Steel imported to Hai Phong port area is stored in customs inspection and supervision locations according to regulations - Photo: CAM GIANG

Previously, according to the anti-dumping tax order, steel products originating from China, with a thickness of 1.2 - 25.4mm and a width of no more than 1,880mm, will be subject to an anti-dumping tax of 23.1 - 27.8% and will last for 5 years.

Therefore, many domestic steel manufacturing enterprises have circumvented this regulation by importing steel products with a width of over 1,880mm to avoid taxes.

Cheap imported goods are preferred?

Responding to Tuoi Tre, some businesses using hot-rolled steel as input material for production affirmed that with the applied tax rate, businesses are almost unable to import steel raw materials from China, so they have found ways to circumvent this regulation.

Because in reality, if taxes are added, imported goods will not be able to compete on price, even though the final price is paid by consumers.

"Therefore, we import HRC steel with a width of over 1,880mm, combined with a "slitting" machine over 2,000mm, to make full use of raw materials, optimize production to reduce costs. Importing raw materials to meet production needs is also a real need of businesses when domestic supply is not enough," said a representative of a steel company in the North.

According to research, to find alternative sources of goods, many businesses have switched to importing HRC steel products with HS codes different from the above taxed list to avoid being subject to anti-dumping tax.

For steel coils with a width of over 1,880mm, businesses use "slitting" machines, which are machines that cut steel to the exact size required (mainly under 1,800mm) to meet production needs.

However, a steel company in Hung Yen admitted that it imported hot-rolled steel with a width of over 1,880mm to cope with the tax order. In fact, hot-rolled steel with a width of 1,500 - 2,000mm is not much different and businesses can use different sizes, optimizing efficiency through design, production line machinery and "size-reducing" machines.

Although according to some steel companies, not all units importing wide-gauge steel and using "strip-reducing" machines are effective. Having to import wide-gauge steel and having to process it through "strip-reducing" machines also causes work and extra manpower with the remaining steel. However, because imported goods are cheaper, this is still the choice of many manufacturers.

"But this is not a big problem, the main thing is to ensure the supply of raw materials for production. In fact, since the tax order, domestic purchasing prices have not fluctuated too much. Although they are on an upward trend, they mainly follow world price movements and the final price is paid by consumers, but we also have to ensure competitiveness," said the business.

Data: Ngoc An - Graphics: N.KH.

Increased monitoring of imported hot-rolled steel shipments

Talking to us, a steel industry expert said that the fact that businesses are racing to import steel with a width of over 1,880mm as production input to replace HRC steel with a size of under 1,880mm will have a direct impact on the domestic manufacturing industry as well as the economy, because cheap steel products continue to flood into Vietnam, due to not being subject to anti-dumping tax.

"HRC products are input materials for many industries such as steel pipes, galvanized iron, household appliances...

The influx of cheap wide-gauge steel into Vietnam to replace products with a gauge of less than 1,880mm will cause major disruption to downstream product prices, create unfair competition, distort the domestic market, seriously affect the domestic HRC production industry, and cause tax losses to the State," he warned.

More worryingly, according to experts, the sharp increase in the quantity of wide-sized HRC hot-rolled steel imported into Vietnam also risks affecting the identification of Vietnamese origin goods.

Because HRC steel accounts for 80 - 90% of the cost structure of downstream steel products, while many large steel importing countries such as the US, Canada and some EU countries... require downstream steel products to be manufactured from HRC products of domestic Vietnamese manufacturers.

"Therefore, allowing large-sized HRC steel over 1,880mm into Vietnam risks being requested by other countries to investigate origin evasion and downstream steel product manufacturers are at risk of being implicated," an expert warned.

Speaking with us, Mr. Chu Thang Trung, Deputy Director of the Department of Trade Defense (Ministry of Industry and Trade), said that he had received information related to the increase in imports of hot-rolled steel products with a width of over 1,880mm with the aim of evading the application of anti-dumping measures.

Therefore, this agency has also sent a supplementary survey questionnaire, requesting import companies to provide additional information on the import, use and sale of hot-rolled steel products with a width of over 1,880mm.

