With the constant fluctuations of the domestic and foreign economic markets, the demand for capital for production, business and consumption activities is increasing, customers have a great need to borrow from commercial banks and financial companies. However, consumers need to be vigilant to avoid falling into the "trap" of fraud by impersonators, especially impersonating financial companies.

Fraudsters have created a series of fake websites, applications, social media accounts and bank accounts of reputable financial companies. These fake channels are advertised heavily on platforms such as Zalo, Facebook, TikTok with attractive offers: "low interest rates, simple procedures, no need to meet in person, bad debt can still be borrowed".

The subjects impersonated financial companies in the form of social networks. Source: Internet

Particularly serious is the phenomenon of impersonating financial company employees, calling to offer attractive loans and sending links to fake websites or applications. These websites often have sophisticated interfaces, similar to the official website of the financial company, making it difficult for users to distinguish between real and fake.

After "approving" a loan with a large amount of money to create trust, the scammer asks the victim to pay in advance "guarantee fees" or "application processing fees" into a personal account. Upon receiving the money, they immediately cut off contact and do not disburse as promised.

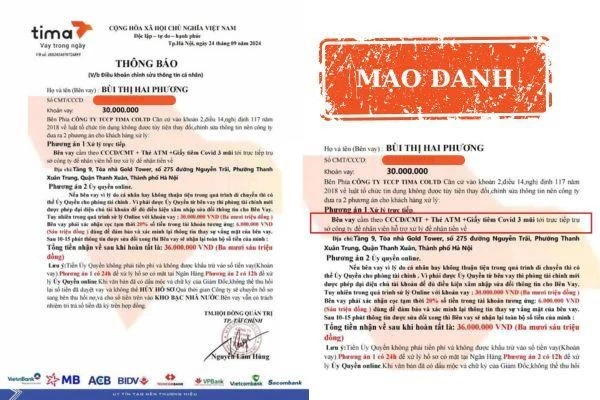

To increase their credibility, the subjects also forged documents such as loan approval certificates, credit contracts, and business licenses in the name of the finance company. These documents were stamped and signed with sophisticated fake names, making it difficult for the victims to recognize them.

Loan contracts are executed by sophisticated subjects. Source: Tima

According to a representative of Tima Group Joint Stock Company, one of the dangerous tricks is to collect personal data of borrowers through emails, messages and fake links. This information is then exploited to open loan accounts under the victim's name or perform other illegal acts, causing the victim to fall into unnecessary debt.

“We never charge any fees before officially disbursing the loan,” Tima representative affirmed.

Faced with this situation, Tima has actively cooperated with the authorities to prevent and handle fraudulent acts, contributing to cleaning up the financial sector. At the same time, the company also called on the authorities to take more drastic measures to ensure a transparent credit environment for the people. The close coordination between the company and the police has initially helped to promptly handle a number of counterfeiters, contributing to deterring criminal acts.

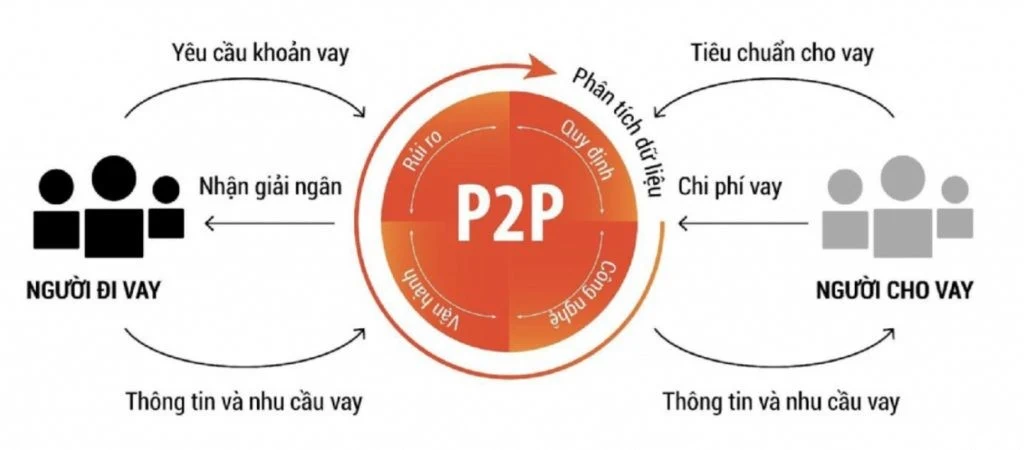

Tima's operating process. Source: Tima

During its 9 years of operation, Tima has always strictly complied with legal regulations, been transparent in all transactions, and has not collected any fees before disbursement. This platform is currently a reliable bridge between borrowers and financial institutions, helping millions of customers access safe and effective capital sources.

With the motto of putting customers at the center, Tima is committed to accompanying users on their personal financial journey, while actively contributing to building a healthy and transparent financial ecosystem in Vietnam. Currently, Tima is the leading financial trading platform in Vietnam, having successfully approved millions of loan applications, supporting many customers to find suitable financial solutions.

In the context of increasingly sophisticated fraud methods, people's alertness and vigilance are the first "shield" to protect themselves from financial risks. People need to be vigilant and choose reputable lending applications when choosing the right financial solution.

At the same time, the role of reputable businesses like Tima becomes especially important - not only providing transparent and safe financial solutions but also proactively coordinating with authorities to eliminate counterfeiting and protect customer rights. With a modern technology platform and strict risk control process, Tima continues to affirm its position as a trusted bridge in the digital financial ecosystem, accompanying people on their journey to access capital in a smart and safe way.

Source: https://baocantho.com.vn/gia-tang-thu-doan-lua-dao-vay-truc-tuyen-mao-danh-thuong-hieu-gia-hop-dong-vay-a185449.html

![[Photo] General Secretary To Lam presents the title "Hero of Labor" to the Party Committee, Government and People of Ho Chi Minh City](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/08a5b9005f644bf993ceafe46583c092)

![[Photo] Flag-raising ceremony to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/175646f225ff40b7ad24aa6c1517e378)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

Comment (0)