|

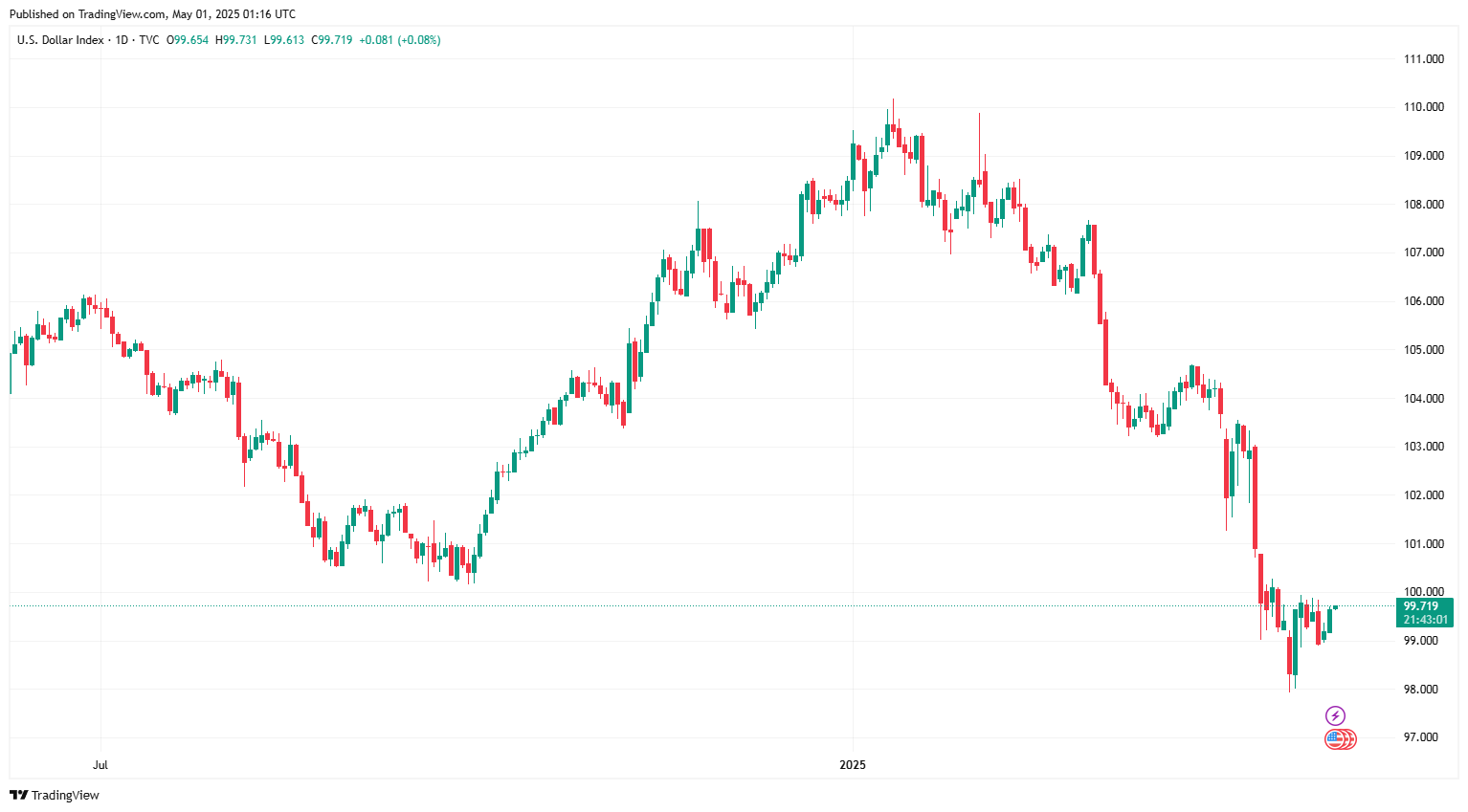

As of 8:30 a.m. this morning, the US dollar index was at 99.719, up 0.081 (0.08%) from the beginning of the session.

The greenback posted its biggest monthly decline in two and a half years in April as US President Donald Trump’s repeated tariff changes weighed on economic growth expectations and shook market confidence.

However, the greenback bottomed out when Mr. Trump announced the suspension of most new tariffs and revealed the possibility of reaching trade agreements with many countries, including China - the partner currently subject to the highest tariffs.

The euro fell 0.13 percent to $1.1313.

Similarly, the British pound traded at $1.3314, down 0.11%.

Richard Franulovich, head of currency strategy at Westpac, said the trend of de-escalation in trade tensions is being maintained and some agreements may emerge.

In a television interview, US President Donald Trump said he has "potential" trade deals with India, South Korea and Japan, and suggested a deal with China was very likely.

However, US Trade Representative Jamieson Greer confirmed that there are currently no formal negotiations underway with Beijing.

In a notable development, newly released data showed that US gross domestic product (GDP) contracted by 0.3% in the first quarter of 2025 as businesses ramped up imports ahead of new tariffs imposed by the Trump administration. This was much lower than economists’ expectations of 0.8% growth and a significant slowdown from the 2.4% growth recorded in the final quarter of 2024.

The labor market is also showing signs of cooling. According to the ADP employment report, private sector hiring increased by just 62,000 in April, less than half the forecast of 134,000 and down significantly from March's 147,000.

Markets are awaiting fresh data due later Thursday, including jobless claims and the ISM manufacturing index. However, April jobs data, due Friday, is seen as the next key indicator for markets to gauge the risk of a recession. The pace of hiring is expected to slow to 130,000 jobs for the month.

In Asia, the Bank of Japan (BoJ) holds a policy meeting amid continued uncertainty over global trade developments. Investors are not expecting a change in policy at the meeting, but are paying attention to the BoJ's outlook and stance on the economy and monetary policy, especially as Japan is also engaged in trade negotiations with the United States.

If the BoJ continues to delay a rate hike this year, the yen could weaken further, allowing the dollar to extend its rally, said Peter Dragicevich, Asia-Pacific currency strategist at Corpay. The dollar traded below 140 yen last month.

The yen rose 0.01 percent to 143.06 yen per dollar.

Elsewhere, the Australian and New Zealand dollars continued to gain against the greenback.

The Australian dollar rose 0.14% to $0.6411.

The New Zealand dollar rose 0.1% to $0.5939.

Source: https://thoibaonganhang.vn/sang-15-dong-usd-on-dinh-tro-lai-sau-phan-ung-voi-du-lieu-kinh-te-yeu-163583.html

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)