Not only leading in scale, VPBank also scores in capital quality thanks to impressive growth in CASA and the ability to attract long-term international capital.

Mobilization growth surpasses two Big4

In the first half of 2025, credit growth reached its highest level since the Covid-19 period as the banking industry promoted lending activities and supported the economy according to the Government's direction. According to data from the State Bank of Vietnam (SBV), as of June 30, outstanding credit of the entire system increased by 9.9% compared to the end of 2024 and 19.32% compared to the same period.

However, deposit growth has shown signs of slowing down compared to credit. In the July 2025 money market report, analysts at MB Securities Company (MBS) estimated that credit growth is about 1.3 to 1.5 times higher than the deposit growth rate. This development has put some pressure on deposit interest rates at private commercial banks to attract deposits.

In a newly published banking industry report, FiinGroup assessed that the slower growth rate of deposits than credit has created liquidity tension, prompting banks to seek capital through market sources, affecting the cost of deposits and net interest margin.

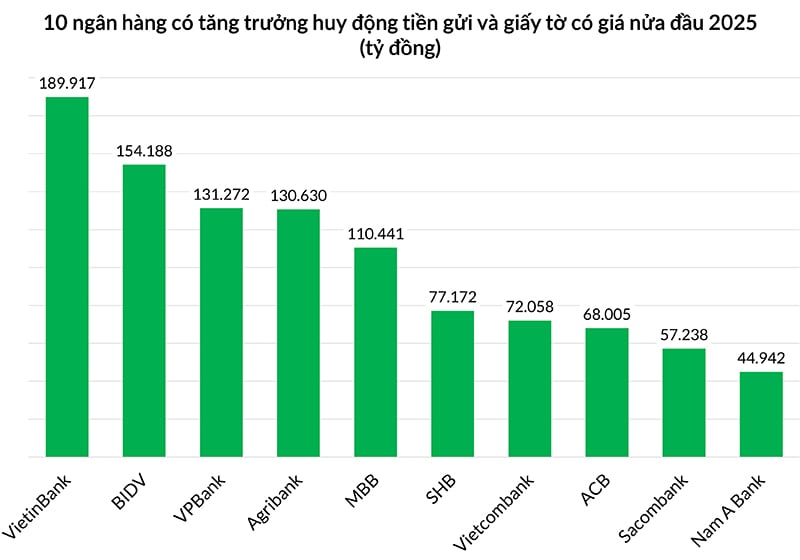

In that context, Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HoSE: VPB) stands out thanks to its strong credit growth, supported by solid mobilization. After only the first 6 months of the year, VPBank attracted an additional VND131,272 billion in customer deposits and valuable papers - the highest among private joint stock commercial banks and the third highest in the system. At the same time, VPBank's mobilization growth surpassed the two giants in the Big4 group, Agribank (VND130,630 billion) and Vietcombank (VND72,058 billion).

Thanks to the above breakthrough growth, VPBank's consolidated deposits and valuable papers mobilization reached nearly VND684,000 billion, nearly 24% higher than at the beginning of the year. Of which, individual banks recorded a growth rate of up to 27.5%, more than 4 times the average rate of the whole industry.

VPBank's mobilization growth is the third highest in the system, only after the two giants Agribank and BIDV. |

Despite the outstanding growth in mobilization, VPBank continues to control capital costs well. At the same time, the bank maintains safety ratios such as loans to total deposits (LDR) and short-term capital for medium and long-term loans controlled at 80.2% and 25.8% respectively, always within the limits prescribed by the State Bank.

In 2025, VPBank aims to grow strongly in scale while still ensuring quality. The bank expects customer deposits and consolidated valuable papers to grow by 34%, while credit growth will reach 25% and total assets will increase by 23%. In the first half of the year alone, VPBank has achieved most of its credit growth and mobilization targets, as well as nearly completed its total assets target.

Explaining VPBank's strong resilience

VPBank's outstanding success in mobilizing deposits and valuable papers in the first half of 2025 is the result of a methodical, flexible strategy and a synchronous combination of many solutions, with growth momentum spread across all segments, especially in the retail customer segment (RB).

In addition to positive growth in scale, VPBank also made its mark in capital quality, with a sharp increase in demand deposits (CASA) helping to reduce mobilization costs, as well as attracting long-term international capital, contributing to strengthening safety ratios.

VPBank's CASA balance increased by nearly 40% in the first half of the year, approaching the VND100,000 billion mark. According to Mr. Phung Duy Khuong, Permanent Deputy General Director in charge of the South and Director of VPBank's Personal Banking Division, in charge of Debt Collection and Settlement, the above achievement comes from the bank's deployment of the Super Profit product, organizing the VPBank K-Star Spark in Vietnam music festival, along with a series of modern and pioneering payment solutions, thereby increasing the CASA ratio to 15.8%.

Specifically, the Super Profit product contributed an additional VND10,000 billion in CASA in the first half of the year and is expected to bring in an additional VND20,000 billion in the last 6 months of the year. At the same time, sponsoring the concert not only helped VPBank spread its brand but also created a direct effect on business activities, with nearly 30,000 newly opened Super Profit accounts and more than VND4,000 billion in CASA.

Along with that, the launch of breakthrough products such as Loc Thinh Vuong deposit certificates has helped attract an additional VND9,000 billion in mobilization.

VPBank also continues to diversify its capital sources with long-term loans from leading financial institutions. In the first 6 months of the year, the bank successfully mobilized a record syndicated loan of 1.56 billion USD, guaranteed by SMBC, Standard Chartered Bank, ANZ, MUFG, etc. In July, the bank continued to make its mark with a syndicated loan worth 350 million USD from SMBC, along with development finance institutions such as BII, EFA, FINDEV CANADA and JICA. Mobilizing activities in the international market helps VPBank consolidate medium- and long-term capital sources, preparing for growth capacity in the coming time.

According to Ms. Luu Thi Thao, Permanent Deputy General Director and Senior Executive Director of VPBank, over the past 10 years, VPBank has consistently built trust with international organizations through transparency, open information and steadfast implementation of commitments. This reputation helps the bank access high-quality international capital sources to serve projects that bring positive impacts to the environment and society, such as supporting SMEs, women-owned businesses or green projects.

Source: https://baodautu.vn/vpbank-but-pha-huy-dong-nua-dau-2025-tang-truong-dan-dau-nhom-co-phan-vuot-hai-big4-d364896.html

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Prime Minister Pham Minh Chinh receives Australian Foreign Minister Penny Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/f5d413a946444bd2be288d6b700afc33)

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

Comment (0)