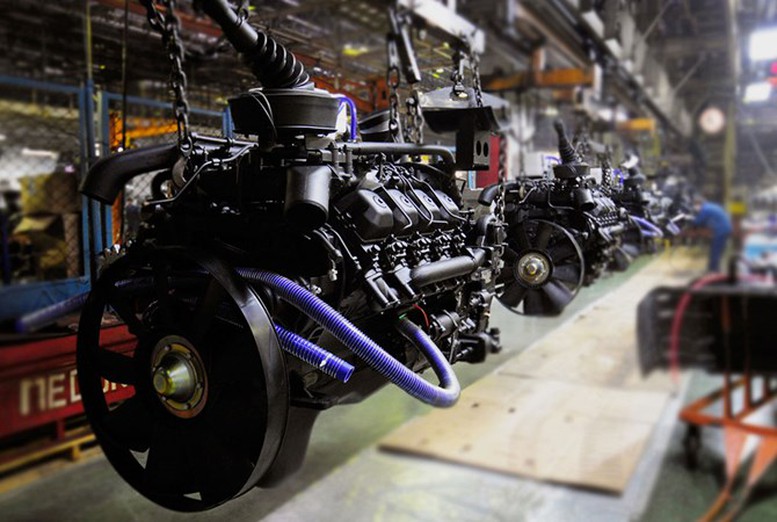

Motor vehicles manufactured by joint ventures for use in the territory of the Socialist Republic of Vietnam must meet technical requirements according to Vietnamese regulations.

This Decision stipulates the process of allocating tariff quotas, procedures for granting import licenses under tariff quotas, import tax rates within and outside tariff quotas, and the coordination mechanism between state agencies to implement the import mechanism under tariff quotas for motor vehicles and SKD sets within the framework of the Protocol.

SKD kit is a set of spare parts and components, imported into the territory of Vietnam by a joint venture and necessary for the industrial assembly of motor vehicles within the quota granted under the Protocol, except for spare parts and components manufactured in the territory of Vietnam.

Requirements for joint ventures

The Decision stipulates the requirements for joint ventures including:

1- Legal entities established under agreements signed between authorized enterprises of the Russian Federation and interested enterprises of Vietnam on the territory of Vietnam in accordance with the provisions of Vietnamese law.

2- Each authorized enterprise of the Russian Federation is allowed to establish only one joint venture in Vietnam.

3- The capital contributed by Vietnamese enterprises in the joint venture must reach at least 50% of the total charter capital of the joint venture.

4- Joint ventures must be established and operated for at least 10 years and no more than 30 years.

5- Authorized enterprises of the Russian Federation may not transfer capital in joint ventures to any third party of a third country.

6- The localization rate that joint ventures must achieve by 2025 is as follows:

- UAZ brand sports utility vehicles (SUVs): 40%

- Vehicles with 10 seats or more, including driver: 50%

- Truck: 45%

- Specialized vehicles: 40%

The Decree clearly states that if the joint venture(s) fail to produce motor vehicles that meet the above localization ratio requirements within 10 years from October 5, 2016, the Establishment License/Business Registration of the joint venture(s) will be revoked.

7- Motor vehicles manufactured by the joint venture for use in the territory of the Socialist Republic of Vietnam must meet technical requirements, standards and conformity assessment procedures as prescribed by Vietnamese law.

8- Joint ventures must comply with the provisions of Vietnamese law.

Import duties within and outside quotas

In addition, the Decision also provides guidance on import taxes within and outside the quota.

The import tax rate within the tariff quota is 0% in case the following conditions are satisfied:

a- The origin of motor vehicles and the origin of SKD sets imported by joint venture(s) for industrial assembly in the territory of Vietnam, if used for assembly into complete motor vehicles in the territory of the Russian Federation, must be confirmed by a Certificate of Origin issued indicating a value added content of not less than 55%, according to the following formula for calculating the value added content (VAC):

VAC = ((FOB Value - Value of non-originating materials)/FOB Value)x 100%

In which, the value of raw materials of non-originating origin will be:

CIF value at the time of import of raw materials in a Party; or

The first price paid or payable for non-originating materials in the territory of a Party where working or processing takes place.

In the territory of Vietnam or the Russian Federation, when manufacturers of goods purchase raw materials of non-originating origin in that country, the value of such raw materials shall not include transportation, insurance, packaging costs and other costs incurred for transporting the materials from the supplier's location to the place of production.

b- All motor vehicles and SKD sets imported into Vietnam by the joint venture(s) must be new, unused goods.

c- Motor vehicles imported by the joint venture(s) must be manufactured no more than 02 years prior to the year of arrival at a Vietnamese port or border gate.

For out-of-quota import tax rates

In case of goods with a Certificate of Origin under the VN - EAEU FTA Agreement (Certificate of Origin form EAV), the import tax rate outside the tariff quota is the current import tax rate according to the commitment in the VN - EAEU FTA Agreement;

In case the goods are not accompanied by a Certificate of Origin form EAV, the import tax rate outside the tariff quota is determined according to the relevant tax laws of Vietnam.

Phuong Nhi

Source: https://baochinhphu.vn/huong-dan-thuc-hien-nghi-dinh-thu-voi-lien-bang-nga-ve-ho-tro-san-xuat-phuong-tien-van-tai-co-dong-co-102241122164426701.htm

Comment (0)