Rising right at the beginning of the morning session, even reaching 1,665 points at one point in the afternoon, the VN-Index only adjusted slightly in the last half hour of the session. At the end of the trading session on August 19, 2025, the VN-Index increased by nearly 18 points, to 1,654.20 points, setting a new historical peak in closing price in the context of strong cash flow. The VN30-Index increased by 15.9 points, closing at 1,802.74 points, surpassing the 1,800-point mark for the first time.

On the HoSE, the matched value reached VND49,851 billion, up 16.45% compared to the previous session. The total trading value reached VND54,554 billion. The HNX-Index increased by 2.58 points to 286.45 points, with 101 stocks increasing in price, overwhelming 63 stocks decreasing. Liquidity on the HNX continued to remain high with 190 million shares matched, equivalent to a trading value of more than VND4,245 billion. On the UPCoM floor, the UPCoM-Index increased by 0.81 points to 109.78 points. The entire floor recorded 183 stocks increasing, surpassing 94 stocks decreasing. Trading volume reached more than 101 million units, equivalent to a value of more than VND1,276 billion.

Green not only dominated the three indices, but also the number of stocks increasing in price. On all three exchanges, the number of stocks increasing in price was overwhelmingly dominant with 60 stocks hitting the ceiling price, 445 stocks increasing in price. On the other hand, only more than 300 stocks decreased.

Banking stocks continued to play a leading role with a series of securities codes appearing in the top stocks that positively impacted the market. Leading the way was VPBank shares, which increased by a large margin and contributed 4.35 points to the VN-Index. Next were TCB, LPB,ACB , HDB and CTG. However, the "big brother" of the banking industry, Vietcombank, decreased slightly by 0.47%, pulling the market capitalization down to VND536,434 billion. However, this is still the listed organization with the largest capitalization scale on the three exchanges.

