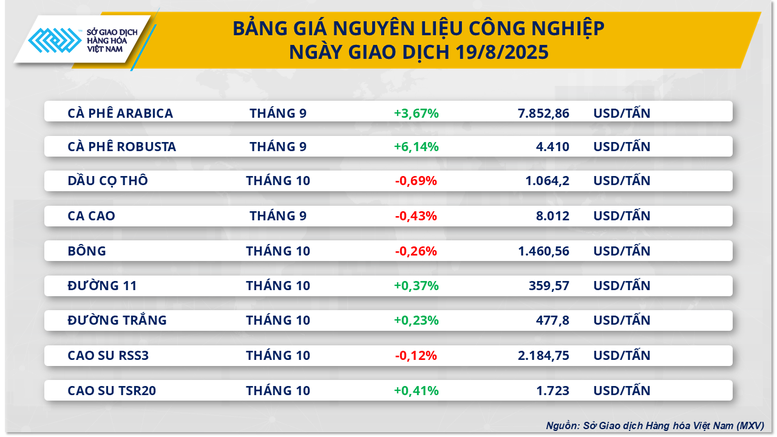

Supply shortage concerns continue to support coffee prices

The industrial raw material market became a bright spot with the strong increase of two coffee products. Specifically, the price of Arabica coffee recorded an increase of more than 3.6% to 7,852 USD/ton while the price of Robusta coffee also increased by more than 6.1% to 4,410 USD/ton, the highest level in more than two months. This decrease mainly stemmed from concerns about supply shortages in Brazil.

According to data released by the Brazilian Coffee Exporters Association (Cecafe), the country's coffee exports in July reached only 2.73 million bags, down 27% compared to the same period in July 2024, when Brazil exported 3.78 million bags. The forecast for August also recorded a similar downward trend, with exports estimated at about 2.8 million bags, down 26.55% compared to the same period last year, when exports reached 3.81 million bags.

In addition, the continued tariffs between the US and Brazil have caused many US importers to cancel new contracts for Brazilian coffee. At the same time, inventories on ICE have fallen sharply, reflecting efforts by roasters to secure supplies before the 50% tariff on coffee imports from Brazil into the US officially takes effect. However, certified inventories on ICE have shown signs of recovery for two consecutive sessions, increasing by 1,366 bags to 733,105 bags yesterday. Previously, inventories here have experienced a series of 14 consecutive sessions of decline and last Thursday dropped to the lowest level since May 2024.

Meanwhile, weather conditions in Brazil have been relatively negative in recent months. Adverse events such as low temperatures, frost and even hail occurred in July, causing significant economic and productivity impacts on coffee plantations. These factors make the forecast of a record 2026-27 harvest of 75–80 million bags unlikely. This week, Brazil is forecast to experience unusually dry and warm conditions, which could put additional stress on coffee trees.

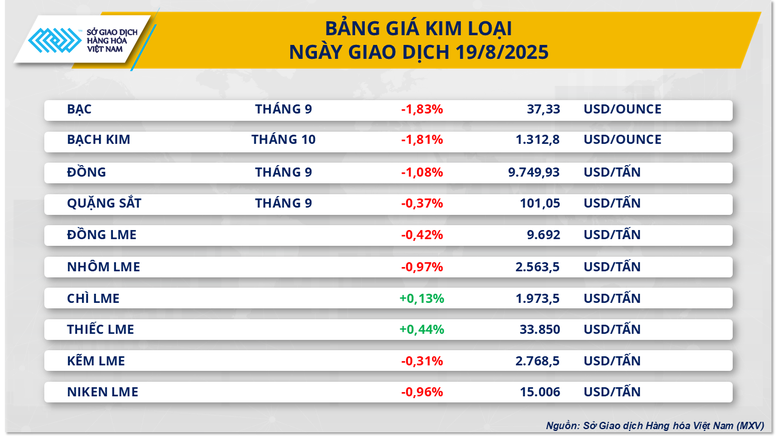

COMEX copper prices recorded a second consecutive session of weakness

At the end of yesterday's trading session, the metal market continued to witness selling pressure dominating with 8/10 commodities simultaneously weakening. In particular, COMEX copper prices recorded the second consecutive decline, losing 1.08% to 4.42 USD/pound, equivalent to 9,749 USD/ton. According to MXV, the continued strength of the USD along with the prospect of abundant supply put pressure on the copper market during the session.

The Dollar Index rose 0.1% to 98.27 yesterday, making commodities priced in USD, such as copper, less attractive to investors using other currencies, putting downward pressure on the commodity during the session.

Meanwhile, the latest supply-demand data on the copper market has yet to show a positive outlook, as the global market continues to face oversupply pressure. The Chilean Copper Commission (Cochilco) forecasts that the world 's largest copper producer will increase its copper output by 1.5% year-on-year in 2025 to nearly 5.6 million tonnes. In Peru, the world's third-largest copper supplier, the Ministry of Energy and Mines said copper output in June rose sharply by 7.1% year-on-year to 228,932 tonnes. Overall, Peru's copper output in the first six months of the year increased by 3.5% compared to the first half of 2024 to more than 1.3 million tonnes.

On the demand side, in the world's largest consumer market, China, data from the National Bureau of Statistics (NBS) of China showed that refined copper output in July reached nearly 1.3 million tons, down 32,000 tons compared to June. This development reflects signs of weakening copper consumption in the context of smelters being under great pressure due to negative ore processing fees, causing profit margins to narrow further.

In addition, China’s copper production is at risk of being impacted by the Chinese government ’s new policy to curb overcapacity and low-price competition. Since 2024, the government has warned of economic risks related to sharp declines in profit margins in many industries, including electric vehicles and solar panels, which are also major copper consumers. If the production curbs spread, copper demand could continue to come under downward pressure.

Notably, China's producer price index (PPI) in July fell 3.6% year-on-year, lower than the forecast of a 3.3% decline, clearly reflecting the increasingly intense price competition that manufacturers are facing in the market.

Source: https://baochinhphu.vn/luc-ban-ap-dao-mxv-index-noi-dai-da-suy-yeu-sang-phien-thu-hai-102250820100521603.htm

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Politburo works with the Standing Committee of Hanoi Party Committee and Ho Chi Minh City Party Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/4f3460337a6045e7847d50d38704355d)

Comment (0)