"We also sent a dispatch requesting the Ministry of Finance (Customs Department) to consider measures to strengthen supervision of imported shipments of hot-rolled steel products declared to have a width greater than 1,880mm to limit the possibility of fraud by traders through false declaration of product size to evade anti-dumping tax," Mr. Trung informed.

Imports of wide-gauge steel increased...18 times

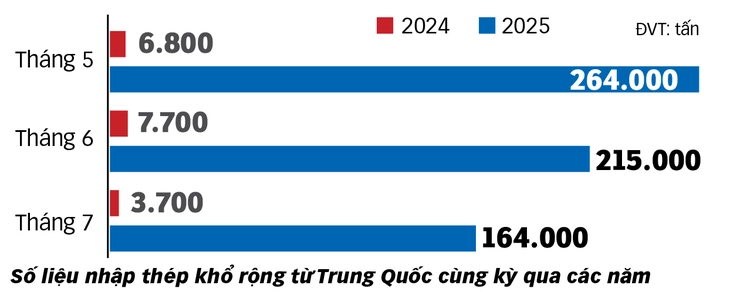

According to statistics from the Customs Department, in July 2025, the total imported HRC steel was 642,000 tons, of which 405,000 tons were from China. Of which, wide-gauge steel products from China were 163,000 tons, accounting for more than 40% of imported HRC steel.

In the first 7 months of the year, the import volume of hot-rolled steel with a width of 1,880mm or more from China to Vietnam reached nearly 832,000 tons, 18 times higher than the first 7 months of last year. Steel with a width of 2,000mm accounted for 72% of the import volume in the first 7 months of the year.

Hot rolled wide steel coils imported from China are mainly common and popular steel grades (Q235B, Q355B, SAE 1006, SS400, A36...), imported for use as regular HRC (production of corrugated iron, steel pipes, structural processing...).

Thus, in the first 7 months of the year, the amount of HRC hot-rolled steel imported into Vietnam was 5.2 million tons, of which the Chinese market alone was 3.2 million tons, accounting for 61%. Of this, the amount of wide-gauge steel from China alone was 832,000 tons, 18 times higher than the same period.

Customs increases control to prevent fraud

Information from the Customs Department said that it has implemented a series of solutions to both prevent fraud and facilitate businesses in importing and exporting goods, including importing hot-rolled steel.

At the Customs Branch of Region 3 (managed in Hai Phong), after the Ministry of Industry and Trade issued a decision to officially apply anti-dumping tax on some hot-rolled steel products originating from China, this agency notified the business community via the website so that businesses could grasp and comply with the regulations.

The agency also directed units to strictly implement the decision of the Ministry of Industry and Trade on imposing anti-dumping tax on HRC steel. In particular, focusing on key contents to prevent fraud such as: collecting information, analyzing, and evaluating import activities of hot-rolled steel products.

In addition, the Customs Authority also establishes and applies inspection flow criteria in carrying out customs procedures for imported steel shipments, in accordance with the risk level. Conduct inspections according to the system flow; monitor and inspect key shipments as directed.

Additional investigative measures may be applied earlier.

Responding to Tuoi Tre, a representative of the Department of Trade Defense (Ministry of Industry and Trade) said that they have proactively collected more information, reported to the Prime Minister and warned businesses to strictly enforce legal regulations.

During the official investigation, the Ministry of Industry and Trade also sent supplementary investigation questionnaires to import enterprises, requesting import companies to provide additional information on the import, use and sale of steel products.

In addition, the ministry has completed the institution and issued circulars guiding Decree 86 to be able to immediately implement new regulations on trade defense from July 1.

The new regulations have anticipated the possibility of businesses evading trade defense measures, so they allow timely application of measures, based on businesses' requests and taking into account the interests of all parties.

If there is a conclusion of tax evasion, strict measures can be applied sooner instead of having to take at least 9 months to apply additional measures and if the investigation is extended, it takes 12 months.

Source: https://tuoitre.vn/dua-nhap-thep-kho-rong-tu-trung-quoc-de-ne-thue-20250821090641528.htm

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Politburo works with the Standing Committee of Hanoi Party Committee and Ho Chi Minh City Party Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/4f3460337a6045e7847d50d38704355d)

Comment (0)