In the context of the global economy facing many uncertainties, Vietnam aims to achieve 8% GDP growth in 2025. However, this goal is facing a big challenge when the US - Vietnam's leading trading partner - applies high import tariffs on goods from Vietnam.

Currently, the US tariffs on Vietnamese goods are 25% for steel, 10% for all other items (except copper, gold, semiconductors, auto parts, medical drugs, energy, and minerals that the US does not have, which are subject to most-favored-nation status).

In this paper, we propose a simple quantitative model to determine the role and scale of public spending needed to achieve the economic growth target in 2025.

In the long term, Vietnam needs a development strategy based on innovation, improving total productivity, diversifying import and export markets, and developing the domestic market. Photo: Nguyen Hue

Background and issues

According to data from the General Statistics Office, Vietnam's GDP in 2024 will reach more than 476 billion USD. Total export turnover of goods will reach 405.5 billion USD, while total import turnover will be 380.7 billion USD.

Trade with the US: Exports of goods to the US reached 136.5 billion USD, while imports from the US were only 13.1 billion USD, creating a trade surplus of up to 123.4 billion USD.

Trade with China: Vietnam recorded a large trade deficit with China, estimated at -82.8 billion USD.

Trade with countries other than the US: Vietnam continues to have a trade deficit with the remaining countries, with a total estimated value of about -98.6 billion USD.

These figures show that, in terms of exports, Vietnam is heavily dependent on the US market, as it is the main export partner. In terms of imports, Vietnam is heavily dependent on China for the supply of raw materials. According to estimates, about 84% of Vietnam's total import turnover is raw materials for production.

This clearly reflects Vietnam’s heavy dependence on two major trading partners: the US (for exports) and China (for imports). This dependence not only poses a challenge in terms of market diversification, but also highlights the need to develop domestic raw material supply, the role of the domestic market (including consumption, private investment), the FDI sector and public spending to minimize risks and enhance economic sustainability. In this article, we prioritize discussing the short-term role of public spending in the context of Vietnam’s economic growth target of 8% for 2025.

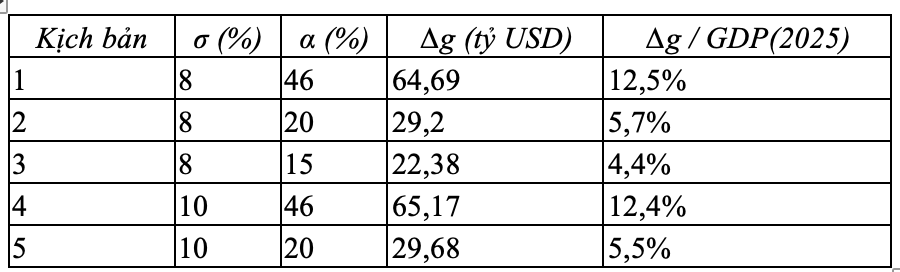

Formula for determining necessary public expenditure

In the current tariff situation, if the US imposes an import tax at α%, then according to the calculation of the US Trade Representative (USTR), Vietnam's trade surplus with the US will decrease THMD = -136.5 x α/100 billion USD.

Domestic spending – including consumption (C) and private investment (I) – accounts for 63% and 32% of GDP respectively, or 95% of GDP in total. Thus, without the contribution from public spending (g) or net exports, aggregate demand would not be sufficient to boost economic growth as targeted.

