SGGPO

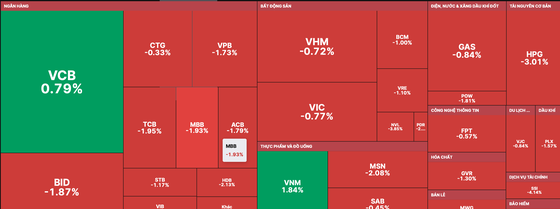

Although the two "pillar" stocks VCB and VNM increased, the downward pressure on most stock groups was too great, causing the VN-Index to turn around and fall sharply, "breaking" the 1,130 point mark, ending the previous 7 consecutive increasing sessions.

|

| 2 "pillar" stocks VCB and VNM increased but could not "support" the index in the session of June 29 |

Faced with strong profit-taking pressure from investors, along with not-so-bright macro information in June, the Vietnamese stock market on June 29 witnessed a session of sharp declines across the board. The number of stocks falling in price was more than four times that of stocks rising. Although VCB and VNM increased, they could not "support" the index, causing the VN-Index to "break" 1,130 points.

In the group of large-cap banking stocks, only VCB remained green, the rest BID, CTG, ACB, HDB, TCB, VPB, VIB, STB, MBB... all decreased from nearly 1 to nearly 3%. The group of securities stocks also decreased sharply such as: VCI decreased by 4.47%, SSI decreased by 4.14%, HCM decreased by 3.61%, VND decreased by 3.84%, SHS decreased by 3.7%... The group of real estate and public investment stocks also "plummeted" with IDC decreased by 2.3%, NLG decreased by 2.36%, PDR decreased by 2.94%, DIG decreased by 5.8%, VCG decreased by 2.11%, NVL decreased by 3.85%, VGC decreased by 3.31%, DRH decreased by 3.08%, DXS decreased by 3%, DXG decreased by 4.2%...

At the end of the trading session, VN-Index decreased by 12.96 points (1.14%) to 1,125.39 points with 361 stocks decreasing, 84 stocks increasing and 63 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also decreased by 2.77% to 227.48 points (1.2%) with 148 stocks decreasing, 50 stocks increasing and 134 stocks remaining unchanged. Market liquidity remained high with a total trading value across the entire market of nearly VND19,600 billion. Foreign investors continued to net buy VND114.74 billion on the HOSE.

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)