Domestic gold price today 5/4/2025

At the time of survey at 13:30 on May 4, 2025, the gold price was anchored at a high of 121 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. Compared to last week, the gold price increased by 300 thousand VND/tael in both buying and selling directions.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday but increased by 300 thousand VND/tael in both buying and selling directions compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price decreased by 1 million VND/tael for buying and 1.5 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.3-121 million VND/tael (buying - selling, unchanged in both buying and selling directions compared to yesterday. Decreased 700 thousand VND/tael in buying direction - unchanged in selling direction compared to last week.

SJC gold price in Phu Quy is traded by businesses at 118.3-121.3 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday. Gold price decreased 200 thousand VND/tael in buying direction - increased 300 thousand VND/tael in selling direction compared to last week.

As of 1:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday and compared to the whole previous week.

Bao Tin Minh Chau listed the price of gold rings at 116.6-119.7 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; down 400 thousand VND/tael in buying direction - down 300 thousand VND/tael in selling direction compared to last week.

The latest gold price list today, May 4, 2025 is as follows:

| Gold price today | May 4, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.3 | 121.3 | - | - |

| DOJI Group | 119.3 | 121.3 | - | - |

| Red Eyelashes | 118 | 119.5 | - | - |

| PNJ | 119.3 | 121.3 | - | - |

| Vietinbank Gold | 121.3 | - | ||

| Bao Tin Minh Chau | 118.3 | 121 | - | - |

| Phu Quy | 118.3 | 121.3 | - | - |

| 1. DOJI - Updated: 5/4/2025 1:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,300 | 121,300 |

| AVPL/SJC HCM | 119,300 | 121,300 |

| AVPL/SJC DN | 119,300 | 121,300 |

| Raw material 9999 - HN | 113,800 | 115,600 |

| Raw material 999 - HN | 113,700 | 115,500 |

| 2. PNJ - Updated: 5/4/2025 1:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,930 | 12,130 |

| PNJ 999.9 Plain Ring | 11,400 | 11,700 |

| Kim Bao Gold 999.9 | 11,400 | 11,700 |

| Gold Phuc Loc Tai 999.9 | 11,400 | 11,700 |

| 999.9 gold jewelry | 11,400 | 11,650 |

| 999 gold jewelry | 11,388 | 11,638 |

| 9920 jewelry gold | 11,317 | 11,567 |

| 99 gold jewelry | 11,294 | 11,544 |

| 750 Gold (18K) | 8.003 | 8,753 |

| 585 Gold (14K) | 6,080 | 6,830 |

| 416 Gold (10K) | 4.111 | 4,861 |

| PNJ Gold - Phoenix | 11,400 | 11,700 |

| 916 Gold (22K) | 10,431 | 10,681 |

| 610 Gold (14.6K) | 6,372 | 7.122 |

| 650 Gold (15.6K) | 6,838 | 7,588 |

| 680 Gold (16.3K) | 7,187 | 7,937 |

| 375 Gold (9K) | 3,634 | 4,384 |

| 333 Gold (8K) | 3.110 | 3,860 |

| 3. SJC - Updated: 5/4/2025 1:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,300 | 121,300 |

| SJC gold 5 chi | 119,300 | 121,300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,300 | 121,300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 | 116,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 | 116,600 |

| Jewelry 99.99% | 114,000 | 115,900 |

| Jewelry 99% | 110,752 | 114,752 |

| Jewelry 68% | 72,969 | 78,969 |

| Jewelry 41.7% | 42,485 | 48,485 |

World gold price today 5/4/2025 and world gold price fluctuation chart in the past 24 hours

