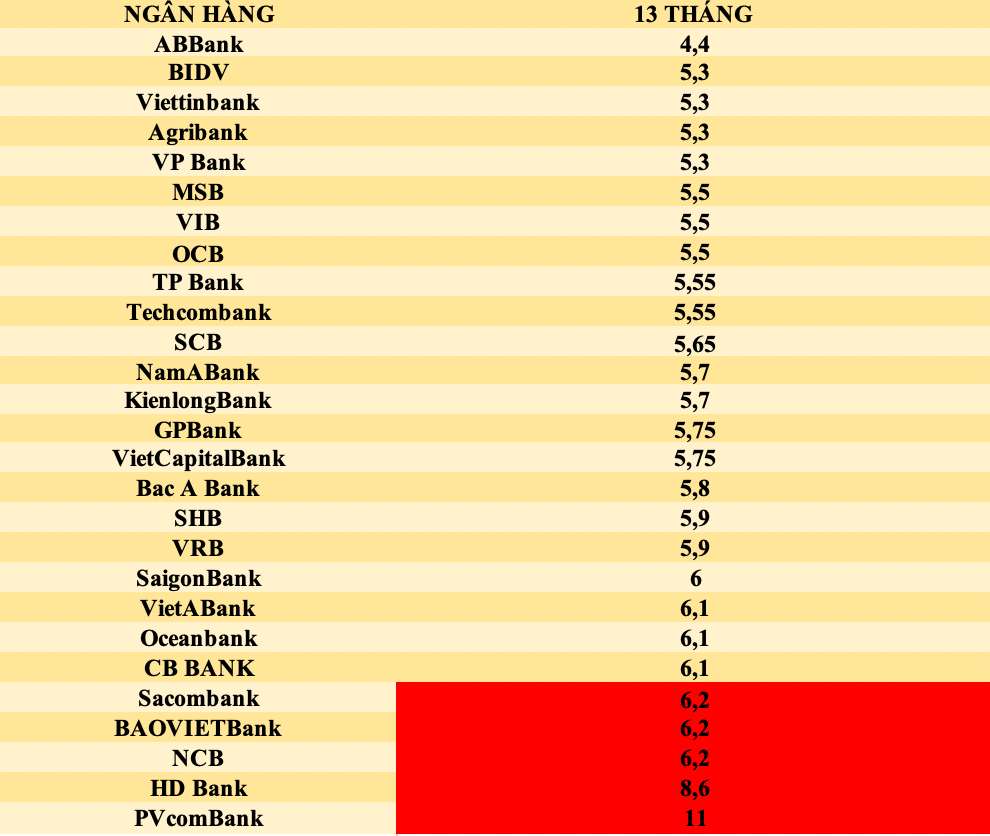

According to a survey by Lao Dong Newspaper with nearly 30 banks in the system, PVcombank's interest rates are currently leading the market.

