|

According to the periodic report on investment fund activities from FiinGroup, the total net withdrawal value from investment funds in the first quarter of 2025 reached nearly VND 4,700 billion, marking the fifth consecutive quarter of net capital withdrawal from funds, showing that defensive sentiment is still dominant in the market.

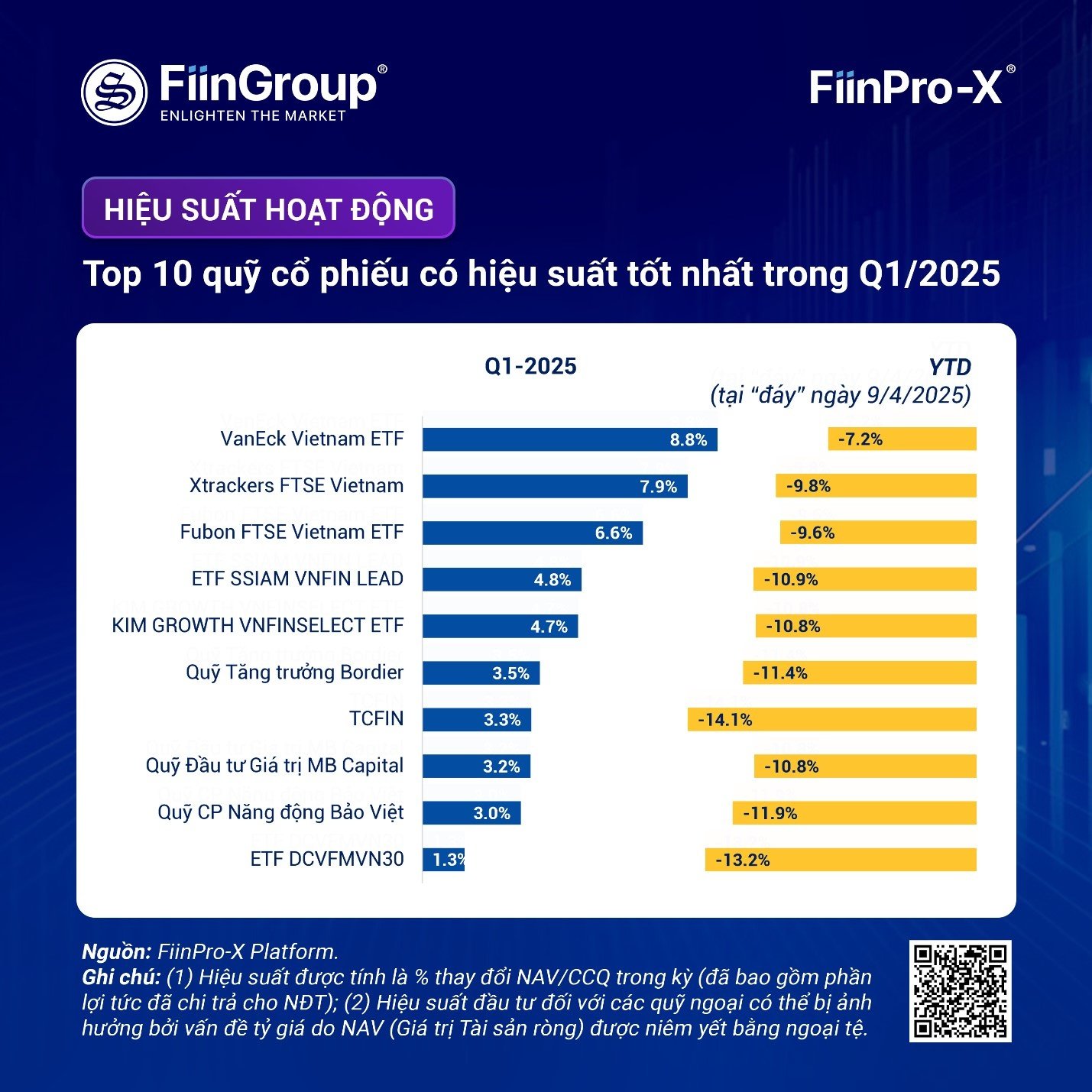

According to Ms. Van Do - Head of Data Analysis, Business Information Division, FiinGroup, in the overall picture, the group of equity funds is the subject of the strongest capital withdrawal pressure. In the first quarter of 2025, equity funds were net withdrawn by more than VND 5,300 billion, double that of the previous quarter.

Notably, foreign ETFs recorded a net withdrawal of up to VND4,100 billion, notably Fubon FTSE Vietnam ETF - the largest fund from Taiwan - although this fund itself still achieved positive performance in the last quarter. Not only ETFs, cash flow also strongly withdrew from the group of closed-end funds, with a scale of more than VND1,800 billion.

On the contrary, according to Ms. Van Do, open-end equity funds have somewhat maintained their capital attraction, with a modest net inflow of VND700 billion in the first quarter. However, compared to the average of more than VND3,300 billion/quarter in 2024, this figure shows that the attractiveness of the open-end fund channel has clearly declined. In particular, the rare bright spot is Dragon Capital's Vietnam Selective Equity Fund (VFMVSF), leading in attracting net capital inflows, focusing on banking and retail stocks such as MWG and CTG.

Notably, the prudence of fund managers is also reflected in the cash holding ratio. In March 2025, up to 19/31 open-end equity funds increased their cash ratio compared to the previous month, especially large-scale funds such as DC Dynamic Securities (DCDS) increased their cash ratio from 5.3% to 21.2%. This shows that fund managers are being cautious in making new disbursements, waiting for clearer signals from the market.

|

Ms. Van Do said that not only the stock fund group, but also the "safe fortress" of bond funds have begun to show cracks. After 12 consecutive months of attracting net cash inflows in 2024, March 2025 witnessed a slight net withdrawal of nearly VND 100 billion from the bond fund group. Although the net cash inflow for the whole quarter was still about VND 358 billion, this figure has decreased significantly compared to the average of more than VND 3,600 billion/quarter before. Large funds such as TCBF, DCBF or VFF all recorded capital withdrawals, while only a few funds such as An Binh Bond Fund (ABBF) maintained the attraction of cash flow.

The cash flow picture for the first quarter of 2025 clearly reflects the defensive sentiment of institutional investors, in a context where the market is heavily affected by external uncertainties, especially information about the US's plan to impose reciprocal tariffs on Vietnamese imported goods of up to 46%. This factor triggered a strong correction in the market, causing the VNINDEX to fall by 16.9% in just the first two weeks of April and "blowing away" the results of most funds. Although the index recovered impressively by +12.2% afterwards, the general sentiment of investors is still cautious.

According to Ms. Van Do, for individual investors, the strong withdrawal of institutional capital in the last quarter has important implications. Firstly, it should be noted that the net withdrawal from ETFs and large funds can create more volatility for the market, especially in large-cap stocks. Secondly, in the context of open-end equity funds still attracting cash flow, good fundamental stocks in the banking and retail sectors - such as VCB, MWG, FPT - continue to be prioritized for holding and can be potential supports. Thirdly, the increase in the cash holding ratio of funds shows that the pressure to disburse in the short term will not be too strong, investors need to be patient and choose the right time to disburse.

"In general, differentiation is becoming a characteristic of the Vietnamese stock market at the current stage. Investors should not panic at the net withdrawal figures, but need to observe more deeply into active cash flows, choose stocks that are prioritized for accumulation and be ready to seize opportunities when attractive price levels are established," Ms. Van Do shared.

Source: https://thoibaonganhang.vn/dong-tien-cac-quy-dau-tu-quy-i2025-luc-rut-rong-manh-me-163645.html

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)