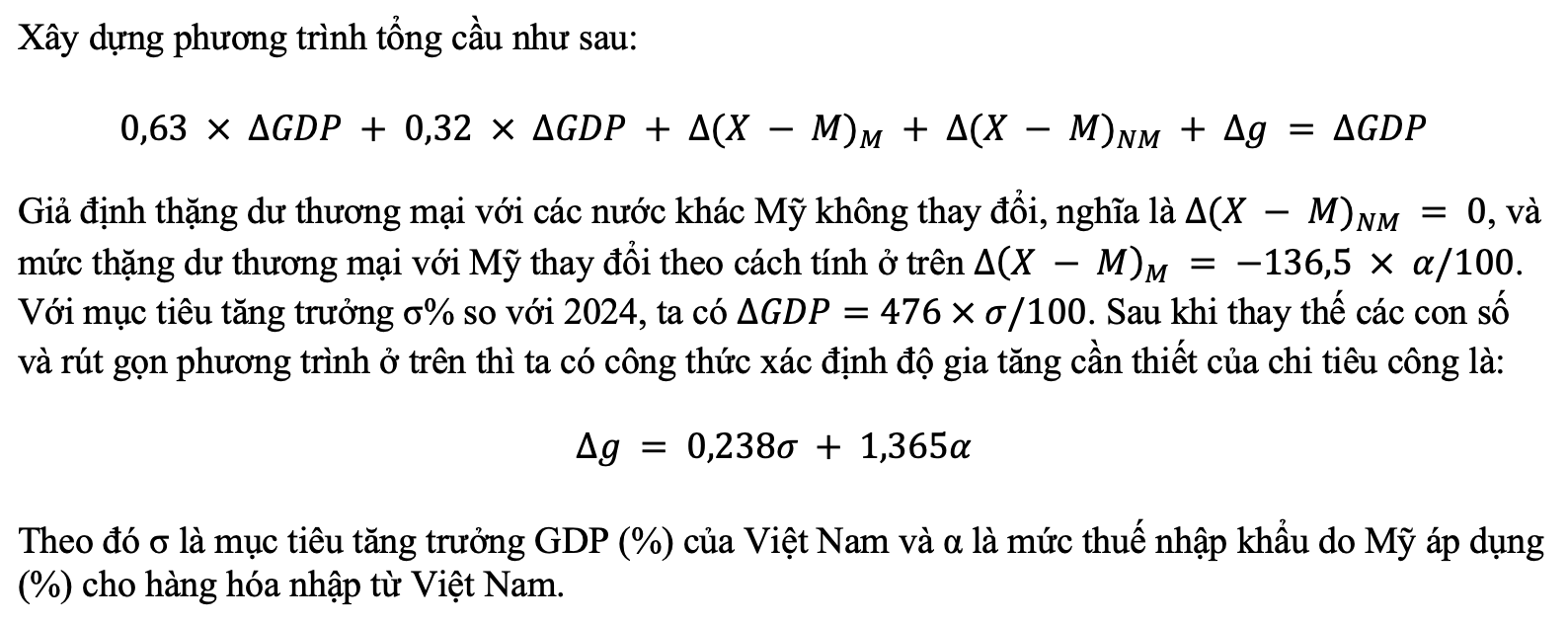

Some public investment scenarios and results

From the above formula, we can discuss several scenarios of public investment. The results show that if the US imposes high taxes (α = 46%), to achieve 8% or 10% growth, Vietnam needs to increase public spending to the equivalent of more than 12% of GDP - a very large number in the current public debt conditions.

On the contrary, if the US only imposes low taxes (α = 15%-20%), the necessary public spending will increase to about 4.4%-5.7% of GDP, which is an acceptable level if the efficiency of public investment is guaranteed.

Public spending and sustainable direction

Public spending is clearly an effective tool in the short term to stimulate aggregate demand. The extent of this effectiveness depends on the level of tariffs that the US imposes on Vietnamese goods, which in turn depends on the outcome of negotiations between Vietnam and the US.

Given the current level of public debt, it is not feasible to sustain high annual increases in public spending. Therefore, the question must be asked: how should public spending be used to not only promote short-term growth but also create a foundation for long-term growth?

We believe that investment spending should be prioritized in: (i) health and education, (ii) training and innovation capacity building, (iii) improving total factor productivity (TFP). These are areas that not only contribute to stimulating current demand but also improve supply capacity in the medium and long term.

Supply-demand balance and the role of the domestic market

Even without US tariffs, Vietnam would still need at least 5% of GDP from public spending to ensure aggregate demand is large enough to meet the 8%–10% growth target. This shows that Vietnam cannot rely solely on private consumption and investment (including FDI), but needs proactive fiscal policy.

In addition, reorienting trade policy to reduce the deficit with partners outside the US, especially China, and diversifying import and export markets is also very important. Increasing the competitiveness of Vietnamese goods in these markets is a long-term strategy to reduce dependence on a single market.

Emergency Tools

Public spending is a necessary and urgent tool to achieve the economic growth target in 2025, especially in the context of the impact of the US reciprocal tariff policy. However, the use of public spending needs to be carefully considered, ensuring efficiency and not putting too much pressure on public debt.

In the long term, Vietnam needs a development strategy based on innovation, improving total productivity, diversifying import and export markets, and developing the domestic market. That is the sustainable path for economic growth in the future.

Author group : Professor Le Van Cuong (CNRS - Paris School of Economics) - Professor Nguyen Van Phu (CNRS - Paris Nanterre University) - Associate Professor Dr. To The Nguyen (University of Economics - Vietnam National University, Hanoi)

Vietnamnet.vn

Source: https://vietnamnet.vn/cong-cu-cap-bach-de-dat-muc-tieu-tang-truong-nam-2025-2396264.html

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)