|

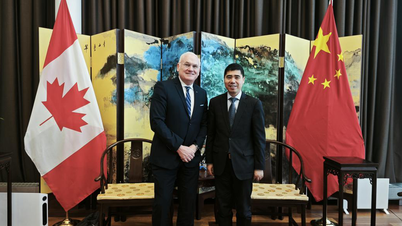

| President Biden is confident about America's latest weapon in the 'economic war' with China. (Source: Shutterstock) |

New rules will control private sector overseas investments and investments in the most sensitive technologies in China will be banned.

“Small yard and high fence”

The Economist said that the use of such restraint by the world's strongest champion of capitalism is the latest sign of a profound shift in US economic policy as it faces the rise of an increasingly assertive and threatening rival.

For decades, the United States has championed the globalization of trade and capital, which has brought enormous benefits in terms of increased efficiency and lower costs for consumers. But in a dangerous world, efficiency alone is not enough.

In the United States and across the West, China’s rise is bringing other goals to the forefront. Officials understandably want to protect national security, by limiting Beijing’s access to advanced technology that could enhance its military power and building alternative supply chains in areas where China maintains a stranglehold.

The result has been a series of tariffs, investment reviews and export controls targeting China, first under former President Donald Trump and now under current President Joe Biden.

While such “risk mitigation” measures would reduce effectiveness, the argument goes, sticking with more sensitive products would limit the damage. And the extra cost would be worth it, because America would be safer.

The implications of this new thinking are becoming clear. Unfortunately, this argument does not deliver resilience or security. Supply chains become more complex as they adapt to new rules. And if you look closely, it is clear that America’s dependence on China for critical inputs remains. More worryingly, this policy has had the perverse effect of pushing America’s allies closer to China.

This may come as a surprise; at first glance, the new policies look like a resounding success. The direct economic links between China and the United States are shrinking. In 2018, two-thirds of US imports from “low-cost” Asian countries came from China; last year, just over half. Instead, the US has turned to India, Mexico and Southeast Asia.

Investment flows are also adjusting. In 2016, Chinese companies invested a staggering $48 billion in the United States. Six years later, that number had dropped to just $3.1 billion. For the first time in 25 years, China is no longer one of the top three investment destinations for most members of the American Chamber of Commerce in China. For the past two decades, China has accounted for the majority of new foreign investment in Asia. In 2022, China received less investment from the United States than India.

Dependency remains intact

However, if you dig deeper, you will see that America's dependence on China remains intact.

The US may be shifting demand away from China to other countries. But manufacturing there is now more dependent on Chinese inputs than ever before. For example, as Southeast Asia’s exports to the US have increased, its imports of intermediate inputs from China have exploded. Chinese exports of auto parts to Mexico, another country that has benefited from US de-risking, have doubled over the past five years.

Research published by the International Monetary Fund (IMF) shows that even in advanced manufacturing sectors, where the US is keen to move away from China, the countries with the greatest access to the US market are those with the closest industrial links to China. Supply chains have become more complex and trade has become more expensive. But China’s dominance is undiminished.

What is happening?

In the most severe cases, Chinese goods are simply repackaged and sent through third countries to the U.S. In late 2022, the U.S. Commerce Department found that four major solar suppliers based in Southeast Asia were performing minor processing on other Chinese products; in effect, they were circumventing tariffs on Chinese goods.

In other areas, such as rare earth metals, China continues to provide inputs that are difficult to replace.

More often than not, however, this mechanism is benign. Free markets simply adapt to find the cheapest way to deliver goods to consumers. And in many cases, China, with its vast labor force and efficient logistics, remains the cheapest supplier.

The new US rules have the potential to redirect their own trade with China. But they cannot remove entire supply chains from Chinese influence.

Much of the “decoupling” is therefore artificial. Worse, in Mr Biden’s view, his approach is also deepening the economic links between China and other exporting countries, pitting their interests against those of the US. Even as governments fret about China’s growing assertiveness, their trade ties with Asia’s largest economy are deepening.

The Regional Comprehensive Economic Partnership (RCEP) — a trade deal signed in November 2020 between several Southeast Asian countries and China — creates a single market for precisely those intermediate goods whose trade has boomed in recent years.

For many poorer countries, receiving Chinese investment and intermediate goods and exporting finished goods to the United States is a source of jobs and prosperity. America’s reluctance to support new trade agreements is one reason why they sometimes see the United States as an unreliable partner. If asked to choose between China and the United States, they might not side with the United States.

All of this holds important lessons for U.S. officials who want to hedge against China by using “small yards and high fences.” But without a clear sense of the trade-offs from tariffs and restrictions, the real risk is that each security concern leads to a larger yard and higher fence.

The benefits so far remain elusive and the larger-than-expected costs have highlighted the need for better strategies.

Moreover, the more selective the approach, the greater the chance of convincing trading partners to reduce their dependence on China in areas that really matter. Otherwise, eliminating risks will make the world more dangerous.

Source

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)