Positive revenue numbers

Right from the beginning of the year, the provincial leaders have directed drastic solutions for budget collection. In particular, special attention is paid to exploiting potential revenue sources, promoting revenue management, preventing revenue loss and handling tax arrears. At the same time, strictly operating and managing budget revenue and expenditure, ensuring savings and efficiency. According to the report of the Department of Finance, the total state budget revenue in the first quarter of 2025 is estimated at VND 3,019 billion, reaching 29.02% of the estimate assigned by the Provincial People's Council and decreasing slightly by 1.68% over the same period last year. Of which, revenue from import-export activities is VND 180 billion, reaching 15.65% of the estimate, decreasing by 42.19% over the same period; domestic revenue is VND 2,839 billion, reaching 30.69% of the estimate assigned by the Provincial People's Council and increasing by 2.89% over the same period.

Economic prosperity affects budget revenue.

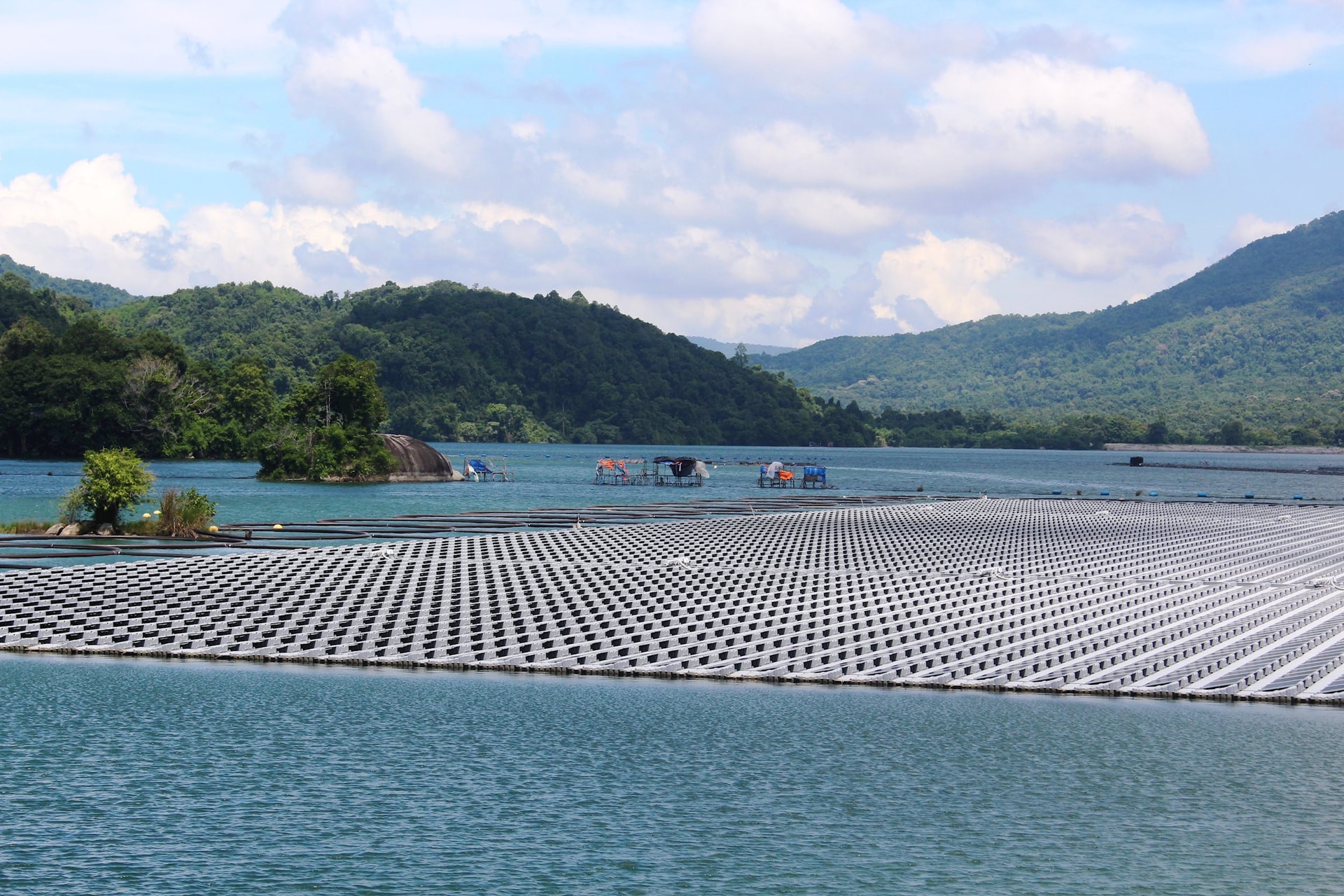

In particular, in the revenue structure, 11/18 revenue items are estimated to reach over 25% of the estimate assigned by the Provincial People's Council. Notably, revenue from foreign-invested enterprises reached 351 billion VND (up 42.06% over the same period). The main source of revenue increase is from corporate income tax payments of LinkFarm Company Limited, which increased by 114 billion VND over the same period, and Vinh Tan 1 Power Company Limited, which increased by 13 billion VND over the same period. Revenue from lottery activities was 971 billion VND, reaching 45.14% of the estimate, up 21.95% over the same period. Revenue from the non-state economic sector alone was 530 billion VND, reaching 28.67% of the estimate assigned by the Provincial People's Council and down 27.78% over the same period. The revenue decrease compared to the same period is mainly due to the fact that in 2025, there will no longer be any extraordinary revenue from enterprises like in 2024...

Some state budget revenues are estimated to reach less than 25% of the estimate assigned by the Provincial People's Council but still recorded growth compared to the same period, such as: Revenue from the central state-owned enterprise sector is 145 billion VND, up 8.87% thanks to the payment of 36 billion VND from Da Nhim - Ham Thuan - Da Mi Hydropower Joint Stock Company. Revenue from granting mineral exploitation rights is 10 billion VND, up 28.82%. Land use fee revenue is 220 billion VND, up 67.86% compared to the same period, of which land use fee revenue from the district block accounts for the entire amount, there has not been any new land use fee revenue source managed by the provincial block...

Regarding local budget revenue, 7/10 localities have quite good budget revenue: Duc Linh is 116 billion VND (77.24% of the estimate), Ham Tan is 100 billion VND (52.14% of the estimate), La Gi town is 113 billion VND (50.23% of the estimate), Phan Thiet city is 439 billion VND (30.11% of the estimate), Ham Thuan Bac is 162 billion VND (41.21% of the estimate), Tanh Linh is 40 billion VND (34.42% of the estimate), Phu Quy is 18 billion VND (70.18% of the estimate). Bac Binh district alone has the lowest revenue, reaching 67 billion VND (16.21% of the estimate), of which land use fees are only 0.356 billion VND.