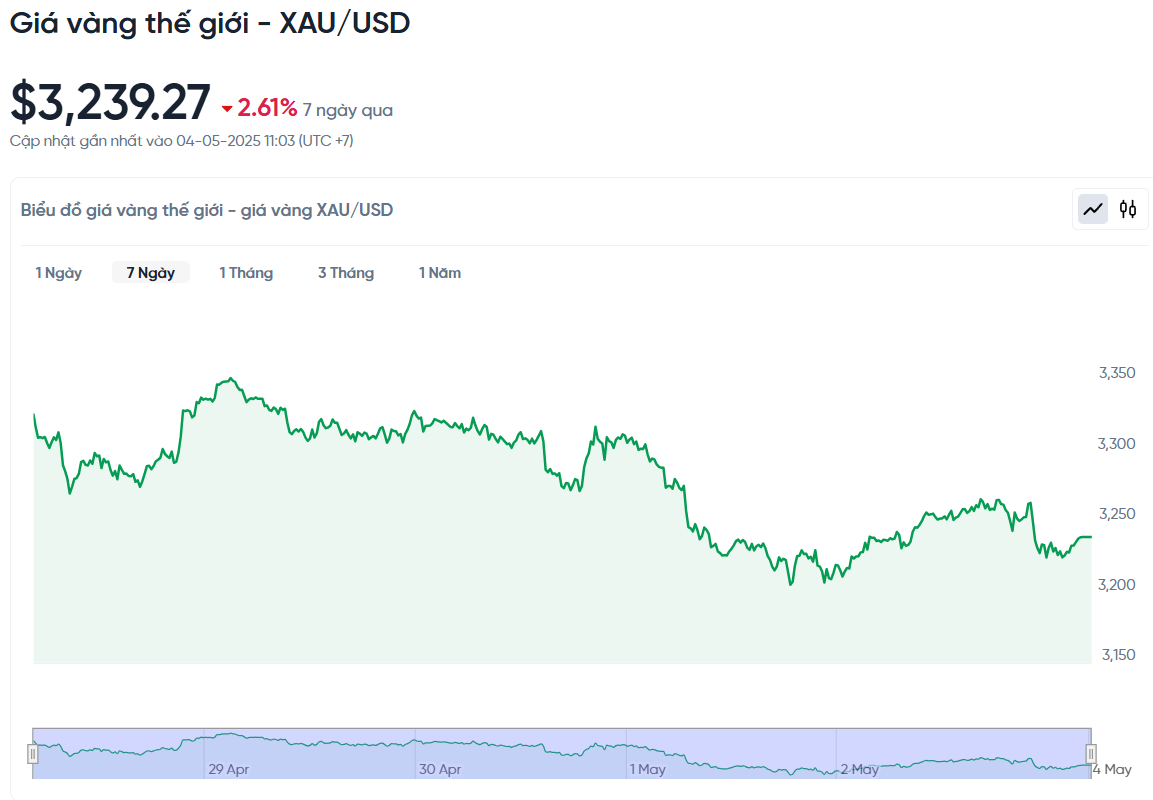

According to Kitco, the world gold price recorded at 1:30 p.m. today, Vietnam time, was at 3,239.27 USD/ounce. Today's gold price remained unchanged from yesterday and decreased by 86.98 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,180 VND/USD), the world gold price is about 103.27 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.03 million VND/tael higher than the international gold price.

The world gold price ended the week down 2.61% compared to the previous week. According to experts, there are no signs of panic in the market. This shows that the gold price may be entering an accumulation phase in a high price range. Expert Phillip Streible said that the gold price is still stable in this short-term resistance zone, but to be able to accelerate again, the gold price needs to surpass the $3,300 mark.

Despite falling more than 7% from its peak of $3,500, gold is still up nearly 24% year-to-date, indicating that the long-term uptrend has not been broken. According to Michael Brown of Pepperstone, the current correction is a good buying opportunity, as gold's long-term outlook remains solid, especially amid uncertainty over the Trump administration and a slowing US economy.

Ole Hansen of Saxo Bank also said that it is worth taking advantage of the correction to buy, but he noted that gold prices could still fall further. Hansen said he would be closely monitoring the reaction of Chinese investors as they return to the market after the extended holiday.

One factor that could act as a catalyst next week is the Federal Reserve’s monetary policy meeting. Although the US economy is slowing, recent data has shown considerable resilience. GDP fell 0.3% in the first quarter due to a surge in imports, while the labor market, while struggling in some areas, has remained resilient, adding 177,000 jobs last month, beating expectations.

The unemployment rate has held steady at 4.2% and wages have been rising steadily. There is no sign of a spike in inflation, which could prompt the Fed to consider changing its stance at its next meeting, although it has previously maintained a neutral stance and is in no rush to cut rates.

Many investors are expecting the Fed to signal more easing. The recent data has weakened the case for keeping interest rates high, said Naeem Aslam of Zaye Capital Markets. He said the current correction has made gold more attractive, attracting a large number of investors to buy at the bottom.

However, Aslam also warned that the market will be sensitive to both the Fed’s monetary policy and global trade developments. He said that the cooling signals from tariff tensions are positive, but could also limit the upside in gold prices in the short term.

Some other experts such as Carsten Fritsch of Commerzbank said that market expectations for the Fed to cut interest rates by up to 90 basis points this year are too high. If the Fed does not do this, gold prices may face the risk of further correction due to adjusted expectations.

Investors will be closely watching key economic events in the coming week: Monday’s ISM services PMI, Wednesday’s Fed rate decision, the Bank of England meeting and Thursday’s weekly jobless claims report. These will be key factors that could have a strong impact on the direction of gold prices.

Gold Price Forecast

Kitco News’ weekly gold survey shows that Wall Street experts are leaning toward further declines in gold prices. Of the 18 experts surveyed, half see prices falling, 28% see them rising and 22% see them moving sideways. Retail investors, on the other hand, remain bullish. Of the 273 people who responded online, 52% believe gold prices will rise next week.

Pressure on gold prices now mainly comes from expectations that US interest rates will remain high in the short term. In addition, positive signals from US-China trade negotiations have reduced demand for gold as a safe haven.

John Weyer from Walsh Trading said that gold prices are still being driven by information related to tariffs, including unconfirmed rumors. He predicted that gold prices will move sideways in the short term but with a large fluctuation range, because although gold is a safe asset, it is still very sensitive to market fluctuations.

According to Barchart expert Darin Newsom, the technical chart shows that the short-term trend of June gold futures is still bearish. Alex Kuptsikevich of FxPro shared the same view, saying that selling pressure increased over the weekend. He assessed that early April was when buyers controlled the market, but now sellers are testing the support level around $ 3,200 / ounce.

If prices continue to fall, gold prices could return to the $2,900 zone and could even slide to $2,600-$2,700 an ounce if the sell-off accelerates.

Mr. Fawad Razaqzada from City Index also commented that gold could continue to lose value, even breaking through the $3,200/ounce mark as demand for shelter gradually decreases amid the prevailing economic optimism.

Some experts such as Michael Moor and Fawad Razaqzada warn that if the optimistic sentiment continues and the USD increases, gold could fall deeply to the $3,000/ounce mark.

However, CPM Group believes that gold prices are approaching a short-term bottom in May. They recommend that investors consider buying when gold adjusts to the range of 3,000 - 3,150 USD/ounce.

The focus of the market next week will be the US Federal Reserve's policy meeting on Wednesday. Although the Fed is expected to keep interest rates unchanged, investors will still closely monitor the speeches of Chairman Jerome Powell for further indications on the direction of monetary policy.

Source: https://baonghean.vn/gia-vang-ngay-4-5-2025-gia-vang-trong-nuoc-va-the-gioi-neo-o-muc-cao-121-trieu-dong-10296514.html

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)