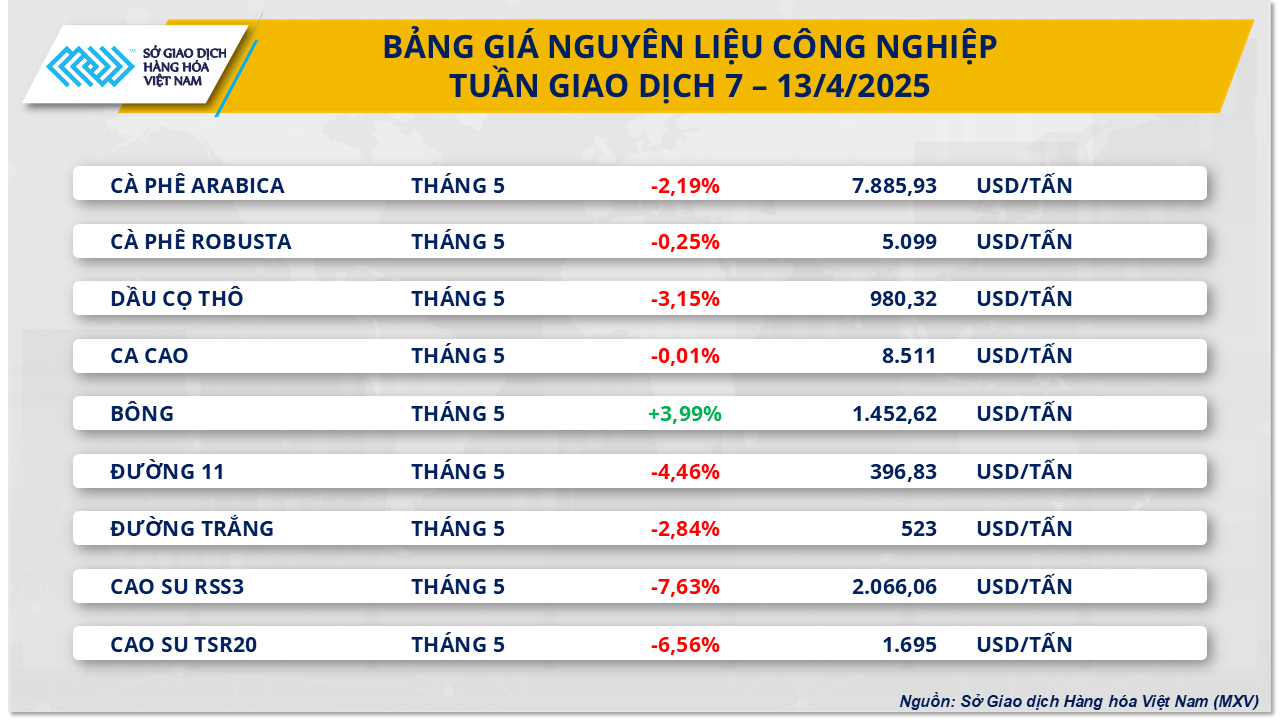

For the industrial raw material group, last week, the world coffee market witnessed many fluctuations with alternating sessions of increase and decrease. At the end of the trading session at the end of the week, the price of Arabica coffee shortened the decline of the first sessions of the week when it increased by 3.51%, to 7,885 USD/ton. However, for the whole week, the price still decreased by 2.19% compared to the previous week. Following the same trend, at the end of the trading session on Friday (April 11), the price of Robusta coffee increased to 5,099 USD/ton, escaping the lowest level since January this year.

Coffee prices last week showed a sharp decline in the first session of the week, then recovered and increased in the last session. The market temporarily calmed down after US President Donald Trump announced a 10% import tax and a 90-day delay in imposing tariffs on most countries. However, tariff tensions still caused some US coffee importers to ask Vietnamese exporters to delay shipments and limit signing new contracts. The US is currently the third largest market for Vietnamese green coffee, accounting for about 8.6% of total export turnover, after the European Union (41%) and Japan (8.2%).

Meanwhile, a report from Cecafe shows that Brazil's green coffee exports in March reached 2.95 million bags, down 26.4% year-on-year. By the end of the first quarter, Brazil exported a total of 9.58 million bags, down 14%. Similarly, preliminary statistics from the General Department of Vietnam Customs also recorded a sharp 15.6% decrease in Vietnam's coffee exports in this quarter. Export supplies from the world's two largest coffee producing countries have both decreased significantly compared to last year, and the market predicts that tight supply will continue in the coming time.

Selling pressure dominated the industrial raw material market last trading week. Two rubber products attracted attention when they plummeted, causing the price index of the entire group to weaken. In particular, RSS3 Osaka rubber ended the trading week with a sharp decrease of 7.63%, down to 2,066 USD/ton. TSR20 rubber also fell sharply by 6.56%, closing at 1,695 USD/ton. Notably, in the first session of the week on Monday (April 7), both of these rubber codes recorded record decreases: RSS3 Osaka plunged by 8.1%, while TSR20 Singapore lost 10.09%, marking the lowest level in more than a year.

