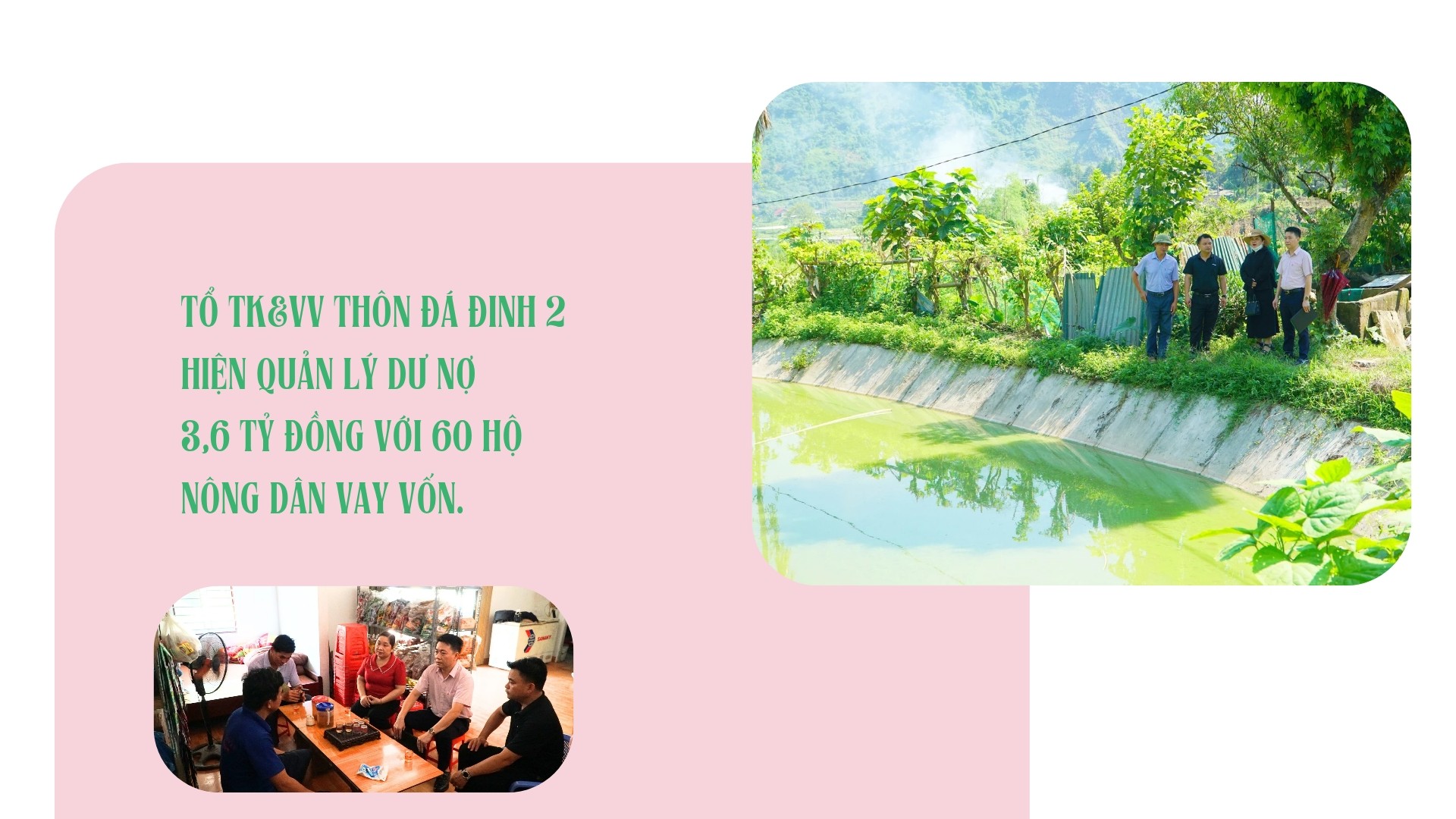

The Savings and Credit Group of Da Dinh 2 village, Hop Thanh commune, has been entrusted with a loan from the Social Policy Bank from the Commune Farmers' Association, headed by Mr. Bach Van Tan. It currently manages a loan balance of up to 3.6 billion VND with 60 farmer households borrowing capital. Mr. Tan is trusted by the group members to hold the role of group leader because his family uses the capital effectively.

