they are especially worried about scams that can occur during online transactions. Specifically, while only 22% of people over 45 are concerned, up to 40% of young users are concerned about this issue. This rate is 10% higher among women than men.

According to the general perception of users, safety and convenience are the biggest advantages of biometric authentication when transacting online. Quick operation and ease of use are the outstanding advantages drawn after the usage process. However, 17% of users still find no advantages in this security measure.

Most users evaluate the limitations of this method mainly from the experience when performing it, such as difficulty in low light, wet fingers... or time-consuming and difficult to operate.

The U25 age group is the age group that has many problems related to difficulty in using certain conditions. Meanwhile, the 25-34 age group is more concerned about the time it takes to complete a transaction. The age group over 35 shows that they are more “easy-going” when the evaluation rate for all factors is much lower than the group under 35.

According to survey statistics, 51% of users have successfully authenticated all transactions made from 10 million/time or 20 million/day or more. Besides, there are still users who failed to authenticate transactions. In the past month, 1 out of 3 users have encountered 1-2 failed authentications.

Most users were neutral in their assessment of transaction times when using biometric authentication. Notably, the rate of rating transactions as fast/very fast was 2.6 times higher than that of rating slow/very slow.

Up to 54% of users who make transactions of 10 million/time or 20 million/day with daily frequency have good reviews about transaction speed, this rate is 1.3 times and 1.5 times higher than users who make transactions weekly and monthly.

When asked about the decision to "stop all transactions if customers do not provide biometric data from January 1, 2025", 64% of users said that the decision was necessary/very necessary, 10% of users rated it as unnecessary/very unnecessary.

It can be seen that, with a large-scale survey at the time of 1 month after applying the regulation, users have gradually become more familiar and adapted to the new security measures. The difficulties in the installation process have gradually improved.

However, in the context of online fraud becoming more and more sophisticated and complex, users still have concerns and worries about the information security risks they may encounter./.

Comment (0)