Recently, the United States announced the application of a 46% reciprocal tax on imported goods from Vietnam, which has posed a major barrier to export activities, affecting many businesses in the province.

According to statistics, in 2024, the export turnover of enterprises carrying out customs clearance procedures at Vinh Phuc Customs Branch reached 547.1 million USD, accounting for 3.1% of the province's total export turnover. However, in the first quarter of 2025, the export turnover to the United States decreased to 125.6 million USD, accounting for 3.6% of the province's total export turnover.

Key products such as motorbike components, garments, helmets, footwear, household appliances and electronic components are all affected by higher tariffs, reducing the competitiveness of Vietnamese products in this market.

According to the Department of Finance, the new tax rate applied by the United States on Vietnamese goods has significantly increased the cost of Vietnamese products, leading to the risk of reduced revenue and narrowing market share in the United States.

Not only affecting exports, the new tax policy also negatively impacts the investment environment in Vietnam in general and Vinh Phuc in particular. Currently, in the province, there are more than 100 enterprises directly and indirectly affected by this high tax rate. Enterprises having to pay high import taxes increases production costs, making it difficult to maintain and expand operations.

A My Industrial Joint Stock Company, Thai Hoa - Lien Son - Lien Hoa Industrial Park (Lap Thach) specializes in manufacturing tiles, ceramics and construction materials for export. For many years, the United States has been one of the company's important export markets, contributing more than 50% to the unit's revenue and profit.

However, when the US imposed a 46% import tax on goods from Vietnam, the company faced many major challenges. Specifically, the high cost of products caused customers in the US to consider switching to buying from countries with lower taxes such as Mexico or China. Orders decreased, forcing the company to consider new business strategies to maintain operations and preserve profits.

To adapt to this situation, Asia America has implemented many strategic solutions. First, the company focused on expanding its market to other regions such as the EU, Japan, Korea and Southeast Asian countries to reduce its dependence on the United States.

Next, invest in new production technology, optimize production processes, reduce costs, increase competitiveness and meet stricter international market standards. Promote the search for trade partners in the United States through import channels with more flexible policies, take advantage of Free Trade Agreement incentives to reduce tax pressure.

Work closely with local business organizations and governments to access provincial support programs, including financial incentives, domestic tax exemptions, and business connections with foreign partners. These measures not only help Asia America maintain stability but also create a premise for stronger export expansion in the future.

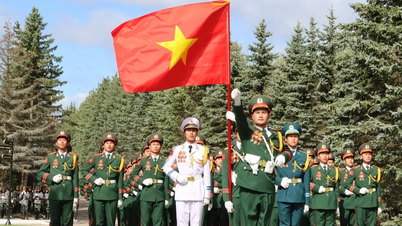

In order to support businesses in adapting to the new situation when the US imposed high reciprocal taxes on Vietnamese export goods, the Provincial People's Committee organized a conference with the participation of representatives of departments, branches and many businesses in the area, to find solutions to overcome difficulties.

At the conference, the provincial leaders affirmed that they will accompany and provide maximum support to remove difficulties for businesses. Vinh Phuc Customs Branch committed to closely coordinate with the business community to ensure transparency in procedures for granting certificates of origin of goods, and at the same time support in handling problems related to tax policies and import-export activities.

At a recent meeting with export enterprises, Chairman of the Provincial People's Committee Tran Duy Dong emphasized that Vietnam is promoting negotiations with the United States to seek reasonable solutions on tariffs.

While waiting for the negotiation results, the province remains steadfast in its double-digit growth target, synchronously and flexibly implementing fiscal, trade and investment policies to support the economy. It will also step up the improvement of transport infrastructure, upgrade the logistics system, and ensure a stable supply of electricity and water to help businesses reduce production costs and enhance competitiveness.

In addition to government support, export enterprises also need to proactively adjust their business strategies to cope with the new tax rate. Some proposed solutions include converting the production model to FOB so that customers can share the tax burden, making the origin of goods transparent, diversifying export markets, promoting e-commerce and applying technology to production to improve product quality. These measures not only help enterprises adapt to changes but also create the premise for expanding export activities in the future.

With the determination of all levels of government and the business community, Vinh Phuc aims to not only overcome the challenges of new tariffs but also create a solid foundation for sustainable development and strong growth in the international market.

Thanh An

Source: http://baovinhphuc.com.vn/Multimedia/Images/Id/127508/Dong-hanh-kip-thoi-ho-tro-doanh-nghiep

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)