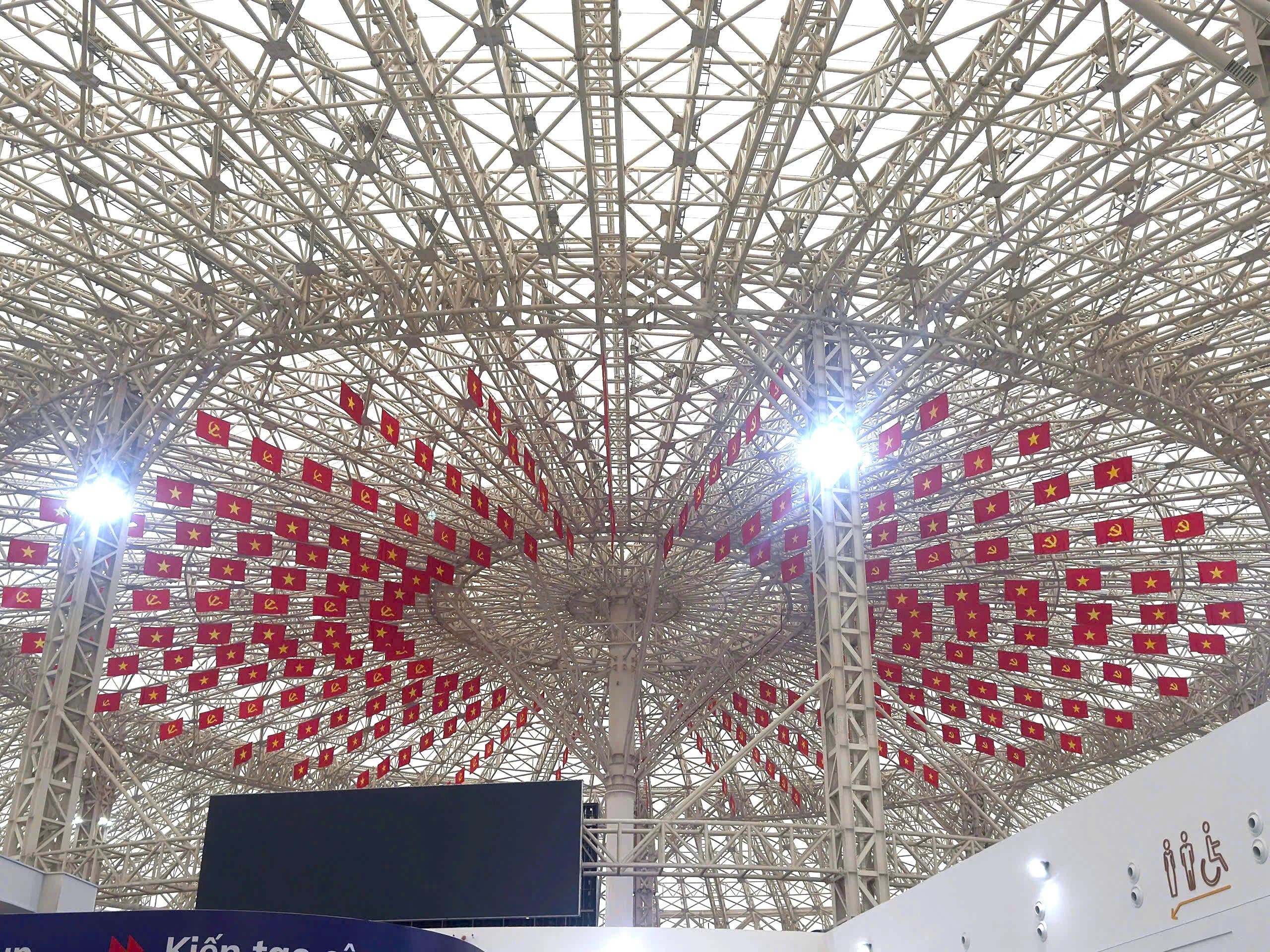

Cash flow also poured into buying strongly in the infrastructure construction, securities, aviation and electricity groups. After yesterday's significant increase, the event of 250 projects in 34 provinces and cities starting construction and inaugurating today with a total investment of more than 1.28 quadrillion VND continued to create a strong catalyst attracting cash flow to the construction group. Many stocks increased sharply such as HHV, DIG, CII...

Liquidity remained high with strong cash flow. Total transaction value on the three exchanges reached over VND59,900 billion. The two stocks with the most transactions wereSHB and SSI with values of VND2,507 billion and VND2,155 billion, respectively.

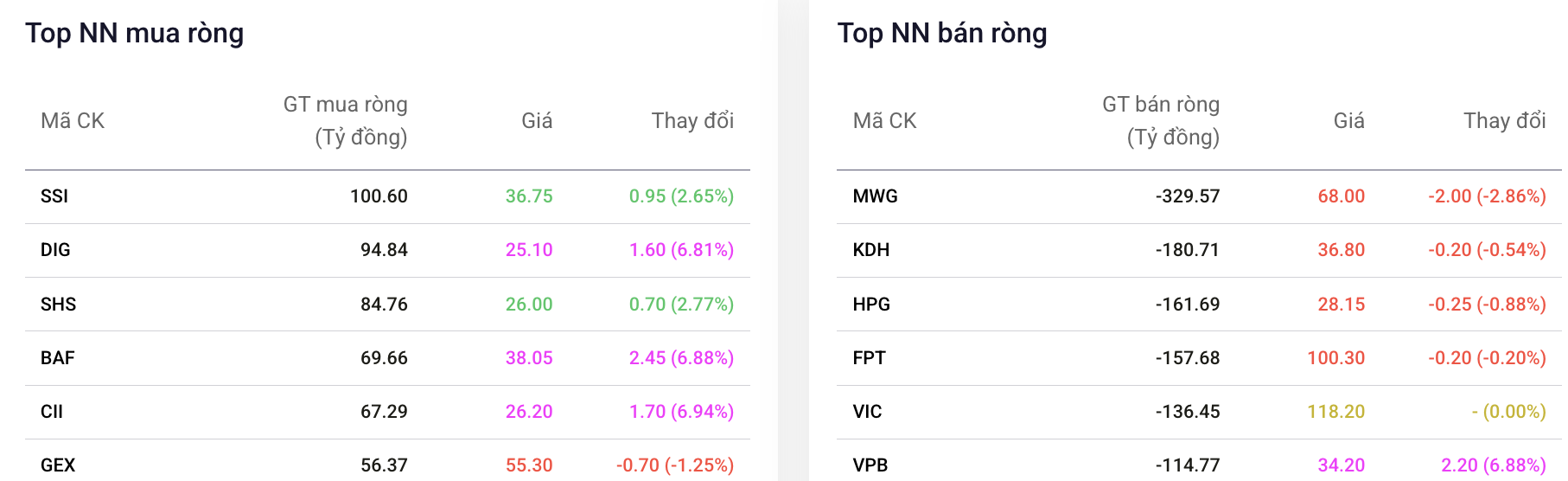

Foreign investors were net sellers on both HoSE and UPCoM, while they were net buyers on HNX. The total net selling value of the entire market reached over VND1,500 billion. This was the 9th net selling session of foreign investors. However, domestic demand still helped the Vietnamese stock market steadily conquer new milestones.

|

| Stocks bought/sold the most by foreign investors in the session. |

The stocks with the strongest net sales were MWG (VND 329.6 billion), KDH (VND 180.7 billion), HPG (VND 161.7 billion),FPT (VND 157.7 billion), VIC (VND 136.5 billion) and VPB (VND 114.8 billion).

Despite strong net selling by foreign investors, VPB was a bright spot with a ceiling increase of VND34,200/share (+6.88%) thanks to information about the IPO plan of VPBankS subsidiary expected in the fourth quarter of 2025. Specific information has not been announced, but this securities company will soon inform about documents to collect shareholders' opinions in the near future. On the net buying side, SSI shares were disbursed for over VND100 billion. Many stocks were net bought and all increased quite well although the disbursement value was not much.

Despite the adjustment in the second half of the session, the green candle remained until the end of the session, showing that the demand was still overwhelming. According to experts from BIDV Securities (BSC), in the coming sessions, the market is forecast to continue to find a balance point in the 1,625 - 1,665 point range.

Source: https://baodautu.vn/vn30-index-vuot-1800-diem-sac-xanh-ap-dao-du-khoi-ngoai-lien-tuc-ban-rong-d364292.html

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)