Just a few years ago, China envisioned itself eventually dominating the global AI race by leveraging the country's vast trove of data to develop applications like facial recognition.

Recent developments in generative AI — using large models to produce content like text, images and videos — have shifted the balance, leaving China looking like a laggard once again.

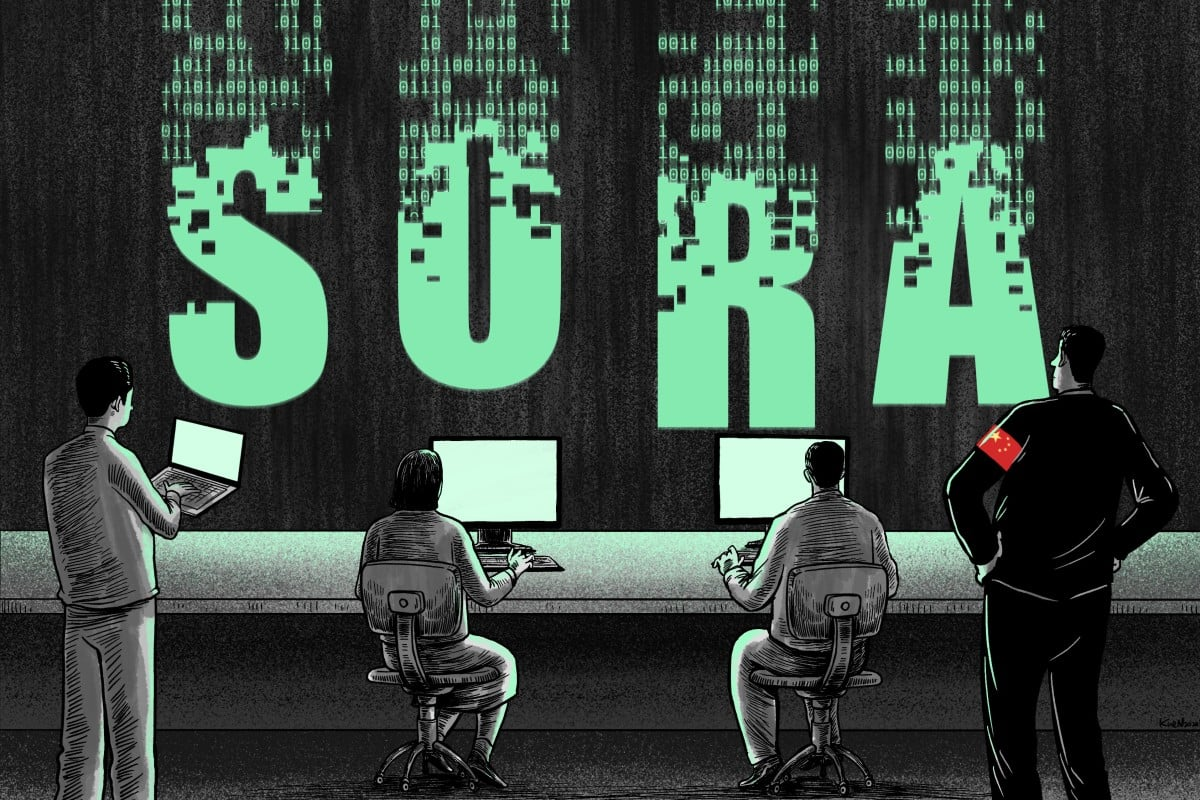

Sora’s launch on Feb. 16 comes as China faces a growing challenge from losing access to Nvidia’s cutting-edge graphics processing units (GPUs) due to escalating U.S. export restrictions. The country’s best AI players are several years behind their foreign counterparts.

Zhou Hongyi, founder of Internet security firm 360 Security Technology, called Sora “a bucket of cold water poured over China,” Yicai reported on February 23. He said it helped many people see the gap between them and the world’s leaders.