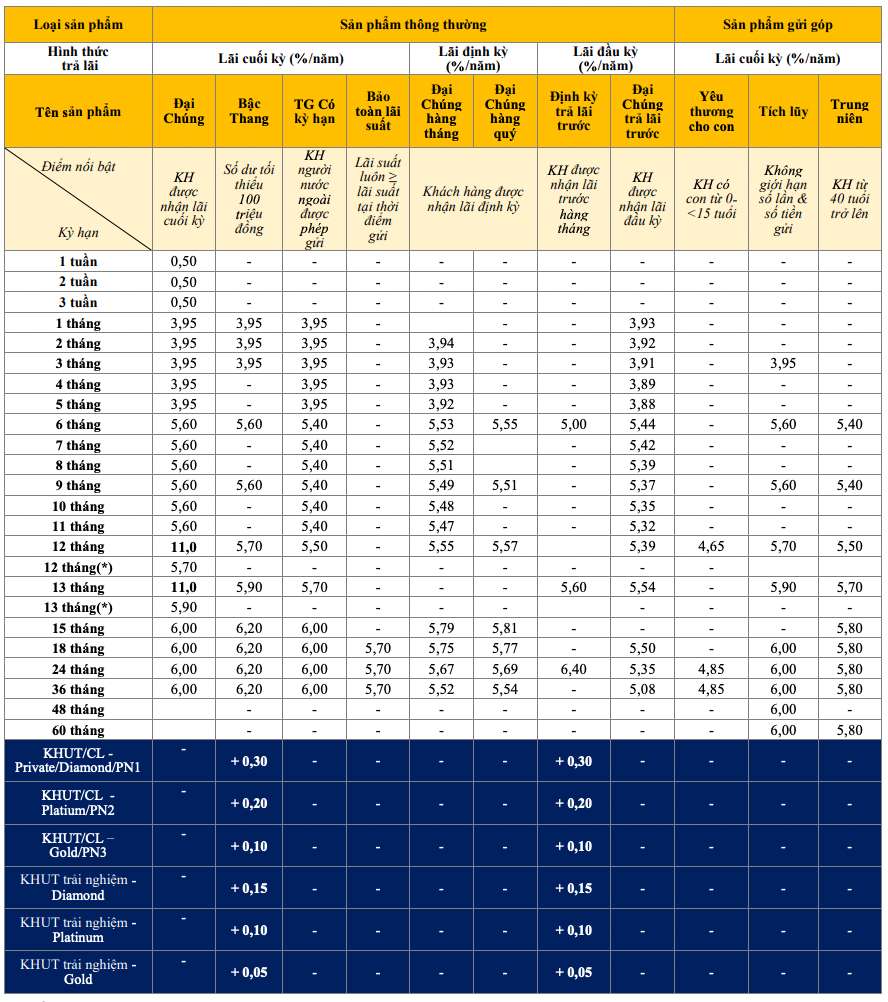

Specifically, PVcomBank is listing the highest savings interest rate for a 13-month term at 11%/year, for mass savings products, applied to savings deposits at the counter for newly opened deposit balances of VND2,000 billion or more. Under normal conditions, PVcomBank is listing the highest interest rate for a 13-month term at 5.9%/year when customers deposit savings at the counter.

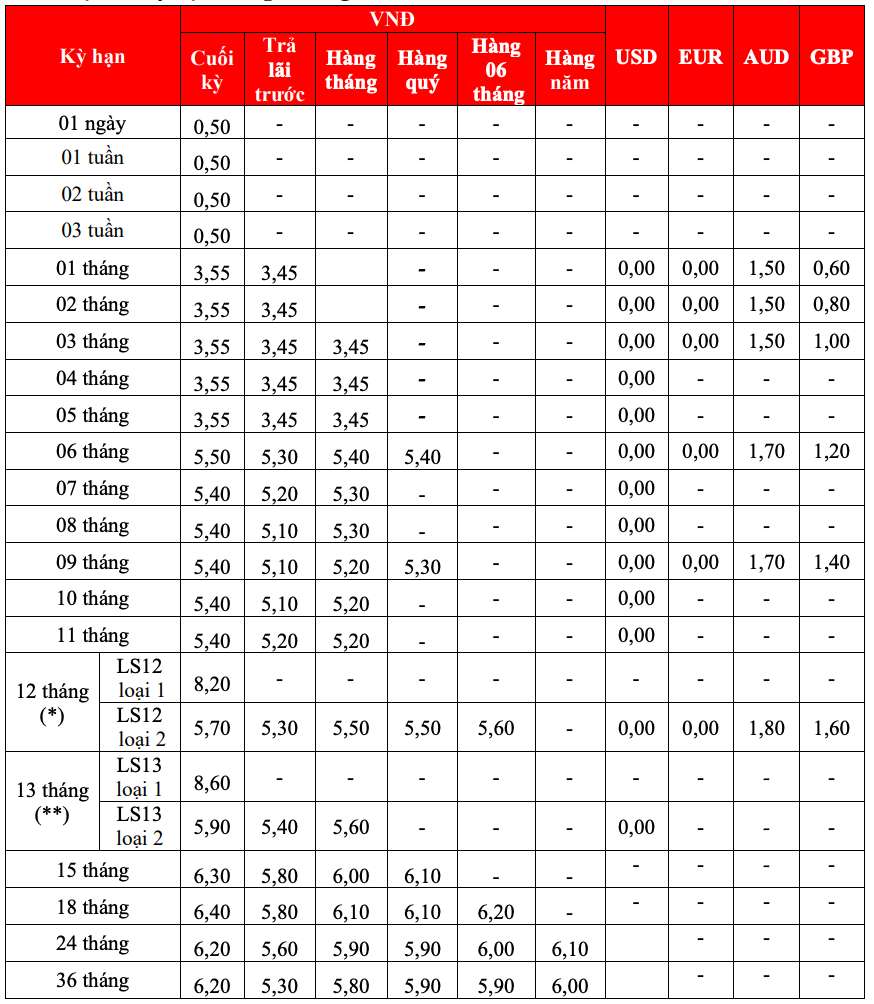

In second place, HDBank applies an interest rate of 8.6%/year for a 13-month term with the condition of maintaining a minimum balance of VND300 billion. When customers deposit online, under normal conditions, they only receive an interest rate of 6.1%/year.

