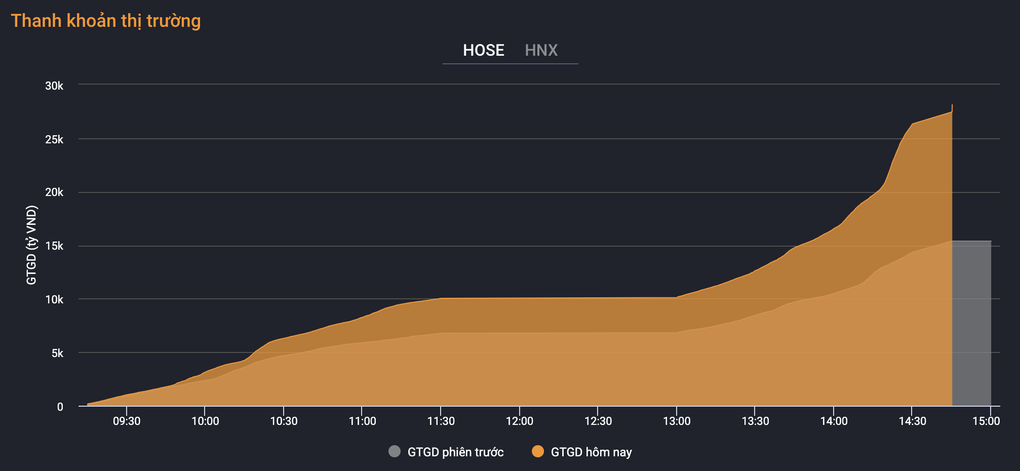

Liquidity today (July 17) increased dramatically on all three exchanges. The volume of shares transferred on the HoSE floor jumped to 1.23 billion units with the amount of money poured into transactions reaching VND 29,324.07 billion.

On HNX, trading volume was 87.8 million shares equivalent to VND1,905.23 billion and on UPCoM, the figure was 87.14 million shares equivalent to VND1,533.51 billion.

Liquidity skyrocketed compared to the session on July 16 (Source: VNDS).

The breakthrough in liquidity after a series of gloomy trading periods recently came from a sudden plunge since 2 p.m. The index charts seemed to be bent. VN-Index lost nearly 20 points at one point before closing down 12.52 points, equivalent to 0.98%, adjusting to 1,268.66 points. HNX-Index decreased by 4.01 points, equivalent to 1.64%, and UPCoM-Index decreased by 0.98 points, equivalent to 1%.

Although the indexes' losses were narrowed, many stocks still fell sharply, with 26 stocks being sold off and hitting the floor. The number of stocks falling on HoSE was more than 3 times the number of stocks rising, and on HNX, the difference was even 5 times.

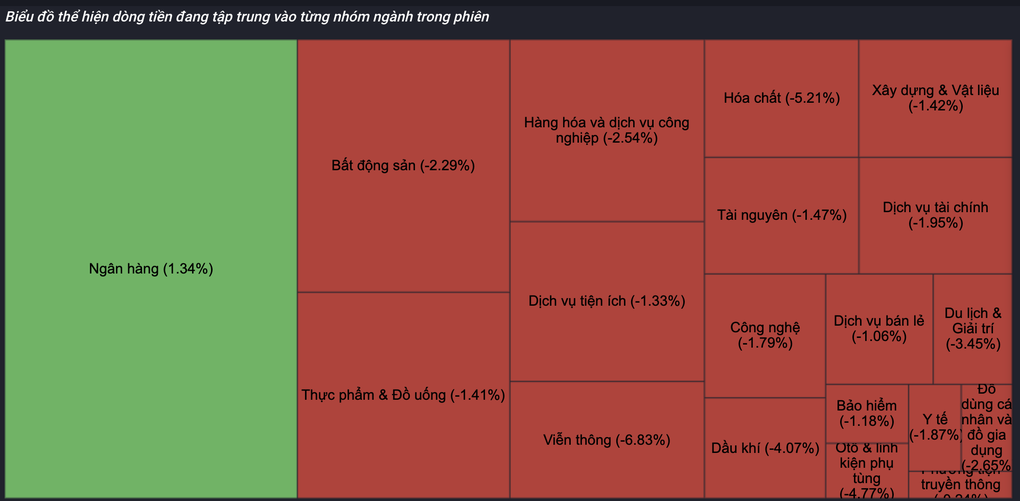

VN30-Index closed up 2.07 points, equivalent to 0.16%, but there were still 17 stocks that decreased, 2 stocks hit the floor. It can be said that the banking group was the pillar of the market in this session when there were stocks that increased strongly and held down the index. NAB and MBB even hit the ceiling at times.