OpenAI has not yet released Sora to the public. It is not open source like some of its predecessors. Only a small number of people have access to a trial version of Sora.

In China, the National Cyberspace Administration requires all public large language models (LLMs) to register with the government. World giants such as OpenAI and Google have not yet officially provided services here.

This absence has led to many domestic tech giants jostling for position in the market with more than 200 LLMs. Baidu, Tencent and Alibaba have all introduced their own LLMs.

However, few tools can match Sora, in part because they do not yet use the new Diffusion Transformer (DiT) architecture. TikTok parent company ByteDance says its internal video motion control tool Boximator, which it uses to help create videos, is still in its infancy and not ready for mass release.

The company admits there is a big gap between Boximator and leading video creation models in terms of image quality, fidelity, and duration.

Rather than catching up with Sora, some in the industry see the more pressing issue as gaining access to OpenAI’s models. But U.S. lawmakers are looking to limit China’s access to its AI cloud services.

An unnamed Chinese developer told SCMP that a possible path for Chinese AI engineers is to “first decode Sora and train it with their own data to create a similar product.” Xu Liang, an AI entrepreneur based in Hangzhou, believes that China will soon have similar services, although there may still be a slight gap between Chinese products and Sora.

Wang Shuyi, a professor specializing in AI and machine learning at Tianjin Normal University (TJNU), commented: the experience of developing LLMs over the past year has allowed Chinese Big Tech to build up knowledge in this field and stockpile the necessary hardware, enabling them to produce products like Sora in the next 6 months.

A few months before Sora's launch, a group of researchers released VBench, a benchmarking tool for video-generating models. The VBench team, which included researchers from Singapore's Nanyang Technological University and the Shanghai Artificial Intelligence Laboratory in China, found that Sora outperformed other models in overall video quality, based on demos provided by OpenAI.

Lu Yanxia, IDC China's research director for emerging technologies, said tech giants such as Baidu, Alibaba and Tencent will be among the first to roll out similar services in the country.

Additionally, iFlyTek, SenseTime and Hikvision — all of which are on Washington's sanctions list — will also join the race, she said.

But China still faces an uphill battle as its tech market becomes increasingly isolated from the world in terms of capital, hardware, data and even people, according to analysts.

The market value gap between China's top tech companies and those in the US such as Microsoft, Google and Nvidia has widened significantly in recent years as Beijing tightened its grip.

Additionally, while China was once seen as having an advantage in terms of data quantity, Lu pointed out that the country now faces a scarcity of quality data needed to train newer models, coupled with the challenge of limited access to advanced chips.

The talent shortage is another concern, according to IDC executives, as the best and brightest in AI often have an easier time shining when working for leading players in the US. At OpenAI, for example, tech experts from China make up a core group. Of OpenAI’s 1,677 LinkedIn members, 23 studied at Tsinghua University.

However, even with enough talent, experts question how far China's homegrown AI can go while facing existing constraints from US-China trade tensions.

In a report, Ping An Securities warned that continued efforts to restrict chip exports from the US could accelerate the maturation of China's AI chip industry, but "domestic homegrown alternatives may fall short of expectations."

Washington has blocked Chinese companies from accessing the world’s most advanced semiconductors. In October 2023, the US tightened regulations again, blocking mainland access to GPUs that Nvidia had designed specifically for Chinese customers to get around the previous restrictions.

Alexander Harrowell, an advanced computing analyst at technology research and consulting group Omdia, notes that China has options beyond GPUs for LLM training, such as Google’s TPU, Huawei’s Ascend, AWS’s Trainium, or one of a number of startups’ offerings. However, it will require more effort in software development and system administration.

The Chinese market will have particular opportunities, according to entrepreneur Xu, when technical reports on Sora and the open-source video model are released. “There will be a platform for Chinese companies to learn from,” he said. Local video models also support Chinese better, he added.

(According to SCMP)

Source

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

Comment (0)