To compile its list of the world's top companies, Statista uses an evaluation method based on key business indicators, along with fundamental analysis such as revenue and number of employees.

Accordingly, 200 leading global companies, in 9 categories including new generation banking, digital payments, digital assets, digital financial planning, digital asset management, alternative finance, alternative lending, digital banking solutions and digital business solutions.

CNBC analyzed Statista's research report and divided it into three key areas: Countries with the most valuable fintech industries based on capitalization; Total number of leading fintech companies; Number of "unicorns" valued at $1 billion or more in different countries.

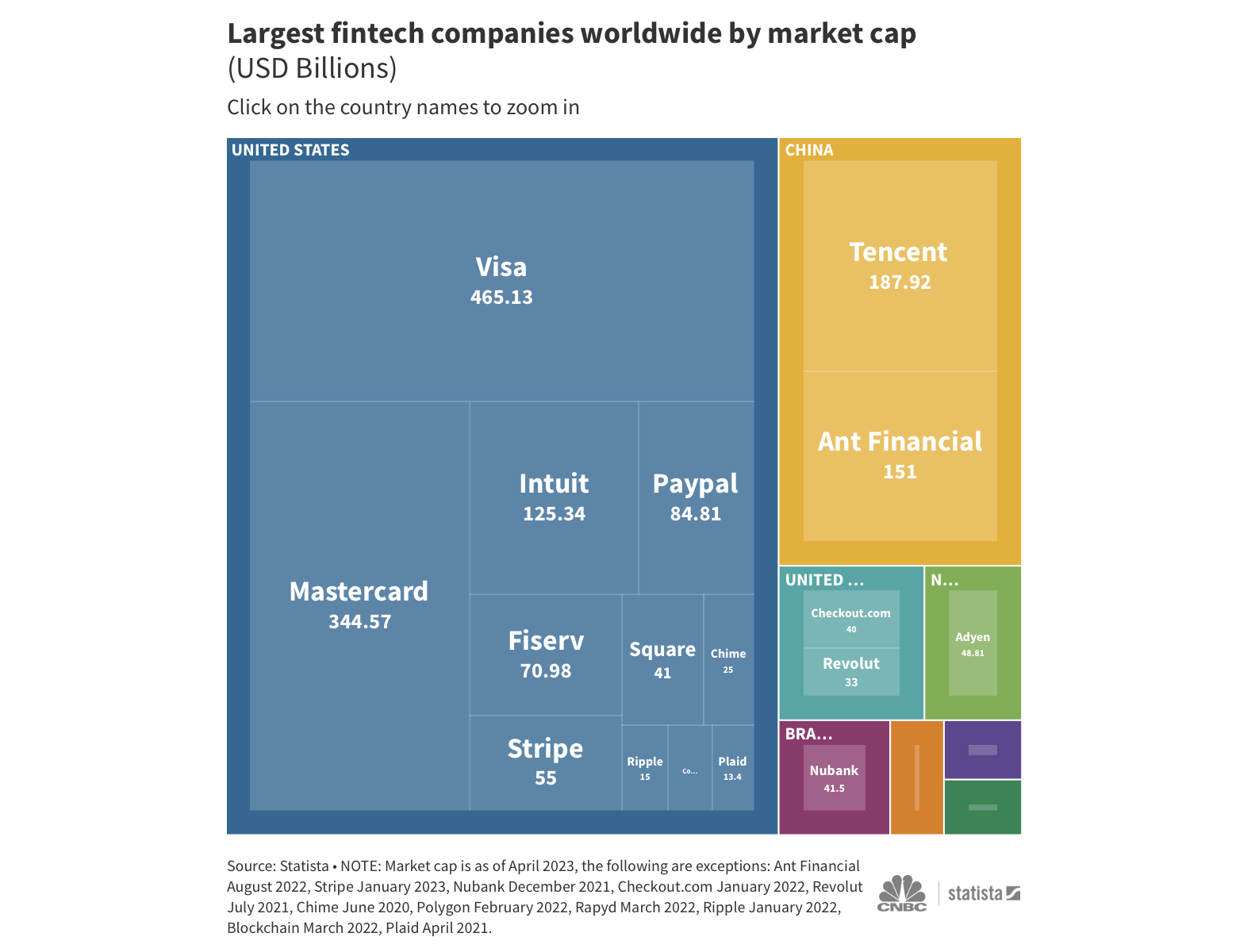

The results show that the US is the "paradise" of the most valuable fintech companies (data up to April 2023), but China is not far behind with big names like Tencent and Ant Group.

