|

| Overview of Eximbank's General Meeting of Shareholders held on the morning of April 29 |

On April 29, 2025, Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HoSE: EIB) held its 2025 Annual General Meeting of Shareholders (AGM). The meeting took place in the context of Eximbank achieving impressive business results and many positive changes within the bank.

2024 business results improve, set record profit

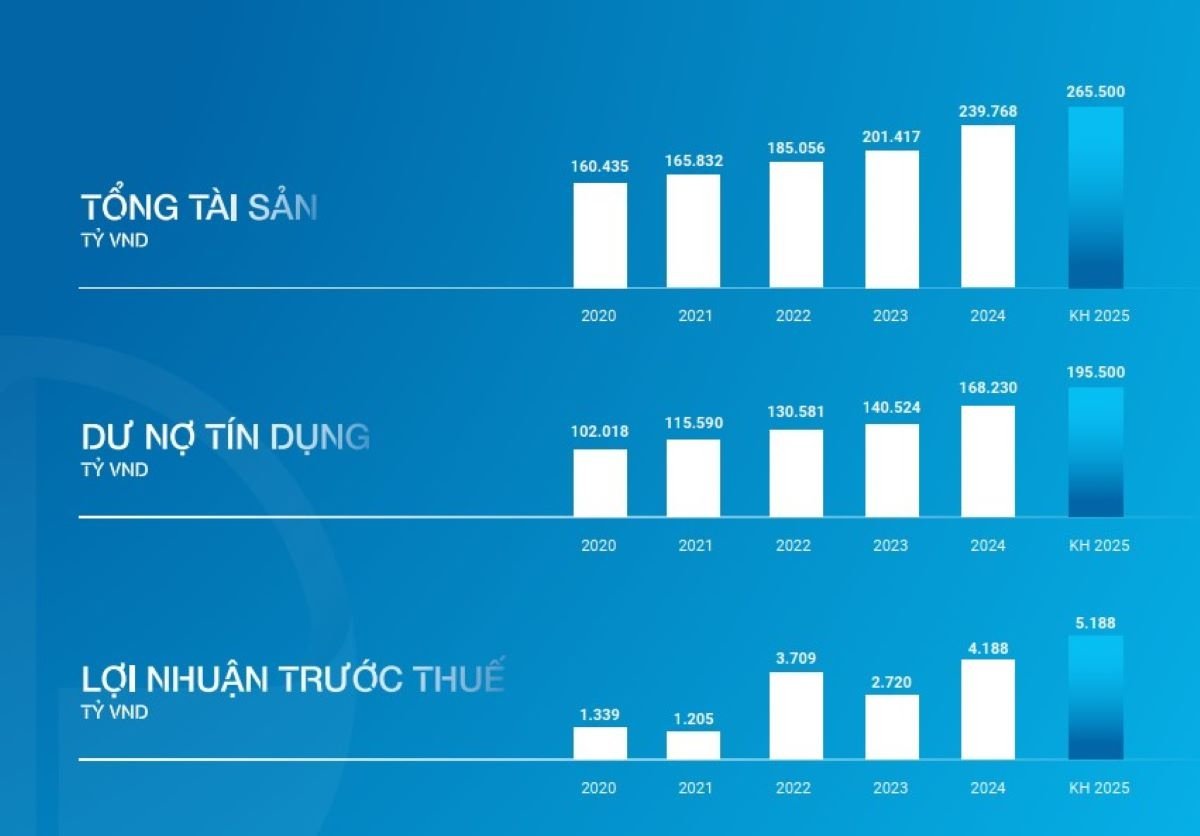

According to Eximbank's report, in 2024, the bank's profit exceeded VND4,188 billion for the first time, up 54% over the previous year. This is the bank's record high profit after more than 3 decades of operation.

By the end of 2024, Eximbank's total assets increased by 19% to VND 239,768 billion, capital mobilization reached VND 178,312 billion, up 12.6% over the previous year. Outstanding credit growth was the highest in half a decade (compared to 2019) when it reached VND 168,230 billion, up VND 27,706 billion, equivalent to a growth of 19.72% over the beginning of the year.

Eximbank's financial picture has some highlights, in which Eximbank's total operating income reached VND8,558 billion for the first time, up 31% year-on-year. The average CASA scale grew by 24.8% compared to 2023. Instead of increasing output interest rates, the bank proactively restructured its asset and capital structure, thereby controlling the cost of capital (COF), resulting in an increase in NIM to 2.81%. Eximbank's bad debt quality has improved, with the bad debt ratio falling to 2.53%. Group 2 debt has remained stable at around 1%.

|

| Total assets, outstanding credit, pre-tax profit of Eximbank from 2020 to present |

Eximbank has controlled operating costs well, with the CIR ratio dropping sharply to 39.73% compared to more than 47.92% in 2023.

