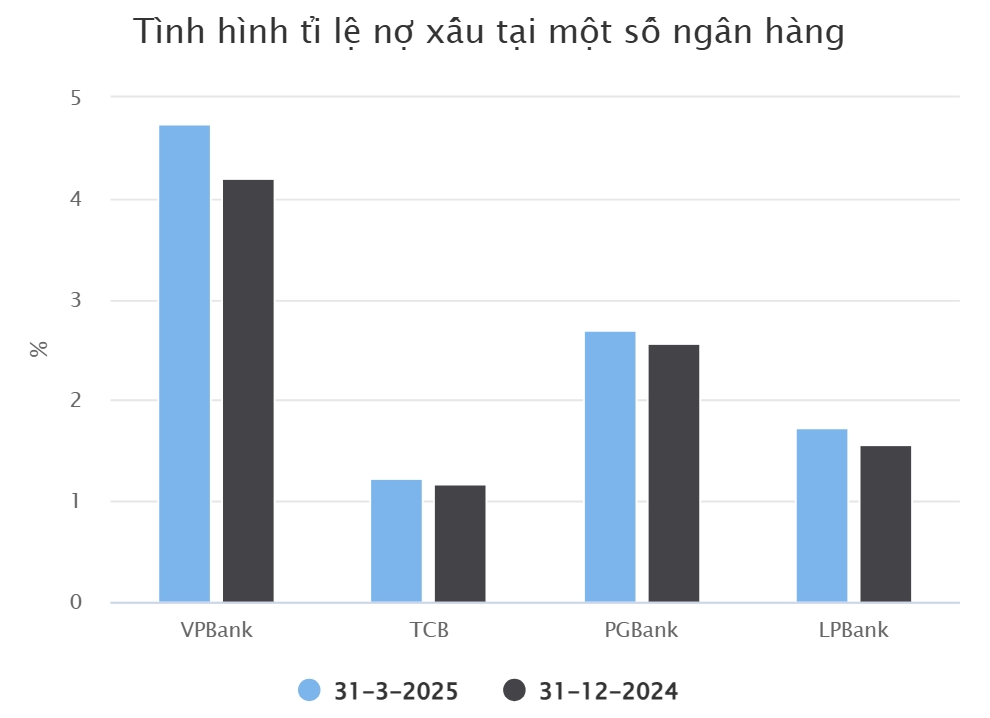

Many listed banks have announced their financial reports for the first quarter of 2025. Profits in many places continue to increase, but debt quality in some banks has not improved.

VPBank's bad debt with potential loss of capital is at 8,383 billion VND

VPBank (VPB) has just announced its consolidated first quarter financial report with net interest income reaching VND13,355 billion, up 18% over the same period last year.

After deducting expenses, profit before tax This bank's assets reached 5,014 billion VND, an increase of nearly 20%.

Notably, in the first quarter of this year, VPBank increased its credit risk provisioning costs by 16%, to VND6,677 billion, in the context of bad debt not yet "cooling down".

As of the end of March 2025, VPBank's bad debt reached VND34,610 billion, up 20% compared to the beginning of the year. Of which, all three debt groups (substandard debt, doubtful debt and debt with potential loss of capital) of this bank increased. Particularly, debt with potential loss of capital increased from VND6,119 billion at the beginning of the year to VND8,383 billion.

VPBank's bad debt/total outstanding loan ratio has accordingly increased from 4.2% to 4.74% after 3 months. By the end of the first quarter of 2025, VPBank's outstanding customer loans had increased by nearly 5.4%, reaching VND 729,969 billion.

This outstanding debt includes VND 12,876 billion in margin trading loans and customer advances when consolidating VPBanks Securities' reports.

Another bank in the group that reported its first quarter financial results quite early is Techcombank (TCB). This bank reported pre-tax profit in the first quarter of this year reaching 7,236 billion VND, down 7% compared to the same period last year.

Part of the reason is that net interest income decreased by 2% to VND8,305 billion. Net profit from TCB's foreign exchange trading and service activities also decreased.

Regarding customer lending activities, TCB's outstanding loans at the end of the first quarter reached VND663,692 billion, up 5% compared to the beginning of the year. Excluding margin trading loans and advances to TCBS customers, TCB's outstanding loans stood at VND633,221 billion.

In the context of economic difficulties, TCB's bad debt increased by 9% compared to the beginning of the year, reaching 7,783 billion VND. The bad debt ratio accordingly increased slightly to 1.23%.

There are still banks reducing bad debt

PGBank is the next bank after TCB to report negative profit growth in the first quarter. The report shows that the bank's pre-tax profit reached VND96 billion, down 17% compared to the first quarter of 2024.

This period, PGBank increased its credit risk provision from VND42 billion to VND146 billion. PGBank's bad debt increased by 16% compared to the beginning of the year, from VND1,059 billion to VND1,227 billion.

Meanwhile, PGBank's outstanding customer loans reached VND45,348 billion at the end of March 2025, up 10%. It can be seen that the growth rate of bad debt of this bank is faster than bad debt.

Accordingly, the bad debt ratio of PGBank's total outstanding debt increased from 2.56% to 2.7% after the first 3 months of this year. Of which, the debt with the possibility of losing capital increased from 618 billion VND to 688 billion VND.

The newly announced financial report for the first quarter of 2025 of Loc Phat Vietnam Joint Stock Commercial Bank (LPBank) also shows that debt quality has not improved.

Specifically, LPBank's outstanding customer loans at the end of the first quarter of 2025 reached VND352,194 billion, up 6.2% compared to the beginning of the year. Of which, the bank's bad debt was VND6,087 billion, up 17% compared to the beginning of the year.

Therefore, the ratio of bad debt to total outstanding debt also increased from 1.56% at the end of 2024 to 1.73% at the end of the first quarter. In terms of business results, LPBank's total pre-tax profit reached VND 3,175 billion, up 10% over the same period.

At SeABank (SSB), pre-tax profit in the first quarter of this year reached VND4,350 billion, an increase of nearly 189% over the same period in 2024. This is the highest quarterly profit in the history of this bank.

Regarding the quality of outstanding loans, SeABank recorded bad debt at VND 3,913 billion at the end of March 2025, a slight decrease compared to the end of 2024. Of which, doubtful debt decreased sharply to VND 384 billion, but debt with the possibility of losing capital and substandard debt increased, respectively at VND 3,223 billion and VND 306 billion.

The financial report for the first quarter of 2025 of Viet A Commercial Joint Stock Bank (VietABank) has just been released and also recorded many bright spots. VietABank's leaders said that credit growth in the first quarter of the year was good, so net interest income increased compared to the same period.

In addition, income from service activities improved, contributing positively to increasing profits for the bank. In addition, the cost of credit risk provision in the first quarter decreased compared to the same period due to the continuous and effective handling and urging of customers to pay debts.

According to the financial statement, VietABank recorded total bad debt of VND536 billion, down 50% compared to the beginning of the year.

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)