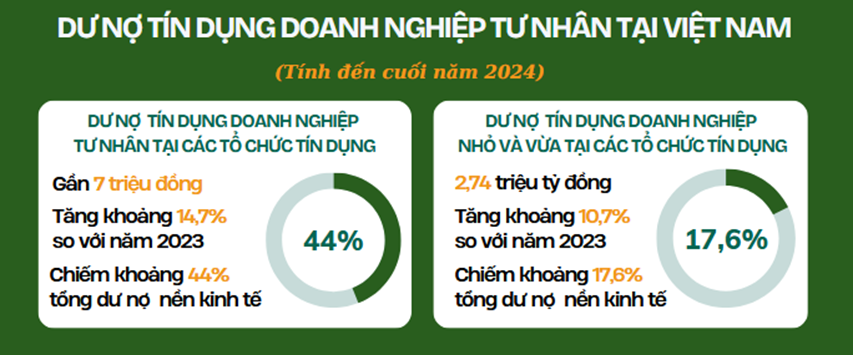

According to data from the State Bank of Vietnam (SBV), by the end of 2024, outstanding credit for private enterprises at credit institutions (CIs) reached nearly 7 million billion VND, an increase of about 14.7% compared to 2023, accounting for about 44% of total outstanding loans of the economy. However, many small and medium-sized enterprises still face difficulties in accessing capital, mainly due to lack of information transparency, procedural barriers and limited financial capacity. Especially after the COVID-19 pandemic, business operations of enterprises have been severely affected, and financial health has declined.

Mr. Pham Anh Nhan, General Director of Vietnam Tourist Trading and Tourism Services Joint Stock Company, said that after the COVID-19 pandemic, businesses in the Vietnamese tourism industry were greatly affected. Although there is a recovery from 2024, many businesses lack collateral, have substandard financial records or are stuck with bad debts. In particular, the requirement to report profitable financial statements for the last three years has become a major barrier as many businesses have yet to overcome the impact of the COVID-19 pandemic in the 2022-2023 period.

“Most tourism businesses reported losses during the COVID-19 pandemic, making it difficult for them to meet loan conditions even though banks have implemented many support packages,” Mr. Nhan shared.

In reality, there are many subjective and objective reasons why businesses cannot access capital. Specifically, some businesses do not have a clear credit history, making it difficult for banks to assess the level of risk and thus require collateral as a safety measure. Others allocate financial resources to many banks, making it impossible for credit institutions to synthesize the actual cash flow of the business. There are even businesses that operate very effectively but the owner has personal credit debt, causing banks to refuse to grant loans to the business.

To expand access to capital for small and medium-sized enterprises, the State Bank of Vietnam has vigorously implemented credit programs and policies, prioritizing stable interest rates and operating flexible and effective monetary policies to create confidence for businesses. The State Bank of Vietnam also focuses credit on priority sectors, traditional and new economic growth drivers, while strictly controlling credit for potentially risky sectors, ensuring safe and effective credit operations.

Currently, banks are also sharing and making efforts to implement solutions to increase access to capital for businesses. Mr. Nguyen Canh Hung, Director of SeABank Corporate Banking, said that banks evaluate businesses through many information channels, from actual transactions, business results to financial reports. Based on that, banks will design unsecured loan packages suitable for each business's creditworthiness level.

Similarly, Mr. Le Ngoc Lam, General Director of BIDV, said that the bank really wants to accompany businesses, but also hopes that businesses will increase their level of transparency to build trust with the bank.

"The more transparent a business is, the more favorable it is for banks to boost credit," Mr. Lam shared. At the same time, he also encouraged businesses to focus on core business activities and avoid activities outside the industry to ensure safety and efficiency.

To increase access to capital, ASCO Auditing Company Chairman Nguyen Thanh Khiet recommends that businesses need to improve their management systems, apply technology and AI in accounting and financial management, as well as other operational areas. Small and medium-sized enterprises need to build transparent financial reports with independent audits to build trust with banks. In addition, businesses also need to proactively build business plans in sync with operational plans and effective capital usage plans to convince banks.

From the above facts, it can be seen that the more transparent a business's cash flow is, the higher its ability to access capital will be. Because this is an important factor for banks to evaluate the financial capacity of a business.

Source: https://thoibaonganhang.vn/minh-bach-tai-chinh-yeu-to-then-chot-giup-doanh-nghiep-tiep-can-von-hieu-qua-162202.html

![[Photo] Flag-raising ceremony to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/175646f225ff40b7ad24aa6c1517e378)

![[Photo] General Secretary To Lam presents the title "Hero of Labor" to the Party Committee, Government and People of Ho Chi Minh City](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/08a5b9005f644bf993ceafe46583c092)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

Comment (0)