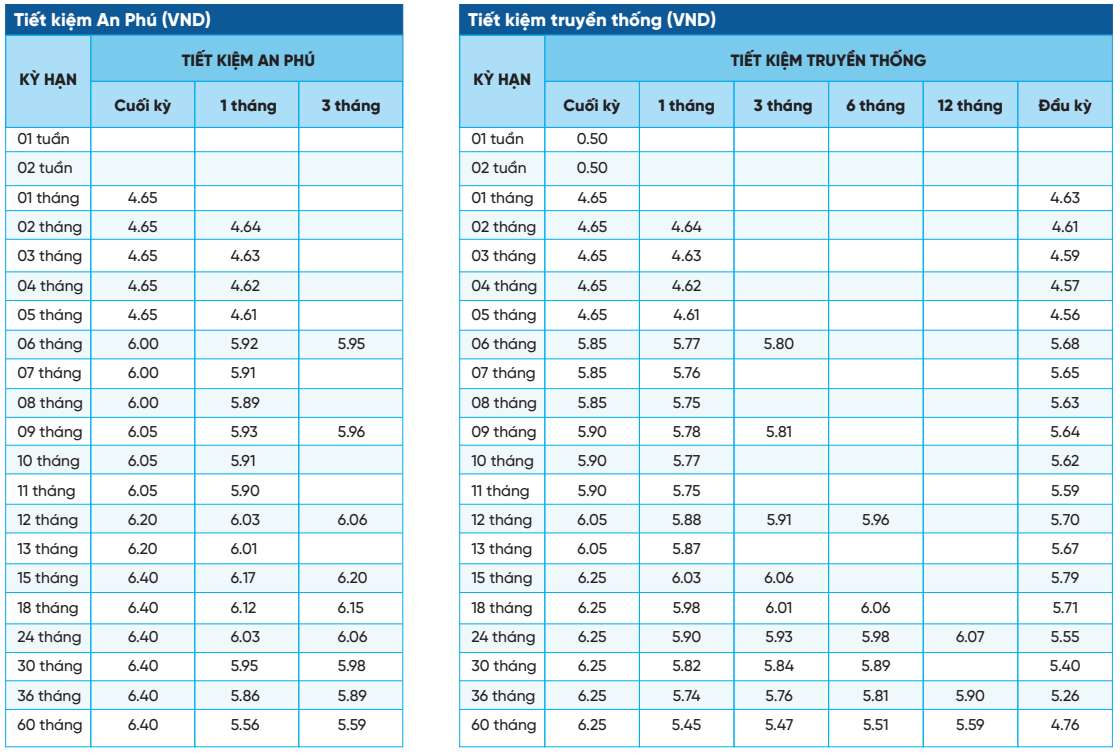

Next, NCB is listing the highest interest rate for a 13-month term at 6.2%/year when customers deposit savings at An Phu. Customers depositing traditional savings receive an interest rate of 6.05%/year when receiving interest at the end of the term.

