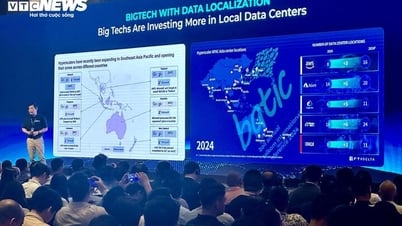

Private investors and asset managers globally are gearing up for multi-billion dollar mergers and acquisitions (M&A) deals involving data centers in Asia-Pacific.

Spending billions of dollars to increase security and information control

As of April 2024, Alibaba Cloud (a subsidiary of Alibaba Group) has 89 data centers in operation in 30 regions around the world. The Chinese e-commerce company is planning to build a data center in Vietnam to store data.

The total investment and specific time for the above project have not been disclosed, but according to calculations by technology investors, the cost is usually more than 1 billion USD. The reason why companies like Alibaba want to build their own servers, besides considering the cost, is to ensure better security and control of information.

On a global scale, Amazon Web Service (AWS – a subsidiary of Amazon) has built a cloud service network with 26 regions and is expanding to 8 new regions. To serve the growing needs of customers in Vietnam, AWS has just announced its investment in building an AWS Local Zone in Hanoi. AWS Local Zone promises to bring faster connectivity and reduce latency to less than 10 milliseconds, helping customers in Vietnam use cloud computing services more effectively.

|

| CMC Data Center Tan Thuan in District 7, Ho Chi Minh City has an area of 13,000 m2, investment capital of 1,500 billion VND |

Currently, the data center market in Vietnam is mainly dominated by a few local telecommunications companies, including Viettel IDC, VNPT, CMC Telecom, FTP Telecom and VNG Cloud. Meanwhile, foreign operators, such as GDS, Telehouse and NTT, often enter the market through joint ventures, accounting for a small portion of the market.

It is understandable that foreign companies in the data center sector need to sign a commercial agreement with a Vietnamese telecommunications company to provide data center services in the country. However, this situation may soon change, when the relevant policies and regulations are clarified, at which time international real estate consultants and brokers expect a significant amount of capital to be poured into the Vietnamese market.

It is known that the Ministry of Information and Communications of Vietnam has proposed a draft Decree detailing a number of articles and measures to implement the Telecommunications Law 2023. The draft allows foreign direct investment and 100% foreign ownership in the provision of data center services, OTT services (over-the-air communication services) and cloud computing. The Telecommunications Law 2023 takes effect from July 1, 2024.

Big challenges in land fund and power source

Rising initial investment costs, rising electricity tariffs, and operating and maintenance costs make data centers a capital-intensive investment, and more and more partnerships between investors and data center operators are emerging to accelerate expansion.

For example, GDS International, a subsidiary of GDS Holdings Limited, raised $587 million through a share transfer agreement issued by GDSI. KKR committed to invest up to $800 million to acquire a 20% stake in the regional data center business of Singapore’s Singtel Telecommunications Group, aiming to expand into the Singapore, Indonesia, and Thailand markets, while exploring the Malaysian and Vietnamese markets.

According to a report at the Data Center & Cloud Infrastructure Summit, the total data center market capacity will reach about 321 billion USD in 2024, with an average growth rate of 7.3%. In Vietnam, it is forecasted that in the coming years, there will be an explosion in data centers, with a scale of 1.27 billion USD in 2030, an average compound growth rate of 10.8%...

Global private investors and asset managers are poised for multi-billion dollar M&A deals and data center-related investments in Asia Pacific.

Savills noted that in the first quarter of 2024, data center acquisitions in Asia-Pacific peaked at $1.7 billion, up 81% quarter-on-quarter and 325% year-on-year, accounting for 80% of total investment volume for the whole of 2023.

Despite its robust growth, the Asia Pacific data centre market is facing significant challenges in securing suitable land and reliable power supply. “The search for land and power sources is putting pressure on developers to expand in strategic locations as soon as possible, which continues to push up development costs,” said Thomas Rooney, Senior Manager, Industrial, Savills Hanoi.

In addition, the requirement by stakeholders, including the Government, customers and society, for data centers to use renewable energy sources and minimize carbon footprints is also a great pressure on data center developers.

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)