Being proactive in negotiating and finalizing a fairly competitive tariff compared to other countries in the region has partly affirmed Vietnam’s attractiveness as a “new stronghold” for multinational corporations. However, in addition to its favorable geographical location, Vietnam needs to demonstrate its capital absorption capacity and a financial ecosystem that is open and deep enough to be ready to “welcome eagles to nest”.

Global FDI flows: Competitor pressure and opportunities for Vietnam?

The US currently accounts for nearly one-third of Vietnam's export turnover, the 20% tax rate not only helps maintain competitive advantage, but also stimulates FDI capital flows and shifts orders to Vietnam.

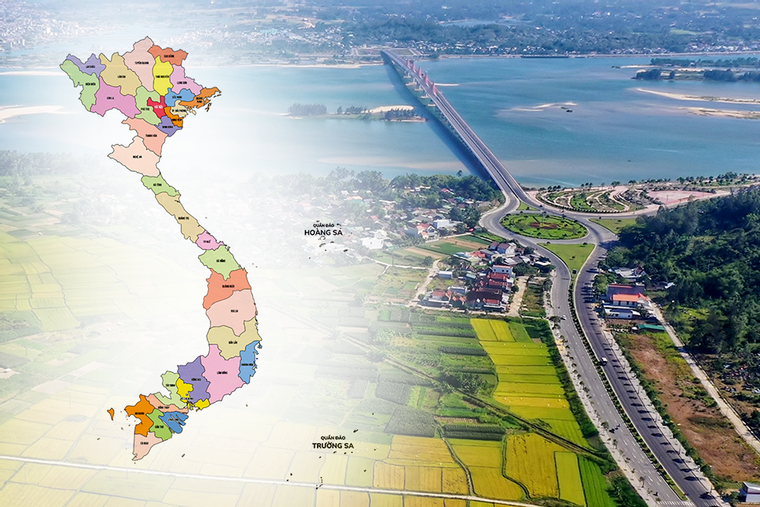

In addition to its geographical advantages, Vietnam also scores points thanks to reasonable labor costs, increasingly improved labor quality, upgraded infrastructure, and efforts to promote digital transformation and administrative reform, creating a favorable environment for investors.

According to a JETRO survey in 2024, 15.6% of manufacturing enterprises, mainly from Japan and China, have moved part or all of their operations to ASEAN, with Vietnam accounting for the highest proportion, at 24.8%. Not only that, according to a DHL report, Vietnam ranked second in the list of destinations receiving orders leaving China, accounting for more than 27% of supply chain relocation decisions in the consumer electronics and industrial equipment industries.

Along with the advantages of multilateral FTAs, Vietnam also promotes digital administrative reform, applies the "post-inspection" process instead of "pre-inspection", simplifies the investment licensing process according to the Government's open mechanism. The rearrangement of administrative boundaries is forming large industrial super-capitals, creating a foundation for the development of international-scale logistics zones and industrial parks such as the expanded Ho Chi Minh City, Dong Nai or Vinh Phuc .

In fact, many corporations are continuing to increase investment and affirm their long-term commitment in Vietnam, such as Lego with more than 1.3 billion USD in Ho Chi Minh City (formerly Binh Duong ), Nestlé expanding its factory in Dong Nai, Coca-Cola building a LEED Gold factory in Tay Ninh, while Syre - Sweden's leading textile corporation bet 1 billion USD on Gia Lai.

However, analysts fromACB Securities (ACBS) also noted that most of Vietnam's key export sectors (except for agriculture, forestry and fishery) have a very high rate of raw material imports, especially for FDI enterprises.

Therefore, the focus in the coming time will be on clear negotiations on the definition of “transit goods” and the applicable transit tax rate, in order to maintain export growth momentum and effectively absorb investment capital.

FDI absorption is not just a policy, it requires a suitable financial ecosystem

To effectively take advantage of this opportunity, Vietnam needs to continue to improve its capital absorption capacity, especially in transit policies and the financial ecosystem serving FDI enterprises.

In Vietnam, some domestic commercial banks such as ACB have proactively developed a financial ecosystem specifically for FDI enterprises, helping to narrow the gap between "potential advantages" and "actual value" with 8 core strengths including:

The highest credit rating in the Vietnamese banking system demonstrates outstanding financial capacity and risk management;

Top 1 private bank in retail sector helps understand domestic consumer behavior;

Top 2 in distribution network with more than 400 transaction points covering key areas of FDI investment;

Competitive, stable and transparent pricing policy for each business segment;

Specialized product suite: multi-currency accounts, trade finance, foreign exchange and flexible exchange rate and/or interest rate risk hedging solutions with terms up to 5 years, guarantees, ERP system connection...;

Pioneering corporate digital banking suitable for domestic and international payment needs;

Deep understanding of investment environment and local policies, closely linked with more than 20 industrial parks nationwide;

With a team of bilingual and multilingual investment consultants (English, Chinese, Korean, etc.), specializing in supporting foreign investors from the survey to the operation stage, ACB has built a "companion bank" model, not only providing financial services but also playing a consulting and supporting role for foreign enterprises.

Mr. Tu Tien Phat, General Director of Asia Commercial Bank, directly visited the most modern and advanced yarn production line at a foreign-invested textile factory in Quang Ninh.

In particular, ACB has packaged credit products, specifically designed for FDI enterprises in Vietnam, ensuring diverse loan forms, easy access with criteria suitable for foreign enterprises.

The Bank has also stood side by side with businesses through the program "Compass in the midst of fluctuations" with timely and specific analysis: updating financial market information in multiple languages such as Vietnamese, English, Chinese; recommending solutions to hedge exchange rate and interest rate risks to import-export and FDI enterprises exposed to exchange rate or interest rate risks for revenue, payments, and loans in foreign currency, VND for short-term, medium- and long-term loans.

In addition, ACB has implemented preferential programs "Competitive exchange rate - Export companion with preferential exchange rate up to 150 points for export customers or Golden day of international money transfer with preferential fee for import customers with a flat fee of only 9.9 USD/transaction.

Mr. Ngo Tan Long - Deputy General Director of ACB Bank said: "We want to create favorable conditions for businesses to access capital and not miss any opportunities for growth. In addition, ACB's comprehensive ecosystem of financial services will also help businesses hedge against risks from economic fluctuations," Mr. Long emphasized.

Vietnam can be a "promised land" if FDI enterprises have a knowledgeable financial partner and long-term companion.

To turn advantages into real value, Vietnam not only needs appropriate attraction policies, but also needs deep enough accompanying capacity at the infrastructure, finance and service levels. In particular, the domestic banking system such as ACB will play a decisive role in supporting FDI enterprises to access capital, operate cash flow and expand investment effectively.

Not only attracting FDI, Vietnam needs to be ready to retain and accompany long-term. And that starts with a financial ecosystem that is brave enough, refined enough, timely and meets the needs.

Customers interested in and learning about specialized policies for corporate customers can refer to the website acb.com.vn, or contact Contact Center 247 via hotline (028) 38 247 247 or contact the nearest branch/transaction office for advice and support.

Source: https://nhandan.vn/giua-lan-song-tai-ban-do-chuoi-cung-ung-acb-cung-doanh-nghiep-fdi-khai-pha-co-hoi-tai-viet-nam-post899308.html

![[Photo] New look of the coastal city on the Han River](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/26f58a4a29b9407aa5722647f119b498)

Comment (0)