Entering a year that promises to have many variables strongly impacting the market, investment funds are planning scenarios for a new investment cycle.

Entering a year that promises to have many variables strongly impacting the market, investment funds are planning scenarios for a new investment cycle.

|

| Representatives of some investment funds in the Vietnam Private Capital Agency (VPCA) Investment Alliance at the founding event in September 2024 |

Foreign capital leads

Global funds are shaping their portfolios for 2025. For the Asian market, funds are looking to combine the new and old economies to protect their investments against the challenges of the Donald Trump administration's uncertain trade policies in the coming period and the rising USD trend.

Saudi Arabia's Public Investment Fund (PIF), with assets of about $930 billion, plans to continue cutting its international investment exposure, ending a period of massive investment with billions of dollars of capital spread around the world.

The move comes as the giant fund refocuses on the domestic economy, rather than seeking opportunities abroad. Specifically, PIF will reduce the proportion of capital invested abroad to 18-20%, from the current 21% and a high of 30% in 2020.

However, PIF aims to reach $2 trillion in assets by 2030, so foreign investment flows are bound to increase. However, international investors intending to seek capital from PIF must also change direction.

The move comes after a decade of massive overseas investments by PIF, including a $45 billion investment in Japan’s SoftBank Vision Fund in 2016 and a $20 billion investment in an infrastructure fund from Blackstone in 2017.

Blackstone is the world's largest investment fund, with total assets under management of more than 1,000 billion USD. The fund's leaders also want to expand their investment in the Vietnamese market.

Blackstone has joined the artificial intelligence (AI) data center race - an area that Vietnam has a strategy to develop.

Warburg Pincus, one of the oldest and largest private equity funds in the world, has also invested about 4 billion USD in Vietnam, making Vietnam the Fund's third largest investment destination in Asia (after China and India). In the Vietnamese market, Warburg Pincus Investment Fund is interested in cooperation to attract green finance capital, renewable energy, etc.

In that general context, KKR Investment Fund (USA) believes that Vietnam is an attractive investment destination and affirms that it will continue to expand its presence here. With a total asset value of up to 528 billion USD, KKR has invested heavily in the Vietnamese economy, with a total investment capital exceeding 2 billion USD. Notable investments of this fund in large corporations in Vietnam include Masan, Vinhomes, Equest, KiotViet, Saigon Medical Group (MSG).

In addition to the above-mentioned giants, at the end of the year, many investment funds also made predictions, scenarios, and variables for the following year. While VinaCapital believes that it is difficult to predict the future, SGI Capital considers 2025 a promising year with many new variables that will have a strong impact on the market. This fund is carefully reviewing the general context, as well as each individual opportunity, to decide on a strategy for the new investment cycle.

Waiting for a boost from within the country

Mr. Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, said that internal factors will determine Vietnam's GDP growth in 2025, because there are many factors that can negatively impact Vietnam's export growth. In particular, export growth to the US is forecast to slow down.

VinaCapital experts said that consumption accounts for more than 60% of Vietnam's economy, so strong consumption growth will easily offset the decline in export growth. Some government solutions show that infrastructure spending in 2025 will reach about 31 billion USD, up 15-20% compared to 2024, to build 1,000 km of highways, complete the first phase of Long Thanh airport, as well as expand existing airports in Ho Chi Minh City and Hanoi.

According to Mr. Michael Kokalari, these measures will help consumers feel more confident in increasing spending. In addition, the Fund expects the Government to take important steps to restore the real estate market. When the real estate market recovers, it will have a much larger impact on consumer sentiment than increased spending on infrastructure. In addition, the Government needs stronger measures to achieve the goal of attracting capital flows from funds around the world.

Meanwhile, SGI Capital believes that, in the context of increasing interest rates and investment cash flow having to be shared with other channels such as real estate and cryptocurrencies, the opportunity of stocks in the coming period depends largely on the trend of foreign capital flows and individual differentiated stocks.

The Fund also assessed that credit depends on real estate and the encouraging sign is that the real estate market is showing many positive signs.

