In an event held on the morning of July 19, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, revealed: The Ministry of Finance and the State Securities Commission will soon announce a draft Circular amending 4 Circulars on transactions, registration, depository, clearing and settlement, operations of securities companies and pre-transaction margin requirements.

The circular raises two major issues: how to eliminate prefunding and how to create conditions for foreign investors to have equal access to information with other members in the market.

"We are currently editing some English sentences, in line with the spirit of the draft circular. When it is announced to members, we will also simultaneously announce the English version. Up to this point, there are still some opinions, but basically the main content has the consensus of international investors. In the review period next September, we expect to have positive results," said Mr. Hai.

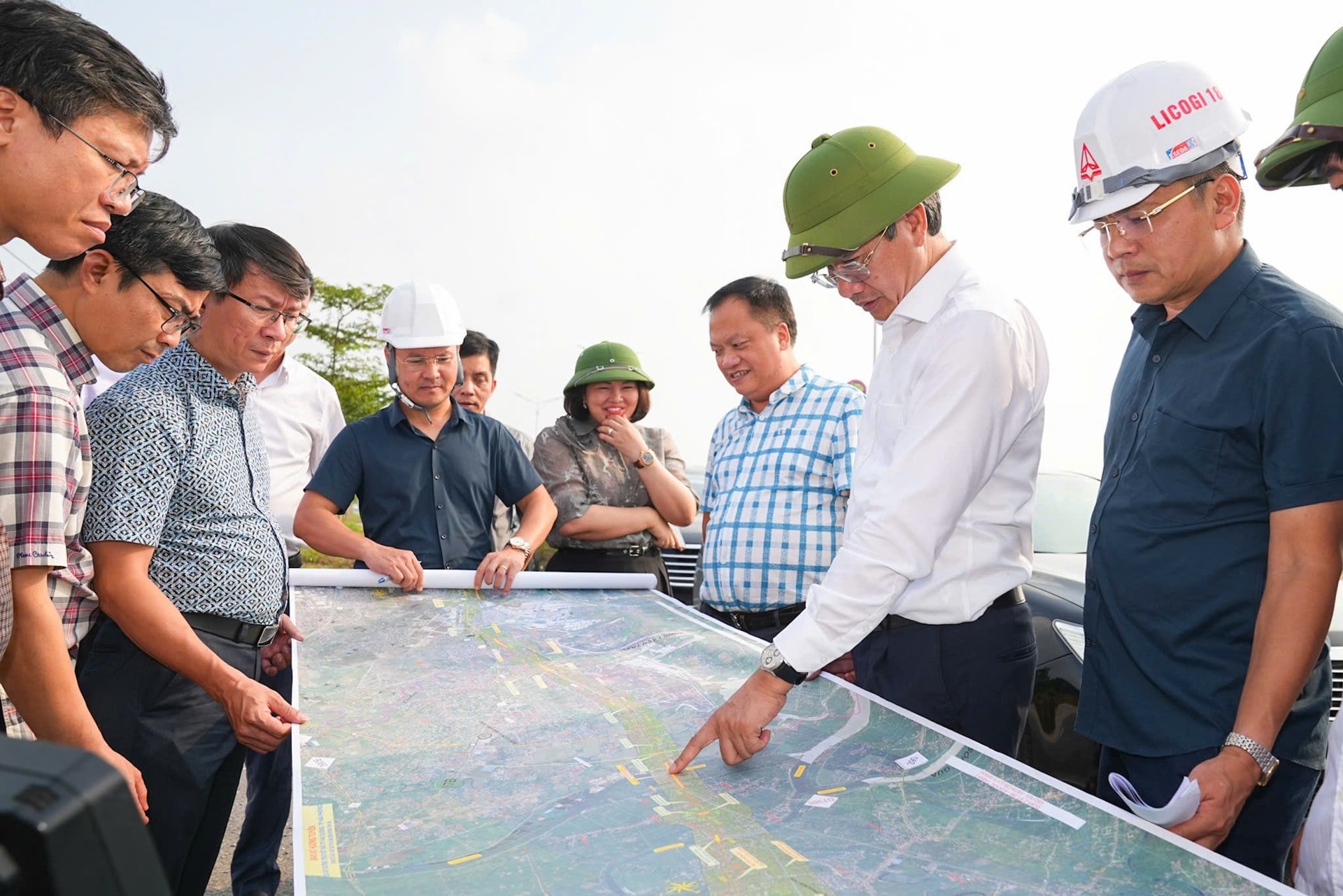

The State Securities Commission (SSC) has just announced a draft Circular amending four Circulars related to the stock market. (Photo: ST)

According to the assessment of domestic and foreign experts, the new solutions and regulations in the draft Circular are appropriate and highly feasible. The State Securities Commission expects that the issuance of the Circular will have a positive impact on the process of considering upgrading the Vietnamese stock market.

After only 1 day, the Ministry of Finance and the State Securities Commission announced the entire content of the draft circular amending 4 circulars after receiving comments from organizations, individuals, and market members.

Accordingly, the draft is expected to amend and supplement Circular 120 to stipulate that investors must have sufficient money when placing orders to buy securities, except for the following transactions: Margin transactions as prescribed in Article 9 of this Circular; Stock purchase transactions do not require sufficient money when placing orders by foreign investors (FIIs) who are organizations as prescribed in Article 9a of this Circular.

The draft adds Article 9a after Article 9 to regulate stock purchase transactions by foreign institutional investors.

Securities companies (SCs) shall assess the payment risk of foreign investors (FIs) that are organizations to determine the amount of money required when placing an order to buy shares (if any) according to the agreement between the SCs and the FIs that are organizations.

In case the foreign investor is an organization that does not make full payment for the stock purchase transaction, the obligation to pay the remaining amount shall be transferred to the securities company where the foreign investor is an organization that places the order through the self-trading account.

Securities companies are allowed to sell by agreement on the trading system or transfer ownership outside the trading system according to regulations on registration, depository, clearing and payment of securities transactions for the number of shares transferred to their proprietary trading accounts for foreign investors who are organizations lacking money to pay for stock purchase transactions no later than the trading day following the day the shares are recorded in the securities company's proprietary trading account in case this transaction does not exceed the maximum limit on the ownership ratio of foreign investors according to the law for such shares.

Financial amounts arising from transactions are carried out according to the agreement between the securities company and the foreign investor being an organization or the authorized representative of the foreign investor being an organization.

Except for the transactions specified in Clause 3 of this Article, the securities company shall sell shares on the securities trading system. Financial amounts arising from the transaction shall be made according to the agreement between the securities company and the foreign investor being an organization or the authorized representative of the foreign investor being an organization.

The depository bank where the foreign investor is an organization and opens a securities depository account is responsible for paying the shortfall and any costs incurred (if any) in case of incorrect confirmation of the deposit balance of the foreign investor being an organization with the securities company, leading to a lack of money to pay for the stock purchase transaction.

Source: https://www.congluan.vn/foreign-investors-are-entitled-when-investing-in-stock-in-vietnam-post304237.html

Comment (0)