Eight of the world’s 15 largest fintech companies, worth a combined $1.2 trillion, are based in the US. Visa and Mastercard are the two largest fintech companies by market value, with a combined market capitalization of $800.7 billion. On the other side of the world, China’s largest fintech companies have a combined market value of $338.92 billion.

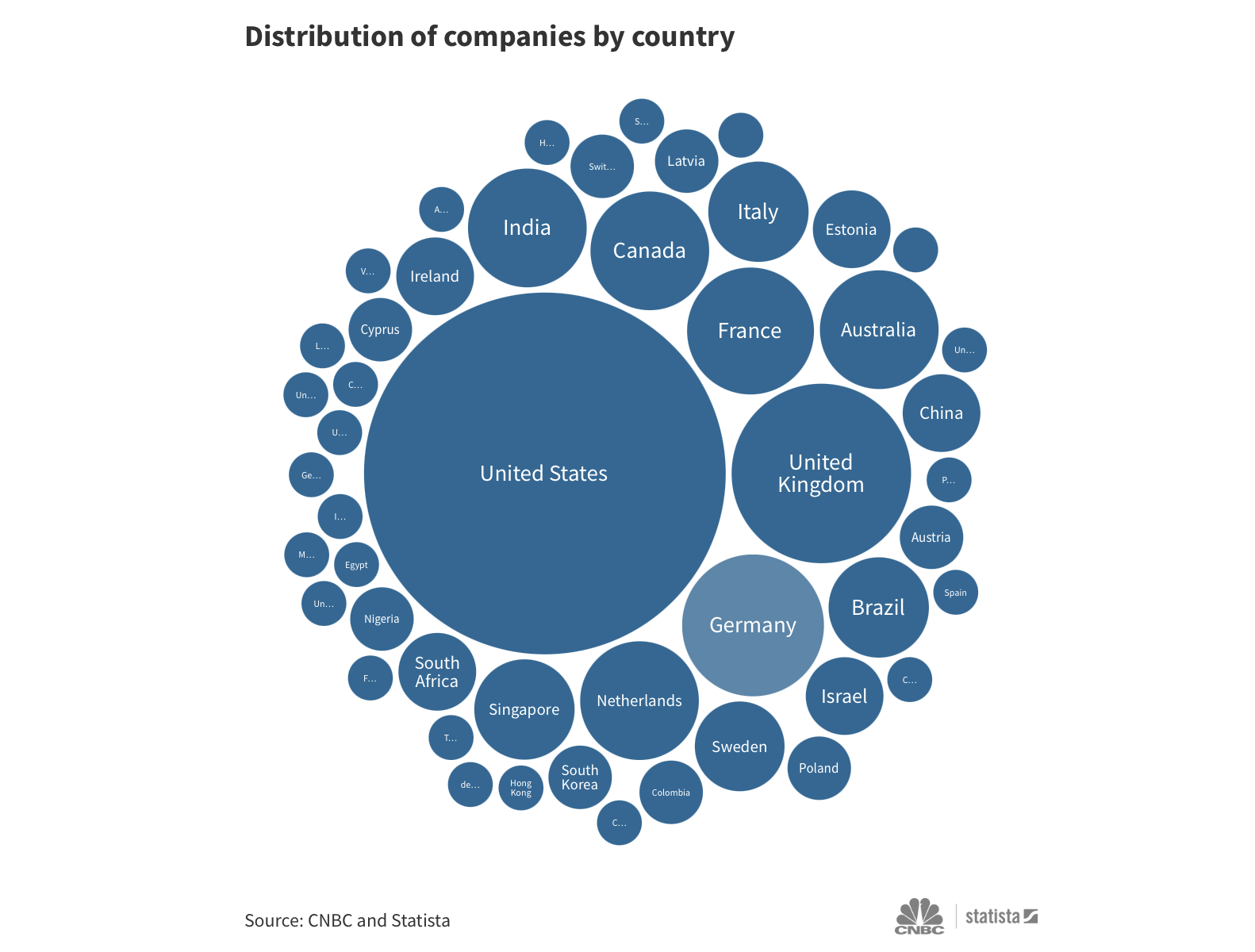

In terms of countries with the largest number of fintech companies, the US continues to lead, followed by the UK, with 65 and 15 companies respectively. The entire European Union alone has 55 large enterprises.