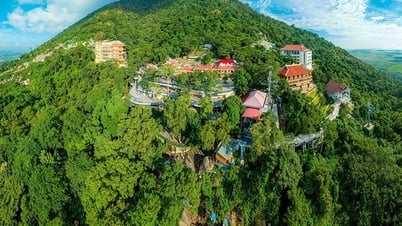

Recently, BTS Bernina Fund and investor Terne Holdings invested in developing Haus Da Lat Project on prime land along Xuan Huong Lake (Da Lat), according to ESG criteria. These two investors have total assets under management of up to billions of USD. Their investment appetite is businesses with unique stories in Asia and fast growth rates, leading new trends in industries.

According to the announcement, BTS Bernina is an open-end investment fund, established on December 11, 2009, owned and managed by major financial experts in the world. This unit devotes 60% of the fund's resources to investing in Asia. In the past 3 years, the fund's performance reached 71.9%, showing that BTS Bernina's investment activities are giving good results.

The Fund's Board of Directors consists of a team of experienced professionals in the fields of international finance and investment management. The Fund has expertise in navigating global markets and overseeing investment strategies. In addition, the unit also has experience in real estate and emerging markets. BTS Bernina representative said that investing in Haus Da Lat Project is a commitment to high-quality, diversified assets in fast-growing markets.

Meanwhile, Terne Holdings is a multi-industry investment company from Singapore. Terne Holdings' core areas are real estate investment consulting, commercial cooperation, brand consulting, design...

Venture capital alliance in start-ups

Notably, recently, leading corporations from Japan, South Korea and Thailand have joined hands to establish a large-scale Alpha Intelligence Venture Capital (AIVC) and are rapidly investing in AI startups in Asia. Among them, SoftBank, SK Networks (part of SK Group), LG Electronics, Hanwha Financial and a Thai corporation have signed an agreement to join a $130 million fund established by the founders of The Edgeof Venture Capital Firm.

Despite its modest initial capital size, the fund will aim to act as a platform for connecting large companies and AI startups, either through investment or acquisition. The fund is in talks with other companies in East Asia and Southeast Asia to raise up to $200 million. The move comes as venture capital funds struggle to keep up with the rapid growth of startups using GenAI (generative AI). Alpha Intelligence also targets startups in Silicon Valley, but will focus on investing in companies with plans to expand in Asia.

The model of “joining hands” to form alliances has also quickly spread to Vietnam. Currently, stakeholders are also waiting for a “push” from an investment alliance called Vietnam Private Capital Agency (VPCA). The alliance was established by partners from private equity funds in the Asia region, including Golden Gate Ventures, Do Ventures and Monk's Hill Ventures.

Over the next decade, VPCA aims to attract up to $35 billion in investment to Vietnam in sectors such as agriculture, education, and healthcare. VPCA plans to expand its membership to 100 individuals by the end of 2025, up from more than 40 currently. Funds participating in the alliance include Vertex Ventures, Ascend Vietnam Ventures, and Mekong Capital.

Many investors appreciate Vietnam’s potential, especially when the US-China trade tensions are causing businesses to seek new markets to expand their operations. Among them, Southeast Asia shows its own attractiveness. According to them, the trend of shifting production away from China is bringing benefits to Southeast Asian countries. Here, Indonesia is a prominent market thanks to its strong domestic economy, strong development of the basic goods sector and the central bank’s focus on stabilizing the exchange rate.

Wenting Shen, a multi-asset strategist and portfolio manager at T. Rowe Price, believes that Vietnam will consolidate its position as an export powerhouse in the future. According to her, the possibility of Vietnam being included in the FTSE emerging market list in the near future could improve the short-term outlook of this market.

Source: https://baodautu.vn/quy-dau-tu-can-nao-cho-chu-ky-moi-d238906.html

![[Photo] Solemn opening of the 9th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/ad3b9de4debc46efb4a0e04db0295ad8)

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/bbb34e48c0194f2e81f59748df3f21c7)

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

Comment (0)