Closing, NAB increased by 5.9%; TCB increased by 4.4%; MBB increased by 4%; BID and HDB both increased by 1.8%; ACB and STB both increased by 1.7%; CTG increased by 1.5%; MSB increased by 1.4%... Liquidity in this industry group is very good and superior to the general market.

Matched orders at MBB during the session reached 72.36 million units; at TCB it was 27.35 million units; at ACB it was 28.89 million units; at STB it was 25.06 million units and at CTG it was 22.6 million units. VPB stood at the reference and also matched orders very high, reaching 34.9 million shares traded.

Except for the banking industry, other industry groups in the market are under strong selling pressure.

In contrast, the sell-off was massive in the real estate sector. A series of stocks hit the floor on HoSE, including TCH, SJS, AGG, QCG, FDC, DIG and IJC. HQC and PDR stocks escaped the floor but still suffered heavy losses, losing 6.5% and 6.6% respectively.

DXS, TDC, HDG, ITC, TIP, HTN, HPX made investors "heart-stopping" when recording the trading situation at the floor price before significantly narrowing the decline. Compared to the floor price drop during the session, HPX ended the session down only 1.2%; HTN down 4.2%; TIP down 4.5%; ITC down 4.6%; HDG down 4.7%.

Some construction and materials stocks also suddenly "wiped the floor" at the end of the session such as DXV, LBM and NHA. EVG, DPG, PC1, CTR, TCR escaped the floor, in which, TCR recovered spectacularly, only down 0.3%; CTR down 2.5%; while other codes such as PC1 still down 3.5%; DPG down 6.2% and EVG down 6.7%.

Many stocks in the goods and services sector were sold heavily, PAC and VOS hit the floor; VTO fell 6.7%; VIP fell 6.4%; VSC fell 5.6%. All three codes were traded at the floor price during the session. PVT fell 4.6%; APH fell 4.4%; HAH fell 4.2%; GEX fell 3.9%.

In addition to GVR, a VN30 stock that was sold off and hit the floor, BFC and CSV of the chemical stock group also saw a sharp decrease in the HoSE floor amplitude. Chemical stocks have had a fairly good growth momentum in recent sessions. Some other codes such as PHR, DCM, DPM, AAA, NHH, SFG also hit the floor at times but were able to escape the floor at the closing time. At the end of the session, PHR decreased by 5.5%; DCM decreased by 5.4%; DPM decreased by 5%; AAA decreased by 4.1%; NHH decreased by 2.8% and SFG decreased by 2.5%.

The healthcare sector also saw strong profit-taking, with some stocks being sold at all costs. Only DBT hit the ceiling, TRA still increased by 0.9%, while IMP and TNH hit the floor on HoSE, JVC fell 4.3%; VMD fell 3.5%; DHG fell 2.2%. On HNX, DP3 fell 7.6%; MED, DVM fell 5.7%; VHE fell 3%; AMV fell 2.8%.

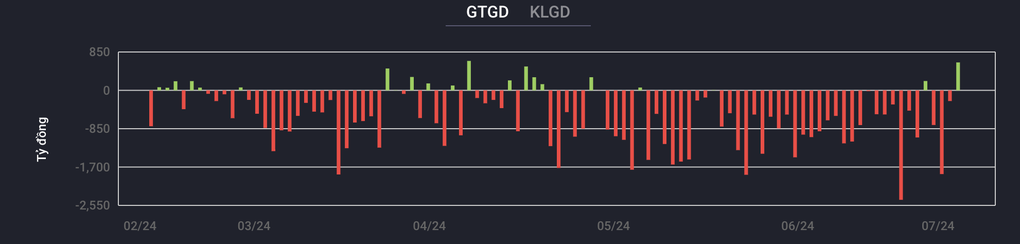

Foreign investors turned to net buying after a series of strong net selling (Source: VNDS).

During the session of broad market correction and sudden increase in liquidity, foreign investors turned to net buy VND624 billion across the market, of which, net buy on HoSE VND552 billion. Accordingly, this group net bought VND163 billion of FPT shares; VND162 billion of MWG shares; VND140 billion of VCB and VND102 billion of TCB. MSN shares were still net sold VND104 billion.

Source: https://dantri.com.vn/kinh-doanh/ban-thao-dot-ngot-hon-30000-ty-dong-lap-tuc-doi-vao-chung-khoan-20240717155756811.htm

![[Photo] General Secretary To Lam presents the title "Hero of Labor" to the Party Committee, Government and People of Ho Chi Minh City](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/08a5b9005f644bf993ceafe46583c092)

![[Photo] Flag-raising ceremony to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/175646f225ff40b7ad24aa6c1517e378)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

Comment (0)