At a time when the market is “hot”, the land fund in the city center is shrinking, procedures are tightening, and prices are increasing day by day. Meanwhile, the provinces surrounding Ho Chi Minh City, with large land funds, infrastructure and an underdeveloped market, have high potential for price increases in the future, making many investors pay little attention.

In addition, the economic shift of the suburbs and the change in investment orientation of many enterprises have created conditions for the development of housing demand, causing demand to increase day by day, especially in the segments of villas, townhouses, land plots... Notably, provinces such as Dong Nai, Long An, Binh Duong, Ba Ria - Vung Tau... with the strong development of traffic infrastructure through major projects such as: Ben Luc - Long Thanh Expressway, Trung Luong - My Thuan Expressway, Trung Luong - My Thuan Expressway...

All of these bring convenience in connection and economic trade between localities, the center of Ho Chi Minh City and neighboring provinces. Therefore, in the early stages of 2022, the real estate market in the provinces on the outskirts of Ho Chi Minh City has become a potential "gold mine" for investors to exploit. Many forecasts also show that by 2025, real estate on the outskirts of Ho Chi Minh City will develop and grow even more rapidly.

Land in suburban provinces with undeveloped infrastructure has attracted the attention of many investors.

However, with the general market “freezing” since the end of 2022, the real estate market in the suburbs of Ho Chi Minh City has been declining day by day. Especially in the recent period, the interest of both buyers and the number of listings for real estate in this area has decreased sharply.

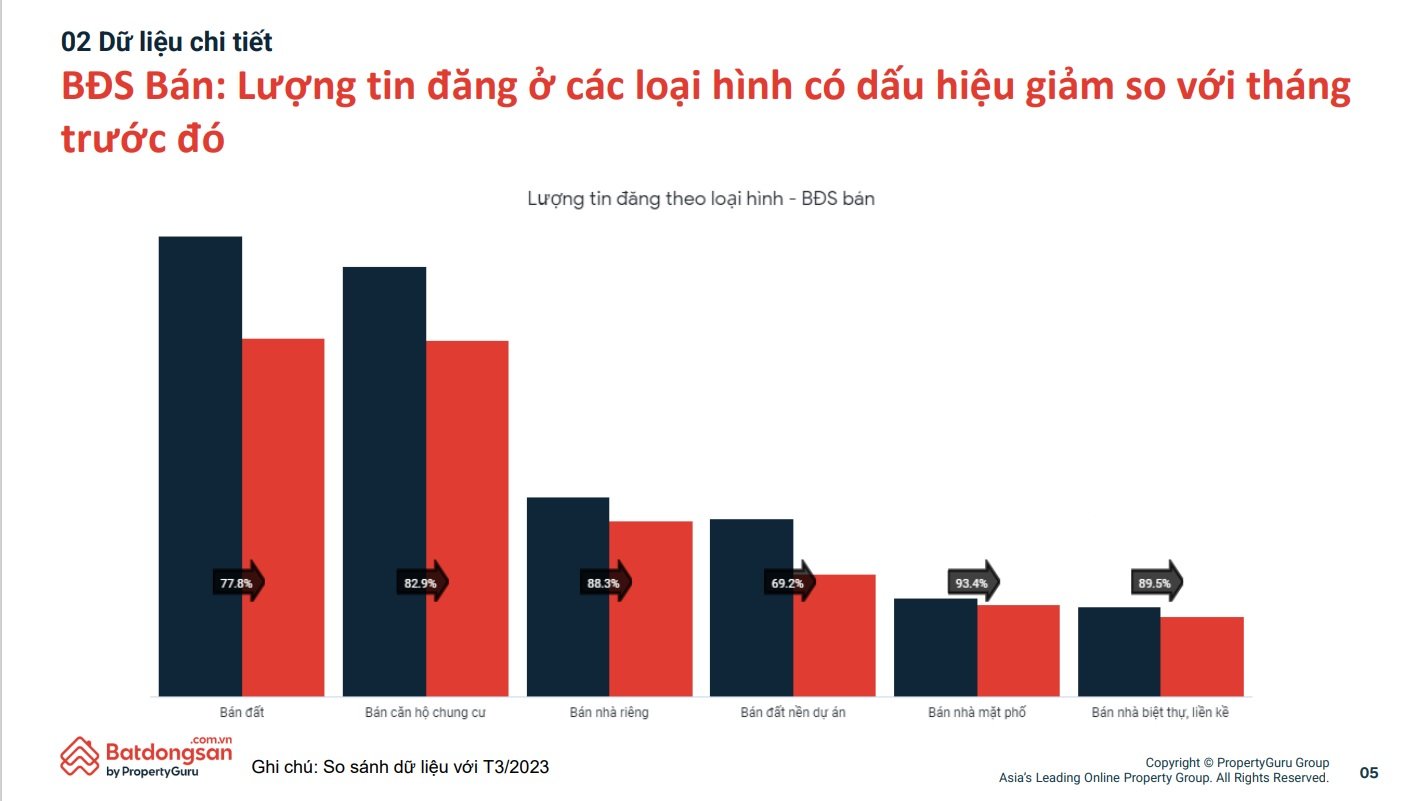

According to the April 2023 real estate market report data of Batdongsan.com.vn, in Binh Duong, the number of listings of all types decreased significantly. In particular, the number of listings for land decreased by 22%, apartments decreased by 17%, villas decreased by 12% compared to the previous month. Along with that, the level of interest in the types is also, such as land is 13%, apartments is 8% or project land is 22.2%.

