Malaysian businessman Vincent Hor has just bought a BYD Atto 3 model to “show off his style”, becoming one of the growing number of Southeast Asian consumers choosing electric vehicles thanks to strong incentives from Chinese car manufacturers.

“It has advanced features like voice control, a rotating screen, and low maintenance costs,” said Mr Hor, 41, who lives in Kuala Lumpur and bought the electric SUV in June at a discount of up to 27% off the list price.

After finding success at home but facing fierce competition and overcapacity, Chinese automakers are expanding overseas, especially in Southeast Asia, where many first-time EV buyers like Mr. Hor are coming from. While accepting that the lifespan of electric vehicles may be shorter than that of gasoline cars, Hor said it is “like a smartphone, which needs to be replaced after a while to keep up with new technology.”

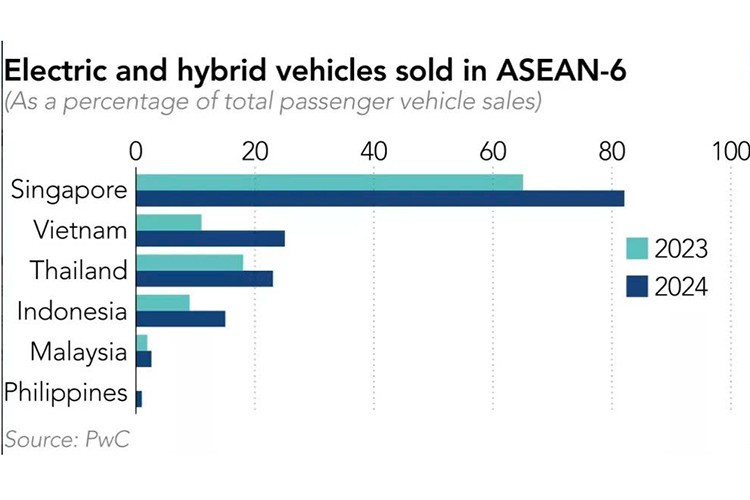

According to Counterpoint, EV sales in Southeast Asia grew 79% in the first half of 2025, driven by Chinese manufacturers expanding their product portfolios, cutting prices, and ramping up local assembly. Brands such as BYD, GAC, Chery, SAIC, Wuling, and Great Wall now account for more than 57% of the region’s EV market share, up 67% from the same period last year.

Strong discount strategy – The “trump card” of Chinese car manufacturers

According to Nikkei Asia, Chinese car manufacturers are cutting prices in Southeast Asia by 8% to 20%, replicating the "big discount" strategy in the domestic Chinese market.

“Price wars are not in anyone’s long-term interest. The sharp price drops will reduce the value of the cars and make buyers lose confidence,” warned Dennis Chuah, chairman of the Malaysian Electric Vehicle Association. He questioned whether some car manufacturers would be able to survive a few years if they continued to sell below cost. “If a company goes out of business, who will provide warranty and maintenance services to consumers?”

However, Chinese companies are still taking full advantage of electric vehicle incentive policies of ASEAN governments to reduce emissions.

In Thailand, the area around Laem Chabang port has become a hub for storing Chinese electric vehicles—many without license plates, left exposed to the elements. According to transport industry experts, imports from China will peak in 2023 and remain high in 2024–2025.

EVs now account for 18% of total car sales in Thailand in the first seven months of the year, up sharply from 12% a year ago.

In Singapore, BYD surpassed Toyota to become the best-selling brand in the first half of 2025.

In Vietnam alone, VinFast is the only Southeast Asian company to surpass its Chinese competitors, with 87,000 vehicles sold in 2024 (2.5 times increase) and continuing to increase strongly in 2025.

In Malaysia, Mr. Hor’s BYD Atto 3 In Singapore, BYD has overtaken Toyota to become the best-selling brand sold through a used car platform, as a “demo car” used in showrooms, so prices are deeply discounted. In Thailand, many cars displayed at auto shows are discounted by up to 15%.

Some dealers complain that they have to cut prices sharply to avoid losing customers. Meanwhile, many customers who have just bought a car may be "shocked" to see the price drop sharply just a few days later.

According to the China Automobile Manufacturers Association, in the first seven months of 2025, China exported 3.68 million vehicles, of which one-third were electric vehicles – an increase of 84.6% compared to the same period last year. With domestic profit margins very low, exports are becoming a better profit channel for Chinese manufacturers.

China shifts production to Southeast Asian countries

Experts predict that competition will become fiercer as more Chinese companies continue to build factories in Thailand and Indonesia. BYD plans to export cars made in Thailand to Europe from late August, while also building a $1.3 billion factory in Indonesia.

Meanwhile, Japanese companies began to adjust their strategies: shifting their focus to hybrid vehicles and adjusting prices. Some companies even reduced their operations in Thailand (Honda, Suzuki, Nissan).

However, according to expert Eugene Hsiao of Macquarie Capital, Japanese companies still have advantages in dealer networks, after-sales services and finance, factors that Chinese companies cannot immediately compensate for.

“At the moment, the majority of Chinese EV buyers are tech enthusiasts, not the mass market customers who currently drive Japanese gasoline cars,” Mr. Hsiao said.

Prospects and challenges

Chinese automakers are expected to account for 30% of global vehicle sales by 2030, with growth largely coming from emerging markets such as Southeast Asia, the Middle East, Africa and South America, according to AlixPartners. However, only 15 of China’s current 129 EV brands are expected to survive by then.

One example is Neta, which has had to close a number of showrooms and service centers in Thailand, prompting complaints from customers about long repair times. Some dealers have even cut prices by up to half, but sales have not improved.

For customers like Mr. Hor, what matters now is simply “enjoying the new technological features on the Atto 3.”

“I bought it to follow the trend. If I lose money later, I accept it,” he said.

Source: https://khoahocdoisong.vn/oto-dien-trung-quoc-ban-chay-o-dong-nam-a-nhung-viet-nam-thi-khong-post2149047018.html

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Politburo works with the Standing Committee of Hanoi Party Committee and Ho Chi Minh City Party Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/4f3460337a6045e7847d50d38704355d)

Comment (0)