Once a poor household, with access to policy credit, Mr. Tan bought two cows to raise. Thanks to raising breeding cows, Mr. Tan's family gradually escaped poverty. Along with that, Mr. Tan also maintains a herd of 120 pigs, raises fish, and the income from the mixed economic model reaches over 200 million VND/year.

The example of the Head of the Savings and Credit Group, Bach Van Tan, has spread to the members. After accessing policy credit capital, the members have learned economic development experience from Mr. Tan's family, paying interest on time, and not using loans for the wrong purposes.

As one of the members who has access to policy credit loans through the Savings and Credit Group managed by Mr. Bach Van Tan, Mr. Hoang Van Dinh has found an effective way to develop his family's economy following the example of the group leader. With a loan of 130 million VND from the Clean Water and Environmental Sanitation Loan Program, and job creation, Mr. Dinh has invested in repairing and upgrading his family's clean water system and raising commercial goats.

Mr. Hoang Van Dinh said: After requesting a loan from the Social Policy Bank, I was reviewed by the Savings and Credit Group, my application was prepared, submitted for appraisal, and within about a week, the loan was disbursed. The Savings and Credit Group is the bridge that helps people access policy credit capital easily and conveniently.

After the merger, the Cam Duong Social Policy Bank Transaction Office manages Hop Thanh commune and a number of communes and wards in Lao Cai city (old). According to Mr. Tran Viet Dung - Deputy Director of the Cam Duong Social Policy Bank Transaction Office, the Transaction Office currently manages outstanding loans of over 420 billion VND with over 6,660 households with outstanding loans, of which 99% of the total outstanding loans are entrusted through socio- political organizations (191 Savings and Credit Groups of the Farmers' Association, Women's Association, Veterans' Association, and Youth Union).

Meanwhile, in Bao Nhai commune, there are currently 9 savings and credit groups managed by the Women's Union, with outstanding debt of 18 billion VND and 283 members receiving loans.

Ms. Dang Thi Nguyen - President of Bao Nhai Commune Women's Union said: Savings and Credit Groups play a good role in reviewing, supporting members in making documents and effectively managing capital from the Social Policy Bank entrusted through the Women's Union.

Currently, the Savings and Credit Groups are widely distributed in villages and hamlets throughout the province. The Savings and Credit Groups directly carry out a number of tasks assigned by the Bank for Social Policies, such as organizing meetings to review loans; monitoring the use of loans; educating and promoting debt repayment awareness for borrowers; promoting and mobilizing group members to participate in saving deposits; carrying out monthly interest and savings collection; promptly monitoring and urging due debts; coordinating the handling of outstanding debts and risky debts... The Savings and Credit Groups are all managed by socio-political organizations, entrusted with the Bank for Social Policies Branches to disburse loans to poor households and policy beneficiaries.

The Savings and Credit Group is the “extended arm” of the Vietnam Bank for Social Policies, helping to transfer capital to the right beneficiaries. The quality of the groups’ operations plays an important role in the operation of the Vietnam Bank for Social Policies. If the Savings and Credit Group operates well and stably, the quality of policy credit will be improved and vice versa.

After consolidation, improvement and arrangement, the Provincial Social Policy Bank has over 4,300 savings and credit groups, the number of groups operating well is 96%. The groups manage outstanding loans entrusted from socio-political organizations of over 11,000 billion VND (accounting for 99.7% of the total outstanding loans of the Provincial Social Policy Bank). Thereby helping over 30,000 poor households and other policy beneficiaries to access policy credit.

Policy credit lending through savings and credit organizations to the right beneficiaries has contributed positively and effectively to the goals of economic development, social security, and new rural construction in the province. In addition, increasingly favorable lending procedures and policies have helped households borrow capital to initiate production and business, increase income, and escape poverty sustainably.

Source: https://baolaocai.vn/canh-tay-noi-dai-dua-nguon-von-tin-dung-chinh-sach-den-ho-ngheo-post879429.html

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

![[Photo] Politburo works with the Standing Committee of Hanoi Party Committee and Ho Chi Minh City Party Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/4f3460337a6045e7847d50d38704355d)

Comment (0)