Investors sold off this morning after Mr. Trump imposed tariffs - Photo: QUANG DINH

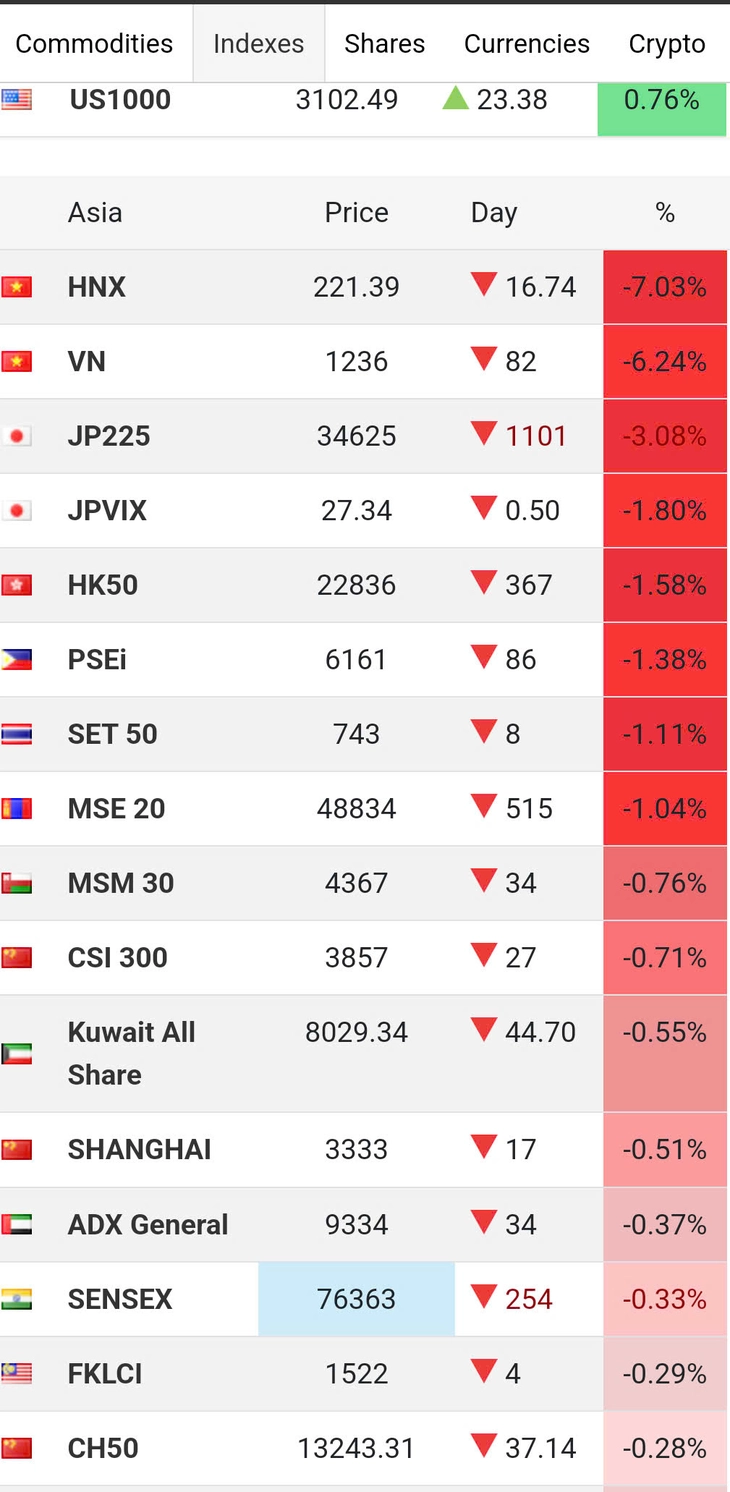

VN-Index closed this morning's session (April 3) with a decline of 82 points, equivalent to a loss of more than 6.2%. The index fell back to 1,235 points under record selling pressure from investors.

Looking at other markets in Asia, most reacted negatively. However, Vietnam was still the country with the sharpest decline in stock indexes.

The Japanese stock index also reacted very strongly, but only decreased by about 3%, lower than the downward trend of the VN-Index.

The Shanghai Composite, China's main stock index, fell 0.51%, despite the country also having very high tariffs.

Vietnam stock index drops the most in the region

Speaking to Tuoi Tre Online , Mr. Nguyen The Minh - director of analysis for individual clients of Yuanta Vietnam Securities Company - said that this was not only the sharpest decline in Asia, but also a record in the history of the stock market, if only considering the score.

Before that, the 2008 period had a higher decline, if calculated in percentage terms. “But if only calculating the score, it was the highest ever,” Mr. Minh said.

Recalling the period of January 2021, VN-Index was under fierce correction pressure, losing 73 points.

Not only the score, Mr. Minh said that the liquidity of this trading session was also at a record level, when the total transaction value was approximately 34,000 billion VND in just the morning.

Mr. Minh reassured investors that they need to calmly restructure their portfolios and not sell off at all costs and in panic.

The 46% tax rate proposed by Mr. Trump will only take effect on April 9. Vietnam still has a week to negotiate. “Deputy Prime Minister Ho Duc Phoc’s trip to the US is expected to renegotiate the reciprocal tax rate that the US president’s administration has proposed on Vietnam to 46%,” Mr. Minh said.

“In many years of following the market, I have never seen such a sharp decline,” Mr. Bui Van Huy - director of investment research FIDT - observed and commented to Tuoi Tre Online right after the session ended.

What Mr. Huy is concerned about is that the margin loan is very high due to high expectations for the stock market. This outstanding debt will pose a huge risk to the stock market.

“Foreign investors are net sellers, but many domestic investors are too optimistic about the market's positivity, so recently the margin debt on capitalization has reached a record high,” Mr. Huy warned.

Answering the question of many investors “should we buy at the bottom?”, Mr. Huy said that there are people who sell strongly, but there are also people who are willing to pour money into buying. However, according to Mr. Huy, we should spend more time observing. The amount of excess floor sales is still large, the possibility of pressure on the market is still high.

Source: https://tuoitre.vn/chung-khoan-viet-nam-mat-hon-82-diem-giam-manh-nhat-chau-a-sau-tin-my-ap-thue-45-20250403123324286.htm

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

Comment (0)