On October 15, 2024, in Hanoi, the Vietnam Institute for Economic and Policy Research (VEPR) coordinated with Vietnam National Assembly Television to organize a seminar on “Policy Dialogue: Growth Recovery - Prospects and Challenges”. The seminar aimed to identify major issues affecting the goals of macroeconomic stability and growth recovery of Vietnam's economy in 2024.

|

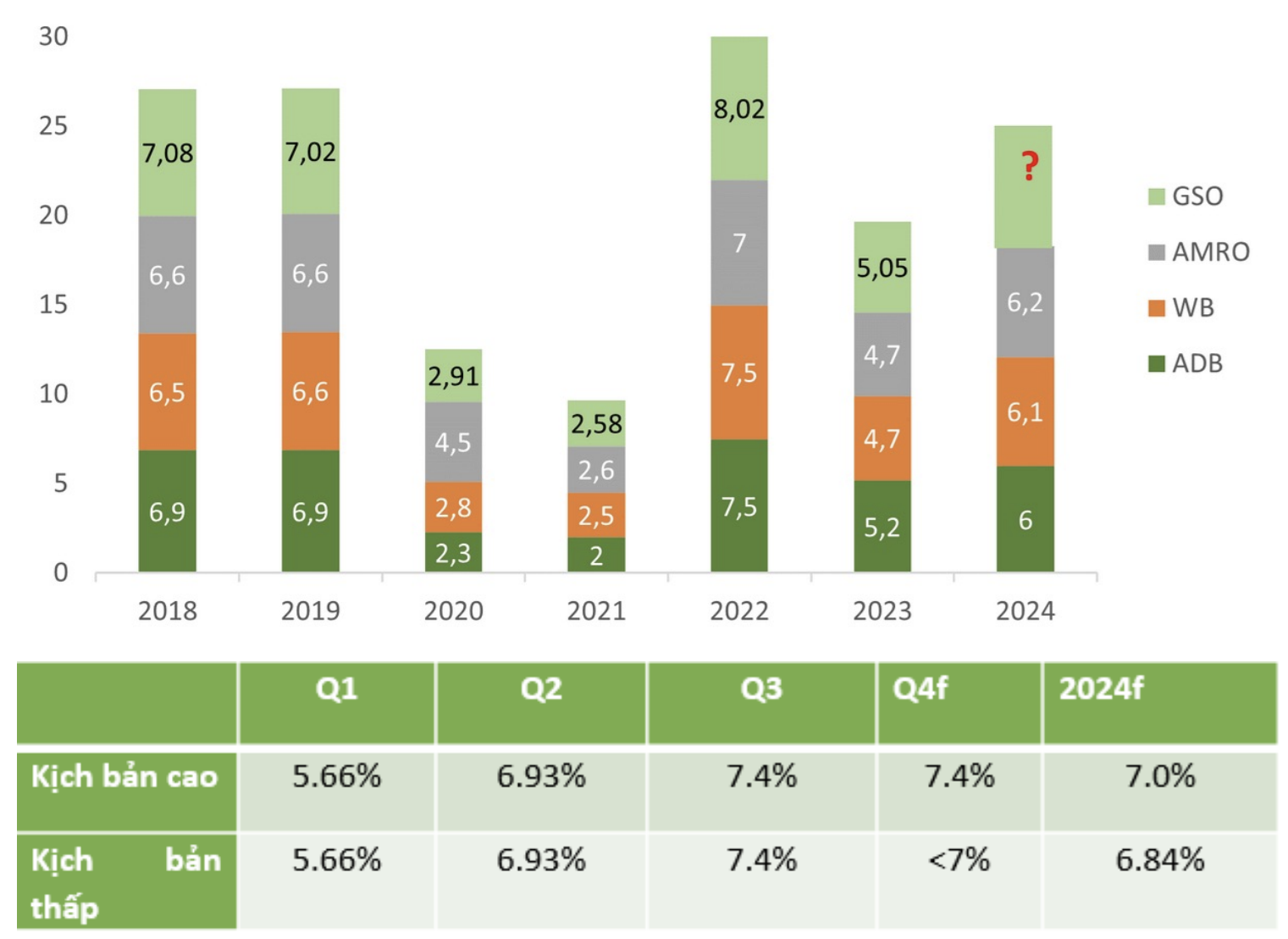

At the seminar, Dr. Nguyen Quoc Viet, Deputy Director of VEPR, presented the report "Economy in the third quarter of 2024: growth recovery - prospects and challenges" of VEPR. Accordingly, by the end of the third quarter of 2024, Vietnam's economy has shown relatively good signs of recovery, along with optimism about the overall growth of the world economy in late 2024 and 2025. GDP growth after 9 months reached 6.82%, an increase of more than 1.5 times compared to 4.4% in the same period last year, with the main contribution from the industrial and service sectors.

In terms of aggregate demand, trade is recovering and active FDI inflows are becoming the main growth drivers. Goods imports and exports increased faster than expected, with total turnover reaching 578.5 billion USD, up 16.3% over the same period. In particular, the trade surplus reached 20.8 billion USD - a fairly positive trade surplus in the 2020 - 2024 period. However, consumer spending is still lower than pre-pandemic levels, while inflationary pressures in the first half of 2024 have eased.

The state budget has recorded revenue exceeding the plan while public spending decreased compared to the same period in 2023, leading to a continued high budget surplus, creating room for continued fiscal policies in 2024. In particular, tax exemption, extension, and reduction policies were proposed in the context of industries and sectors suffering damage from Typhoon Yagi.

Trade has developed positively, FDI capital has reached a record high, and tourism has recovered strongly. The USD exchange rate at domestic commercial banks has continuously decreased, with the price much lower than the ceiling set by the State Bank. The growth rate of money supply and credit growth has recovered quite well, contributing positively to promoting growth and investment, although it is still lower than the average before the Covid-19 pandemic. The State Bank continues to implement a flexible monetary policy, helping to lower interest rates and support capital costs for the economy.

Although the economy has many positive bright spots, there are still risks and challenges ahead. The purchasing managers index (PMI) declined and fell below 50 points in September. The ratio of enterprises exiting compared to enterprises entering the market remains high. Domestic consumption and public investment disbursement have not met expectations...

Looking further, the trend of global economic and political fragmentation and extreme weather events due to climate change may cause external demand to decline. Cost-push as well as export competitiveness face many challenges. Meanwhile, input factors in production still face many barriers, and the difficult situation in transforming the growth model, innovating the business environment, and reforming institutions, although there has been some progress, is still slow, causing many risks in investment and business, discouraging the domestic and foreign business community.

|

| Vietnam's forecasted/actual growth rate |

Source: https://thoibaonganhang.vn/vepr-du-bao-tang-truong-nam-2024-trong-khoang-684-den-7-156737.html

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine taxable value from May 1-7](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/2/e4631afaeaf54451b5132f3c5d3341cd)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)