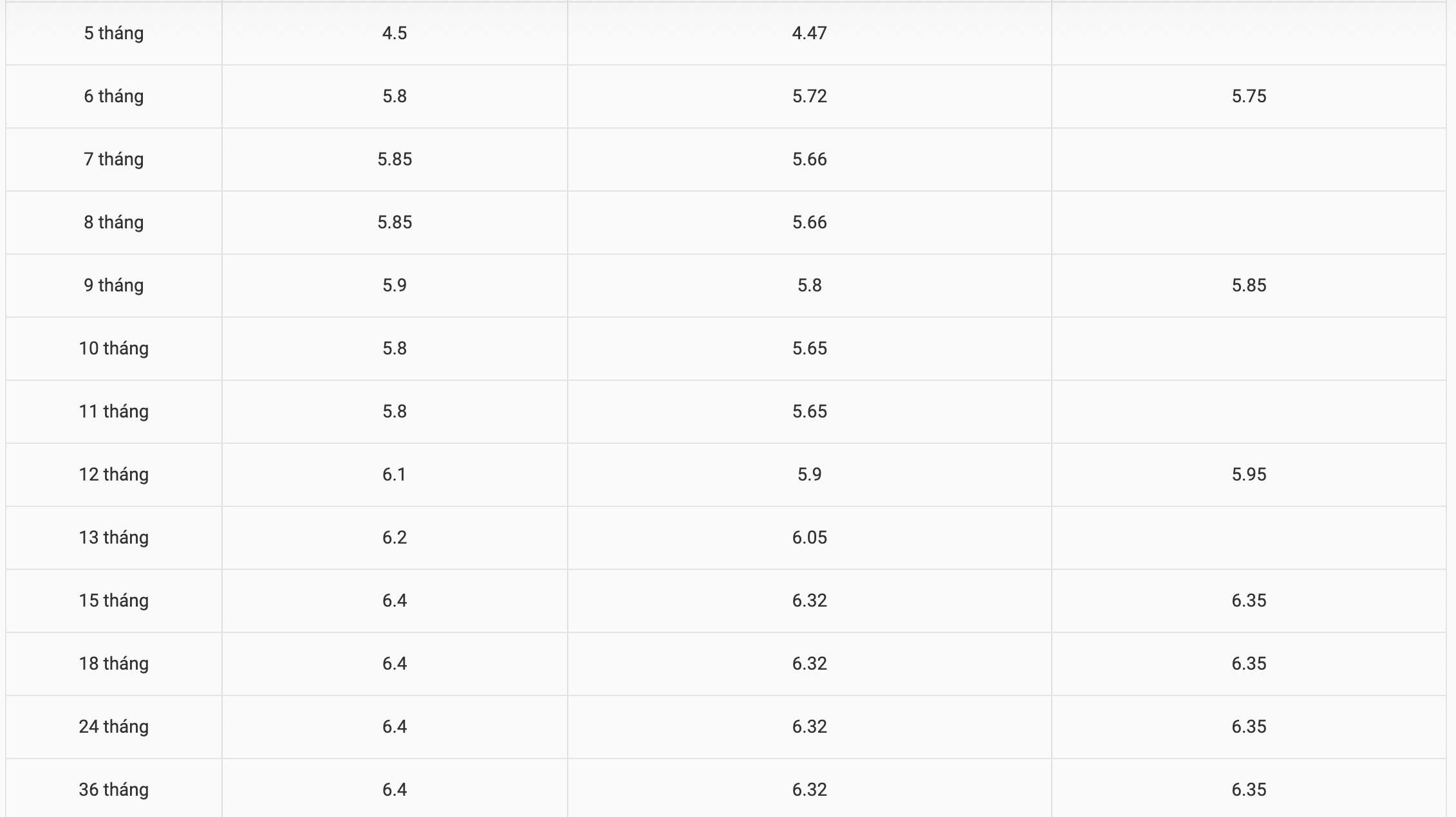

NCB is listing the highest interest rate of 6.4%/year when customers deposit savings at An Phu for 15-60 months. For other terms, NCB is listing interest rates ranging from 0.5-6.4%/year.