The US has a vibrant fintech market thanks to deep-pocketed investors. Silicon Valley is the natural home for the sector, with its long history of tech giants like Apple, Meta, Google and Amazon, and its traditional venture capital ecosystem like Sequoia Capital and Andreessen Horowitz.

The world's number one economy is home to Stripe, Paypal and Intuit - leading financial technology companies that are capturing a large portion of the world's market share, with products and services being used by millions of large and small businesses.

Meanwhile, the UK’s thriving fintech scene is driven by factors ranging from an innovation-minded regulator to a growing number of investment funds. Some of the country’s notable fintech companies include digital bank Monzo and payments company Wise.

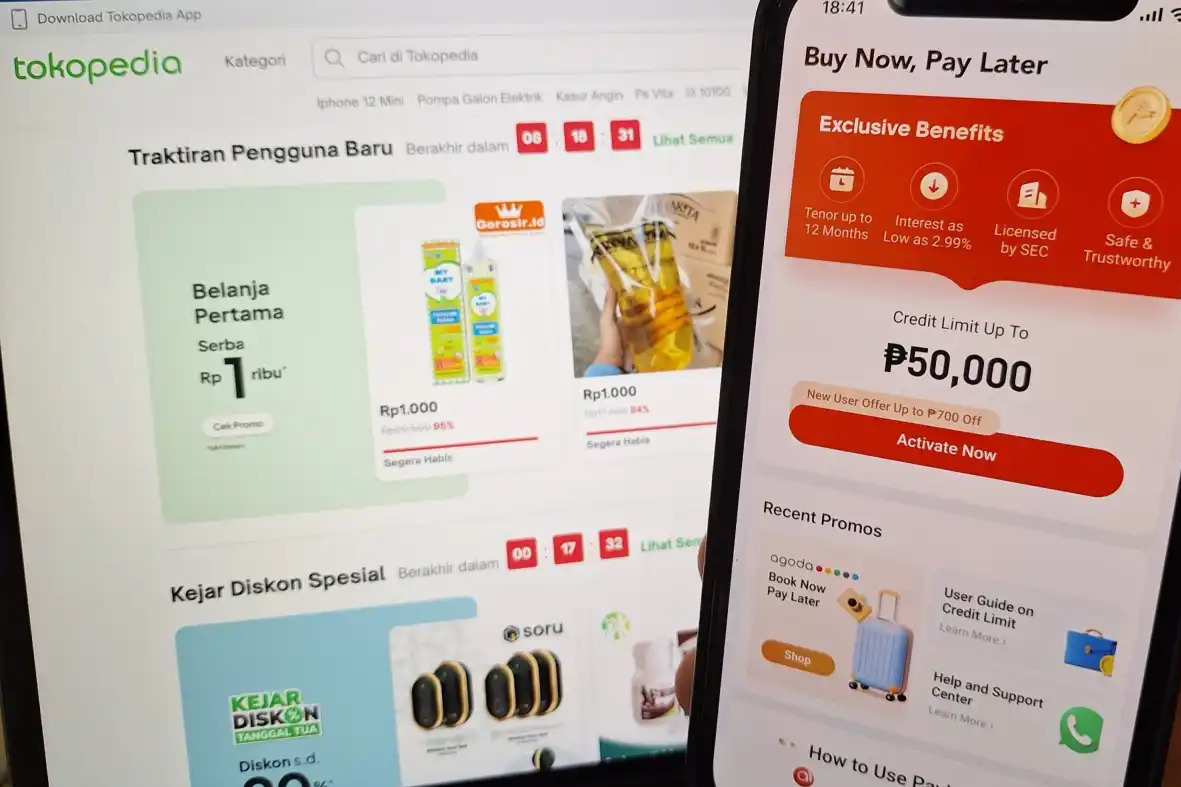

Southeast Asian fintech startup fills lending gap with data

Many young Southeast Asians with limited access to traditional financial services are turning to fintech startups for loans.

Seoul invests 5 trillion won to become fintech capital

Seoul Mayor Oh Se Hoon said he will pour 5 trillion won ($3.7 billion) to turn fintech startups into unicorns and make the South Korean capital a global fintech capital.

Banks are “eager” to transform digitally due to pressure from Fintechs

Banks in Vietnam tend to build digital banking blocks or develop technology centers to create resources for digital transformation.

Source

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)