Petrolimex's profits plummet amid the lowest gasoline prices in the past 5 years - Photo: QUANG DINH

Vietnam National Petroleum Group - Petrolimex (PLX) has just announced its consolidated financial report for the first quarter of 2025 with net revenue reaching VND 67,861 billion, down nearly 10% over the same period last year.

Parent company profit down 97%

Cost of goods sold in the first 3 months of this year was VND64,149 billion, down nearly 9%. Revenue minus cost of goods sold, PLX's gross profit reached VND3,711 billion, down 20%.

In the context of low bank interest rates, PLX's interest expense in the first quarter was about VND165 billion, down 15% year-on-year. However, revenue from financial activities (mainly interest on deposits) also decreased by 6%, to VND421 billion.

Not to mention, revenue has decreased but most of the costs recorded on the financial reports of the "big" petroleum company have "increased".

For example, sales expenses cost 3,353 billion VND, up 5%, while business management expenses cost 263 billion VND, up 10%.

As a result, Petrolimex’s consolidated profit after tax reached VND211 billion, down 81% compared to the same period last year. This is also the second lowest profit in the last 10 quarters of this “giant”.

In the parent company's financial report, PLX only made a profit of nearly 23 billion VND, while in the first quarter of 2024, it made a profit of 808 billion VND, a decrease of 97%.

Previously, at the 2025 annual meeting, Mr. Tran Ngoc Nam - Deputy General Director of PLX - acknowledged that the US tariff policy has had a great impact, including on oil prices.

Accordingly, after April 2, when President Donald Trump announced the tax rate, world oil prices dropped sharply, from 75 USD/barrel to below 60 USD/barrel. "This is a rapid, shocking decrease, at one point the deepest decrease was over 20%," said Mr. Nam.

Meanwhile, state regulations require that key players like PLX must maintain a minimum inventory of 20 days and manage prices for 7 days. With fluctuations of up to 20%, the group's inventory is at a high level of 750,000m3 /ton.

Non-term bank deposits increased by 30%, reaching 6,593 billion VND

Returning to PLX's financial report for this quarter, the company recorded the price stabilization fund as of March 31, 2025 at VND 3,082 billion, equivalent to the end of 2024.

On the balance sheet, PLX's cash, bank deposits and financial investments are quite large at more than VND 30,460 billion, an increase of more than VND 400 billion after the first 3 months of this year.

Of which, the amount of non-term bank deposits was 6,593 billion VND, an increase of 30%. The amount of investment in stocks was worth nearly 6.7 billion VND, but more than 2.1 billion VND had to be set aside as a reserve.

In addition, PLX also recorded 17,811 billion VND being deposited in banks with short-term terms and 253 billion VND with long-term terms.

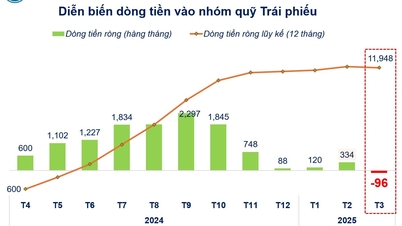

Not to mention, this "big guy" with a lot of money also recorded an investment of 3,300 billion VND in both short-term and long-term bonds.

Source: https://tuoitre.vn/loi-nhuan-petrolimex-lao-doc-dang-co-gan-28-000-ti-gui-ngan-hang-rot-vao-trai-phieu-20250502194325555.htm

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)