Increase revenue potential.

Strengthening the exploitation of potential revenue sources

Mr. Nguyen Duc Ngoc - Deputy Head of the Tax Department of Region XV said that the budget collection results in the first quarter of 2025 with 11/18 revenue sources having growth factors are positive signals. However, one of the reasons affecting the provincial budget collection in the first months of the year is that there are no extraordinary revenues from land. It is expected that in the second quarter of 2025, the provincial state budget collection will be about 1,800 billion VND, with a cumulative collection of about 4,659 billion VND in the first 6 months of the year. The tax sector will continue to promote debt management solutions and tax debt enforcement.

According to the assessment of the Provincial People's Committee, although the results of domestic revenue collection in the first quarter of 2025 were quite good compared to the estimate assigned by the Provincial People's Council (reaching 30.69% of the estimate), the revenue mainly increased from lottery activities and land use fees of districts, towns and cities. To ensure the implementation of the task of collecting the state budget and striving to exceed 10% of the estimate assigned by the Provincial People's Council according to the direction of the Prime Minister, the Provincial People's Committee Party Committee led the Provincial People's Committee to direct departments, branches, People's Committees of districts, towns and cities to focus on exploiting revenue sources, especially revenue sources with room for growth in various fields, especially revenue sources related to land, temporary basic construction, value-added tax on food and beverage services, restaurants and hotels, e-commerce, chain business, house rental, mineral resources, real estate business, renewable energy industry, revenue from business households... Focus on handling tax arrears, especially large tax debts; Speed up the progress of land use rights auction, land price determination, and land use fee collection for eligible land plots.

Chairing the meeting of the Provincial Party Standing Committee on the budget revenue and expenditure in the first quarter of 2025, Secretary of the Provincial Party Committee, Chairman of the Provincial People's Council Nguyen Hoai Anh directed departments, branches, localities, and tax sectors to strengthen measures to collect the State budget, increase revenue from the state-owned enterprise sector, collect land use fees, fees, focus on exploiting remaining revenue sources, and collect tax debts. Speed up the progress of establishing and approving land use plans for districts, determining specific land prices, and auctioning land use rights. At the same time, the budget must be flexibly and strictly managed in accordance with legal regulations.

Source: https://baobinhthuan.com.vn/khoi-dau-tich-cuc-trong-thu-ngan-sach-quy-i-2025-129064.html

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

Comment (0)