Approval of 2025 business plan

Regarding the 2025 business plan, Eximbank targets total assets to increase by 10.7% to VND265,500 billion, capital mobilization of VND206,000 billion, up 15.5% over the previous year. Outstanding credit is expected to increase by 16.2% to VND195,500 billion. Pre-tax profit target exceeds VND5,188 billion, up 23.8% over 2024.

Eximbank's leaders emphasized that the special task in 2025 and the coming years is to develop the customer base, position the target segment, improve efficiency and increase competitiveness. Eximbank will restructure its finance and asset portfolio, strictly control credit quality, and promote a centralized debt handling model. Improve capital efficiency, improve profitability indicators, strengthen financial capacity and risk response ability.

Regarding the development of a strategy for the next 5 years, the bank's leaders said that this is mandatory and needs to be done systematically. On the one hand, Eximbank self-assesses its strengths, weaknesses, opportunities, and challenges and cooperates with international strategic consulting units to create the best strategy. From there, it aims to build a bank with its own identity, transparency, efficiency, creating value for customers, serving the community, and bringing the greatest benefits to shareholders.

Mr. Nguyen Hoang Hai - Acting General Director of Eximbank shared: “Shareholders can trust in the quality of the bank's assets. In the near future, we will streamline, optimize and improve operational efficiency, bringing benefits to customers, shareholders and employees. The team will act unanimously to catch up with market trends, doing everything in a controlled and practical manner”.

The head of the bank's Board of Directors emphasized that Eximbank will aim to build a bank with sustainable development, stable governance structure, and especially there will be a huge change in the bank's appearance, image, and position in the market.

Regarding the issue of not paying dividends in 2025, Eximbank Chairman Nguyen Canh Anh said that he fully understands the wishes of shareholders regarding dividends. However, the Board of Directors assessed that 2025 will still have many uncertainties both internationally and domestically. According to Eximbank's long-term strategy, the bank is preparing many resources for risk management towards applying Basel III standards, as well as meeting the increasingly high requirements from the State Bank, Eximbank has decided not to pay dividends in 2025.

“This is not something negative but a proactive decision by the Board of Directors to contribute to creating solid value for the bank, responding to economic fluctuations. This capital source will also be further enhanced for digital transformation, increasing bank efficiency, thereby increasing value for shareholders,” said the Chairman of Eximbank’s Board of Directors.

Election of new members of the Board of Directors and Supervisory Board

Personnel issues are of particular concern to shareholders at this year's Eximbank Annual General Meeting of Shareholders. Accordingly, with high consensus and unanimity, the Congress elected the Board of Directors and the Supervisory Board for the new term (2025-2030).

As a result, the 5 new Board members include: Mr. Nguyen Canh Anh, Ms. Do Ha Phuong, Mr. Pham Tuan Anh and 2 independent Board members: Mr. Hoang The Hung and Ms. Pham Thi Huyen Trang.

Along with that, the structure of the Board of Directors for the 2025-2030 term nominated two independent members to ensure the new requirements of the Law on Credit Institutions 2024, ensuring the operation of the Board of Directors is independent, objective and transparent.

In the process of comprehensive transformation of the bank, Eximbank aims to perfect the quality Board of Directors, attract candidates with diverse expertise, experience and enthusiasm, to be able to develop strategies and effectively manage the bank in the new period, towards a transparent, effective, safe and sustainable organization.

The Congress also unanimously elected 5 members of the Board of Supervisors for this term, including: Ms. Doan Ho Lan, Mr. Lam Nguyen Thien Nhon, Mr. Nguyen Tri Trung, Ms. Tran Thi Minh Ly and Mr. Hoang Tam Chau.

|

| Board of Directors and Supervisory Board for the 2025-2030 term |

The congress also approved the regulation that the total shareholding of foreign investors in Eximbank shall not exceed 6% in order to attract strategic investors, and at the same time amended and supplemented the Eximbank charter; approved the termination of the investment policy to build Eximbank's Headquarters in Ho Chi Minh City and other important contents.

The general context of 2025 also poses many challenges, the competition in the banking industry is increasingly fierce, but Eximbank is entering a period of comprehensive transformation with new thinking, new ways of doing things, focusing on customers and focusing on internal audit, risk management, protecting the rights of customers, employees, shareholders and continuing to build values for the Eximbank brand after 35 years of establishment.

With consensus and unanimity of up to 99%, the Congress approved all reports, proposals and many important contents.

Source: https://thoibaonganhang.vn/dhdcd-thuong-nien-eximbank-2025-thong-qua-muc-tieu-loi-nhuan-gan-5200-ty-dong-163543.html

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

Comment (0)