The decision to approve listing on HOSE means that MCM shares will soon "move home" from UPCoM to HOSE in the near future.

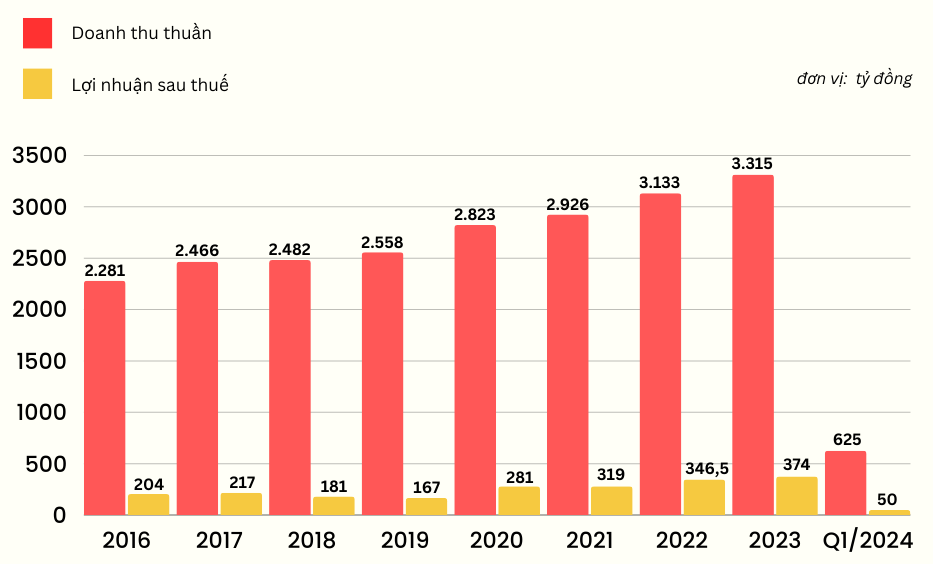

Having invested in MCM shares for more than a year, Ms. Hoang Ngoc Lan (35 years old, Dong Da District, Hanoi) expressed her hope for this new direction: "The business results of the first quarter just passed, profit at MCM decreased sharply by 51% compared to the same period, so I am a bit hesitant. But the business developments over the years, Moc Chau Milk has always maintained a steady growth state, not too sudden but "slow but sure". MCM is about to be listed on HOSE, I have more confidence in this code".

Recently, the Ho Chi Minh City Stock Exchange (HOSE) has decided to approve the listing registration of MCM shares (UPCoM) of Moc Chau Milk Seed Joint Stock Company.

This means that 110 million MCM shares will soon be listed on the HOSE in the near future, with a par value of VND10,000/share, equivalent to a total listed value of VND1,100 billion. The decision takes effect from the date of signing (May 24). The accompanying condition is that Moc Chau Milk must comply with regulations on securities, the stock market and other relevant regulations.

MCM shares continuously hit the ceiling after good news from HOSE (Photo: SSI iBoard)

Immediately after this information, MCM shares increased sharply, reaching a 2-year peak (since May 2022) at VND 43,700/share (May 27), up 12.05% compared to the previous session.

The upward momentum continued in the early morning session this morning (May 28), MCM jumped to 48,000 VND/share, up 10.34% compared to yesterday's session. Compared to the beginning of this year, MCM's stock value has increased by 33%.

Previously, MCM shares were first listed on UPCoM in December 2020, with 110 million shares in circulation.

The decision to approve MCM's listing on HOSE is expected to help MCM stock attract more attention from investors, helping the stock break out.

Specifically, at the end of the first quarter of 2024 , net revenue at MCM reached VND 625.4 billion, down 15% over the same period last year. As a result, gross profit decreased by 25.6%, resulting in after-tax profit at MCM in the first quarter of this year, reaching about VND 50 billion, down sharply by 51% over the same period.

Notably, total assets at MCM are maintained relatively safe, with total assets of more than VND 2,605 billion, of which equity reaches VND 2,372 billion (accounting for 91%), liabilities reach only VND 233 billion (accounting for 9%). In particular, MCM does not record outstanding financial loans.

Business situation in recent years at Moc Chau Milk

Source: Compiled financial statements at MCM

Although the results of the first quarter of 2024 were not very positive compared to the same period last year, overall in 2023, MCM earned record profits, creating a basis for the expectations of many investors.

In the 2024 full-year plan, MCM targets after-tax profit of VND332 billion and net revenue of VND3,367 billion. Thus, after the first 3 months of the year, MCM has completed 15% of after-tax profit and 18.6% of net revenue compared to the full-year plan.

Moc Chau Milk, formerly known as Moc Chau Military Farm, was established in 1958. This is currently the oldest milk brand in Vietnam. The company operates mainly in the field of dairy farming, providing dairy cow breeds, manufacturing and processing dairy products and producing animal feed.

In December 2019, Vietnam Dairy Products Joint Stock Company - Vinamilk (VNM, HOSE) became the parent company of GTNFoods after increasing its ownership ratio to 75%. Meanwhile, GTNFoods holds 74.5% of shares in Vietnam Livestock Corporation - Vilico (VLC, UPCoM), Vilico owns 51% of shares in Moc Chau Milk. That means Moc Chau Milk officially belongs to Vietnam Dairy Products Joint Stock Company (Vinamilk) through GTNFoods (merged into Vietnam Livestock Corporation - Vilico). Also at the end of 2020, Moc Chau Milk's MCM shares officially traded on UPCoM.

Currently, Moc Chau Milk has two major shareholders: Vilico (owning 59.3% of shares) and Vinamilk (owning 8.85% of shares). Ms. Mai Kieu Lien, General Director and Member of the Board of Directors of Vinamilk, also holds the position of Chairwoman of Moc Chau Milk.

This deal is assessed to bring many strategic benefits to Vinamilk, such as: increasing domestic milk supply from GTNFoods' dairy cows; owning the Moc Chau Milk brand which already has a brand in the domestic market and export channels.

However, it seems that this has also brought many improvements to Moc Chau Milk. Looking back over 4 years of being under the same roof, the business situation at MCM shows clear growth year by year, reaching record profits in 2023.

Source: https://phunuvietnam.vn/gia-co-phieu-thuong-hieu-sua-lau-doi-nhat-viet-nam-tang-dung-dung-sau-thong-tin-chuyen-san-20240528101500365.htm

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)