According to Ms. Le Thi Hoa - Financial Advisor of FIDT Investment Consulting and Asset Management Joint Stock Company, the world economic picture in early 2025 shows that the financial market is "surging". In Vietnam, there are highlights such as: bank interest rates at historic lows, stocks oscillating strongly due to the US tariff policy disrupting the global supply chain, hot gold prices because they have become a popular safe haven, and real estate has seen "big waves" of local fever in many areas due to administrative mergers.

In this context, young people who want to find the safest and best investment direction need to have solid knowledge.

At the age of 20-30, young people do not have many financial dependents. The initial capital may not be much, but young people possess an asset more valuable than money: time.

Time is the “long journey ahead”, the space for trial and error, learning and accumulating experience. The sooner the ship sets sail, the more opportunities it has to take advantage of the power of “compound interest”, accumulating seafaring experience for the captain and gradually forming courage through each wave.

“Young people are the captains. The sooner you set sail, the more you can train your skills. Investing early is not to reach the finish line quickly, but to make sure you reach the destination,” Ms. Hoa said.

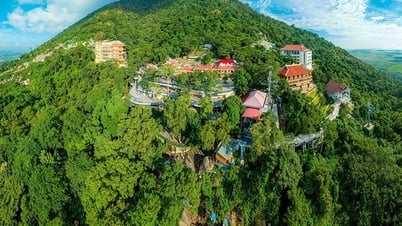

How should young people invest at the end of 2025? (Illustration photo)

However, not every boat that sets sail is ready to weather the storm. According to expert Le Thi Hoa, young people who want to invest long-term need to prepare a solid financial foundation, such as equipping a sturdy boat structure so that the boat does not sink before the first waves, before dreaming of the vast ocean.

First, you need to prepare a reserve fund of 3-6 months of essential expenses (including regular debt repayments for asset investments) combined with participating in health insurance, health insurance, and life insurance at a reasonable rate (5%-8% of income). These layers of protection are like lifebuoys, adding a protective shield.

Besides, saving 10 - 20% of your monthly income regularly is the way to accumulate fuel for a long journey, instead of stopping in the middle of the sea because of running out of fuel.

Finally, Ms. Hoa believes that young people need to understand the investment map, understand the economic cycle and know how to allocate assets appropriately, like the way a captain reads the wind direction and chooses a route.

2025 sees gold at its peak but the trend is difficult to predict. Real estate is expensive and requires large capital. Direct stocks require young people to have in-depth knowledge and sensitivity in forecasting, so the risk is high.

Meanwhile, investing in fund certificates (open-end funds, ETFs) is a safe and easy-to-control choice for young people new to business.

According to Ms. Hoa, fund certificates have advantages such as the efficiency of the rate of return: If accumulated regularly, the rate of return is superior to savings deposits.

Flexibility: Start from just a few hundred thousand dong.

Diversification: A fund portfolio invests in many businesses, like anchoring a boat in many ports, avoiding sinking in the same area.

Guaranteed liquidity: Can be easily withdrawn when needed.

Professional management: There is a team of experts to monitor and adjust direction when there are fluctuations.

Supported by the economic cycle: the economic cycle is in the recovery phase (however, it is also necessary to note the possibility of extending the time to enter the pre-growth phase due to the impact of US tariff policy), suitable for the securities asset class, including fund certificates.

“Young investors do not need to go too fast, but need to go in the right direction and be sure to reach their desired goals,” Ms. Hoa advised.

Source: https://vtcnews.vn/thi-truong-nhieu-bien-dong-chuyen-gia-mach-cach-dau-tu-cuoi-nam-cho-nguoi-tre-ar939783.html

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/bbb34e48c0194f2e81f59748df3f21c7)

![[Photo] Solemn opening of the 9th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/ad3b9de4debc46efb4a0e04db0295ad8)

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

Comment (0)