Policies to promote investment channels

In the first 6 months of 2024, GDP increased by 6.42%, only lower than the growth rate of 6.58% in the first 6 months of 2022 if considering the period 2020-2024. Entering the third quarter of 2024, economic experts are also very optimistic about the growth rate of the economy. Although industries such as real estate and aviation are still facing many difficulties, groups such as chemicals, steel, seafood, and telecommunications technology have outstanding results.

The solid foundation for economists' optimism is the policies that will take effect in the near future. This will be the driving force for investment channels.

According to Dr. Le Xuan Nghia - member of the National Financial and Monetary Policy Advisory Council, the most prominent policy highlights from now until the end of 2024 are 3 laws: Land Law, Housing Law, Real Estate Business Law taking effect on August 1, 2024. In particular, there are a number of decrees detailing a number of articles of the above 3 laws under the Government's authority to issue decrees.

"The decrees detailing a number of articles of the Land Law, Housing Law, and Real Estate Business Law are being finalized in the final stages and the Government has also issued a Decree on the establishment and management of database information on housing and the real estate market; a Decree stipulating a number of articles of the Housing Law on the development and management of social housing. Thus, there will be up to 7 Decrees under the Government's authority to issue related to the above 3 laws" - Dr. Nghia said.

According to experts, the positivity and effectiveness of these policies are creating great momentum and hope for the real estate market, and even affecting other asset markets such as the stock market, corporate bonds, etc., helping these markets recover and become more positive at the end of the year.

Dr. Nghia said that many foreign investors, both direct and indirect, highly appreciate the shortening of the validity period of the above three laws, creating confidence for investors to expand investment in production and business and return to the stock market positively.

It is worth noting that our country's monetary policy continues to be loosened. The Government, directly the State Bank, continues to direct credit institutions to reduce lending interest rates for production and business enterprises. Moreover, in the last 6 months of 2024, Circular 02 on extending, deferring, and maintaining debt groups for enterprises aims to continue pumping credit into the economy.

Fiscal policy continues to maintain policies to reduce taxes, fees, and charges to support businesses, and budget revenue continues to increase in reality.

"Despite geopolitical difficulties, Vietnam's trade relations with major partners continue to be stable and growing. The international trade surplus continues to increase even in the context of high import growth. This shows that Vietnam has taken advantage of the recovery of international trade quite well even in the context of conflicts in some areas," said Dr. Nghia.

Sharing the same optimism as Dr. Nghia, Dr. Nguyen Tri Hieu - an economic expert, commented: With the results achieved in the first half of 2024, Vietnam's economic outlook will continue to be positive for the second half of the year if the US Federal Reserve (FED) decides to lower interest rates, reducing pressure on the USD/VND exchange rate, inflation and positively impacting other macro balances.

The stock market has had good growth.

Among the investment channels with good prospects in the last 6 months of the year, experts pay special attention to the stock market.

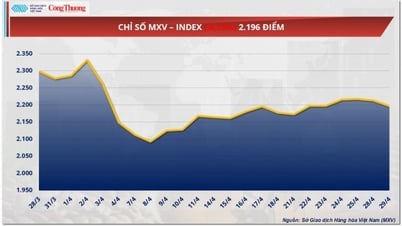

Dr. Nguyen Tri Hieu commented that in the first 6 months of 2024, the stock market was affected by many investment decisions of foreign investors and fluctuations in the international financial market. However, when looking at the VN-Index, we can see that the stock market has had good growth.

In the second half of 2024, the stock market will be more stable and better than the first half of 2024 because this is the "test barometer" of the economy. If the economy recovers strongly in the second half of 2024, the stock market will reflect that strong recovery. Dr. Hieu believes that sustainable and attractive stocks will be those related to industrial parks, renewable energy, transportation and especially the banking sector.

Source: https://laodong.vn/kinh-doanh/trien-vong-tang-truong-kinh-te-viet-nam-trong-nua-cuoi-nam-1373709.ldo

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

Comment (0)