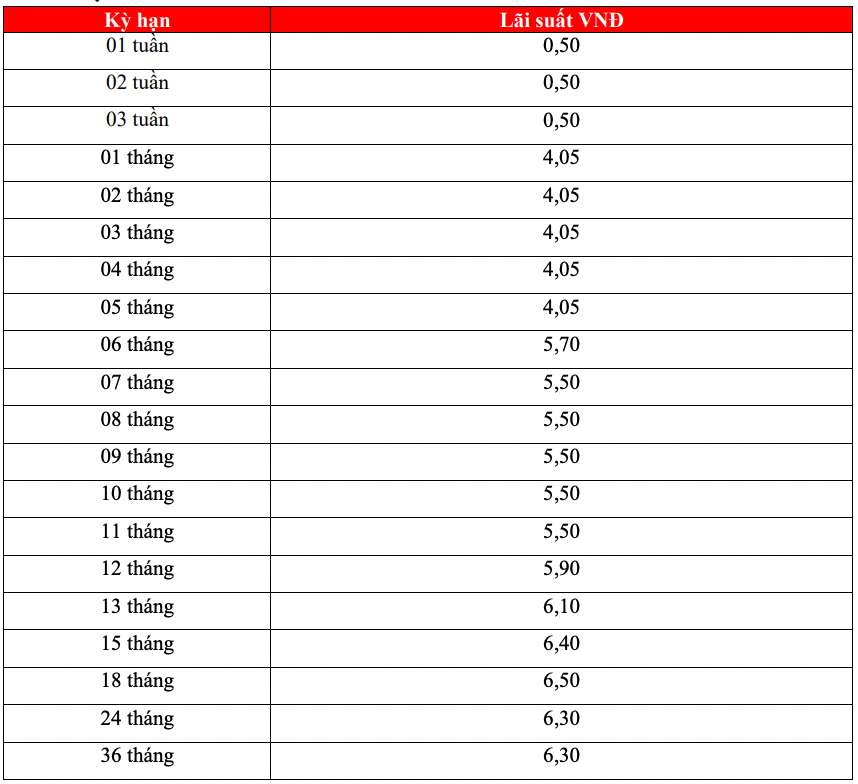

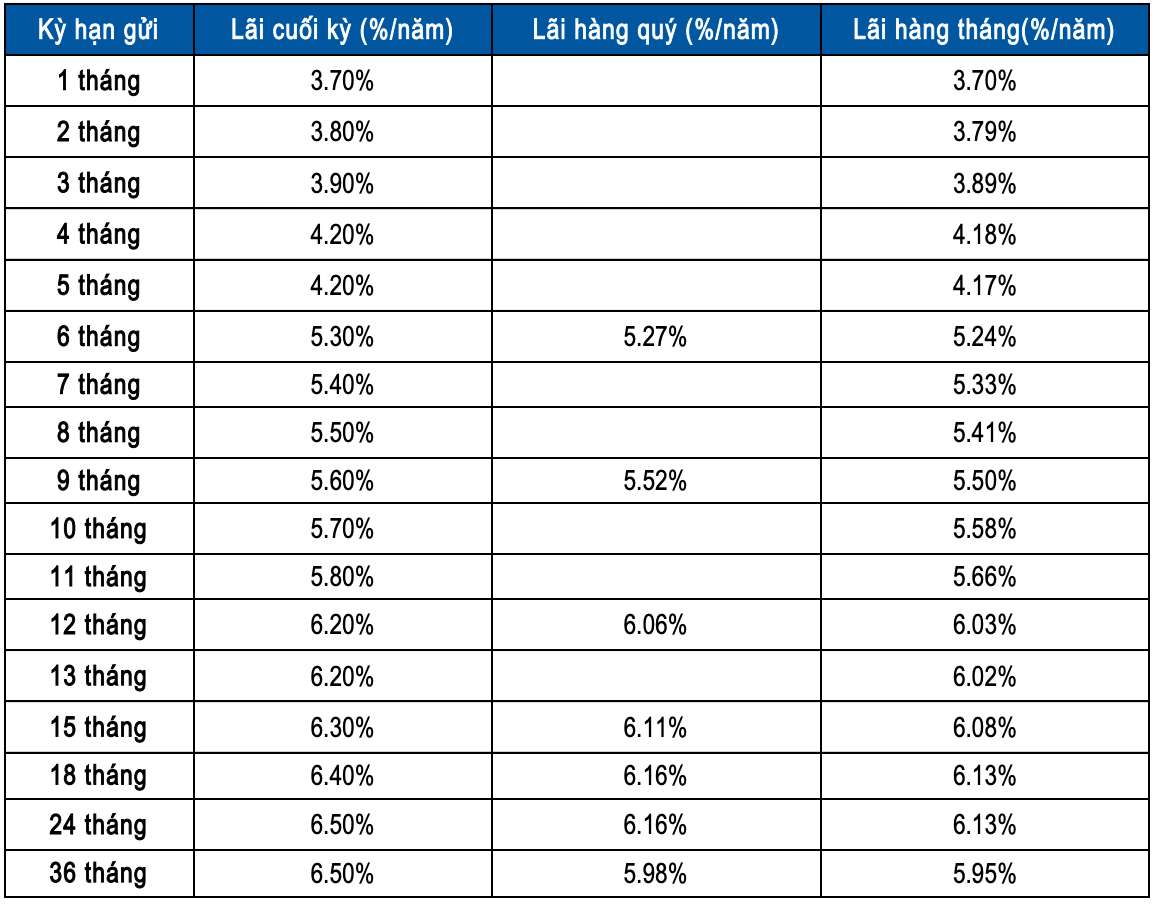

BaoVietBank is currently listing the highest interest rate for a 13-month term at 6.2%/year when customers deposit savings online and receive interest at the end of the term. Customers who receive interest monthly only receive an interest rate of 6.05%/year.

SacomBank is listing the highest interest rate for a 13-month term at 6.2%/year when customers deposit savings online and receive interest at the end of the term. Customers who receive interest monthly receive an interest rate of 6.02%/year.

Currently, SacomBank is listing the highest interest rate at 6.5%/year when customers deposit savings for 24 and 36 months.

Below is a comparison table of 13-month savings interest rates compiled by PV of Lao Dong Newspaper on October 29, 2023 in a system of nearly 30 banks, readers can refer to:

Save 2 billion VND, after 13 months how much interest will you receive?

You can refer to the interest calculation method to know how much interest you will receive after saving. To calculate interest, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit.

For example, you deposit 2 billion VND in Bank A, term 13 months and enjoy interest rate 6.2%/year, the interest received is as follows:

2 billion VND x 6.2% / 12 x 13 = 134.3 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.

Source

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)