China’s auto exports may face greater pressure than expected this year due to the impact of increased US import tariffs, according to the China Automobile Industry Association. This could significantly reduce demand for rubber, a key raw material in the auto industry, in the coming time.

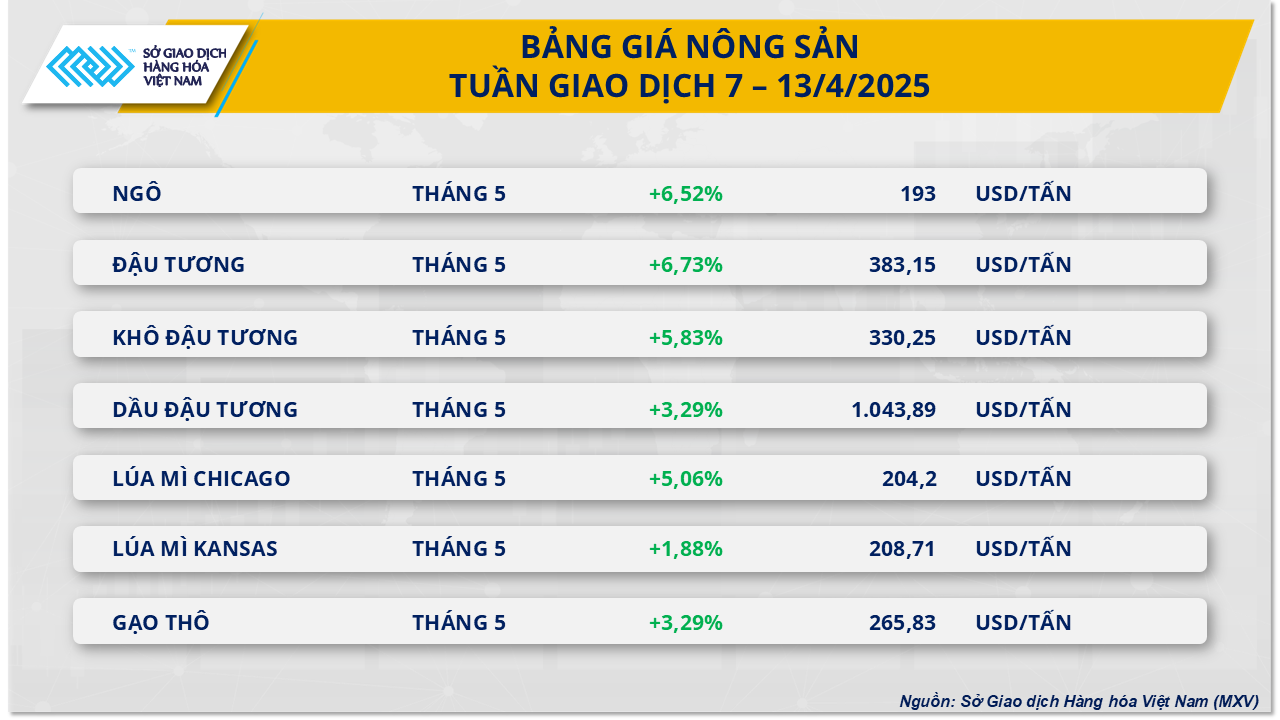

The agricultural market maintained its upward momentum throughout the past trading week. At the close, all 7 commodities were in the green. Of which, the prices of some commodities increased notably: Corn increased by 6.5%; soybean meal increased by nearly 6%, CBOT wheat increased by 5%. Soybean prices increased the most - 6.7%, marking the strongest weekly increase since July 2022. According to MXV, the combination of many supporting factors such as: stable exports, trade policy adjustments from the US and the risk of supply disruptions in South America significantly supported soybean prices this week.

The first major factor supporting soybean prices is that U.S. exports remain positive. The U.S. Department of Agriculture (USDA) Export Deliveries report showed shipments of more than 805,000 tons for the week, significantly higher than the same period last year. In addition, the USDA also announced a sale of 198,000 tons of soybeans to an unnamed buyer during the week, the first such sale since early March, indicating that demand for U.S. soybeans remains stable despite the ongoing tariff tensions.

US trade policy continues to be a major influence on market sentiment. The Trump administration’s tariff cuts for more than 70 countries have fueled hopes of new trade deals, particularly in the agricultural sector. While tensions with China have not eased, markets have responded positively to the prospect of expanding exports to other partners.

In addition, a strike at Argentina’s Rosario port complex – the country’s largest soybean export hub – has disrupted the flow of goods to the global market, raising concerns among investors about a potential short-term supply shortage, which has helped bolster buying pressure in the market this past week.

Source: https://baodaknong.vn/thi-truong-hang-hoa-14-4-thi-truong-dang-lay-lai-can-bang-249311.html

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

Comment (0)