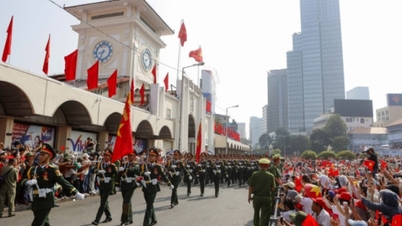

Securities companies switch to new system during holidays - Photo: QUANG DINH

From May 5, Ho Chi Minh City Stock Exchange (HoSE) and market members will officially operate the new information technology system - KRX, marking an important turning point of the Vietnamese stock market.

Excited about the 5-5 milestone

Before the April 30 and May 1 holidays, the conversion work was coordinated between HoSE, Vietnam Securities Depository and Clearing Corporation (VSDC), Hanoi Stock Exchange (HNX) and securities companies, and was deployed, preparing for the big "transfer" day that investors have been waiting for for many years.

As an investor who has been "sticking" to the market for more than 10 years, Mr. Dinh Lan (Hanoi) feels quite excited about the new system. He said the whole market has "fallen short" many times, so the determination to put this system into operation this year has brought some "momentum" to investors.

During the holidays, Mr. Lan spent time reading the regulations for the new technology system, the differences in transactions compared to the current system. "Understanding the changes is very important, because the new system actually has many very fundamental changes," Mr. Lan shared.

HoSE representative said that from session 5-5, investors will experience trading in the new system. The implementation sequence starts from data conversion to system conversion, configuration, market parameters...

The parties involved will carry out internal testing and market testing before officially putting the new system into operation.

According to HoSE, this entire process requires working overnight and coordination between many units with the common goal of ensuring the new system operates safely and smoothly.

Securities company leaders said they have been working around the clock to prepare the smoothest system for investors. According to the general director of a securities company in Hanoi, the transition is going according to plan.

"However, we still feel quite nervous and somewhat pressured, because normally when testing is quite good, there can still be errors when officially released. However, we also met continuously to come up with error handling scenarios and quick response plans to try to maximize stability in transactions," he said.

Many changes investors need to note

KRX is considered as a "backbone system" covering all trading activities, market information, registration, custody, clearing, supervision and risk management. In particular, this system transforms from fragmented management among exchanges and depository corporations to a centralized management system.

The consolidation of functions creates a unified, consistent system, expanding product features. This also means there will be many changes that investors need to pay attention to.

Mr. Le Van Minh, director of VPBanks Securities Trading Operations Center, said the change will take place in both the underlying and derivative markets.

For the underlying market, investors will be allowed to modify the price or volume of unfilled limit orders (LO orders) or the remaining unmatched portion in the continuous order matching session.

However, modifying the order will affect the order matching priority: if the volume is reduced, the order will not change; but if the volume is increased or the price is modified, the order will lose its original priority.

In addition, ATO (opening price order) and ATC (closing price order) orders will no longer have the highest priority as before, but will have to "give" priority to ceiling or floor price limit orders that have been placed in advance during the regular session. Previously, these two orders had the highest priority.

Regarding the derivatives market, according to HNX, previously when an account was restricted by VSDC, investors would be banned from trading all derivative products until it was removed.

However, when the new system is operational, according to HNX, the scope of transaction restrictions for violating accounts will be divided according to the level of the entire market, product, or transaction code, depending on the cause and level of violation determined on VSDC's system.

When the account is in a restricted trading status, investors can place an order with the "close out" parameter to close out some positions to help correct the violation.

KRX is not a magic wand for liquidity

Mr. Truong Hien Phuong, senior director of KIS Vietnam Securities, said that in the long term, KRX is a platform for developing new financial products such as short-selling, T0 trading, new ETF and derivative products.

This is an important condition for the Vietnamese market to meet the criteria for upgrading the market according to FTSE and MSCI standards. However, this person noted that KRX creates a technical infrastructure to deploy T0, short selling, and other derivative products later, but not right now.

When new products will be introduced to the market will be calculated by the regulatory agency based on market conditions. A question that many investors are also interested in is whether liquidity will increase when KRX operates?

Regarding this issue, Mr. Le Van Minh said that market liquidity is affected by many factors, not just from KRX.

"With the ability to process millions of orders per day, the upgraded transaction, clearing and payment speed will contribute to increasing liquidity. However, market value is not determined by the system alone," VPBanks experts noted.

Source: https://tuoitre.vn/van-hanh-he-thong-giao-dich-chung-khoan-moi-nha-dau-tu-cho-buoc-chuyen-lon-20250502230516242.htm

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)