Meanwhile, the level of interest in rental types increased significantly, but the number of listings decreased sharply in all types compared to March 2023. This shows that rental demand is increasing sharply in the context of no growth in supply to the market.

The number of real estate listings in Binh Duong decreased in all types.

Similarly in Long An, the level of interest in all types of properties has decreased, except for the type of selling private houses. The number of listings for apartments, villas, and land plots has decreased sharply compared to the previous month. Especially in the two types of project land plots (down 31%) and villas, townhouses (down 24.9%). Meanwhile, the demand for renting private houses, rooms and apartments has increased sharply, only warehouses and factories have decreased in terms of interest.

Notably, the interest in real estate in Thu Thua district and Tan An city has maintained its growth in the current period. Explaining this increase, experts said that these localities have a lot of development potential, being a bridge between two major urban areas, the Mekong Delta and Ho Chi Minh City. There are many projects being promoted here to anticipate the market, so it is understandable that investors are still interested.

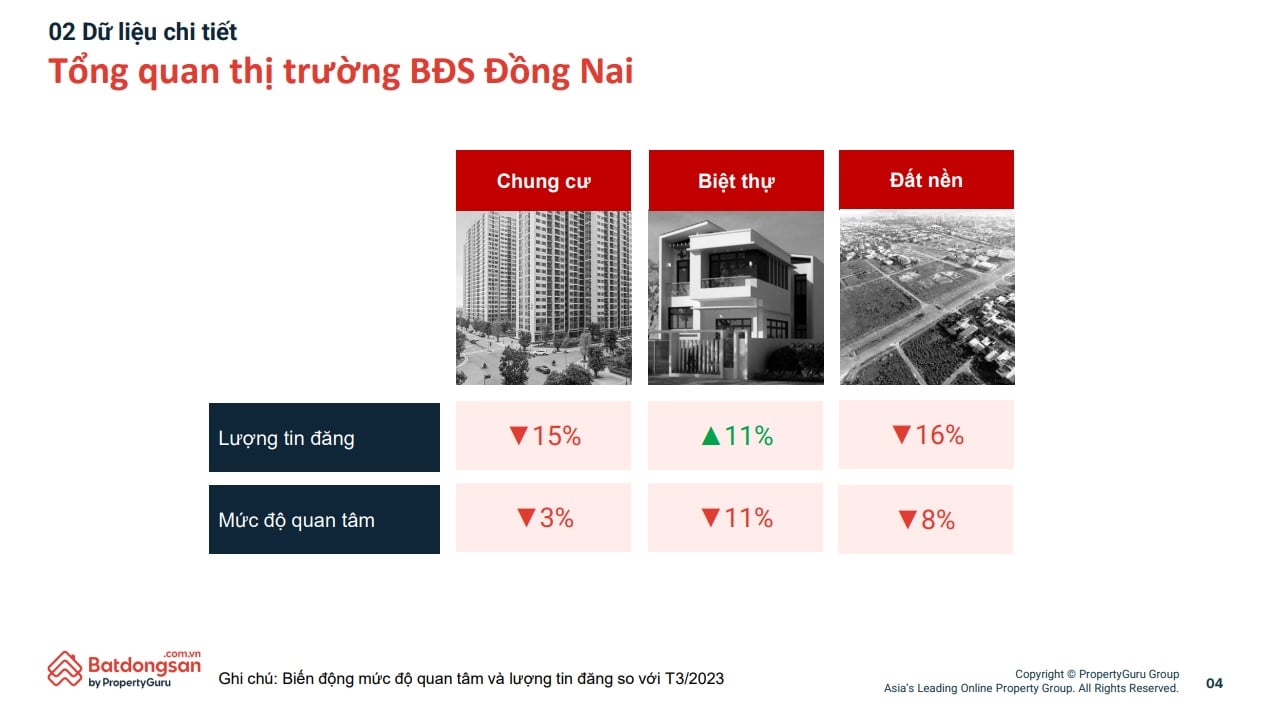

As for the market in Dong Nai province, with a large inventory of townhouses and villas, the number of listings for these types of properties still increased compared to previous months while other types decreased. In a similar situation to the market in general, the level of interest in all types of real estate in Dong Nai recorded a decrease.

Meanwhile, the demand for rental properties has increased sharply, similar to Long An and Binh Duong. This demand for rental properties may come from the trend of choosing long-term rentals instead of outright purchases by those with real housing needs. In the context of real estate prices not yet returning to their real value and loan interest rates not being really attractive to home buyers.

Responding to Journalists and Public Opinion, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the South, said that the decline in land transactions is mainly due to the sharp decline in investment and speculative demand for this type of property. Because currently, the market is a playground for people who have real housing needs. This group of people is not very interested in land, a type that cannot serve immediate housing needs. Especially land products for investors are often located far from the center.

“Land is a product that tends to be more for investment and speculation than for real living compared to other segments. When the market is vibrant, land is the first segment to increase in price, and when the market is difficult, this type is most affected. Not to mention, the recent decline in confidence and the inability to determine the specific time when the real estate market will recover also makes many people hesitant to spend money to buy land at this time,” Mr. Tuan analyzed.

According to this expert, the real estate market in general, land and townhouses in particular, has been sluggish since mid-2022 until now, but the sharp price reduction to get rid of goods mainly occurs in underdeveloped residential areas, where services, utilities and infrastructure are limited. Land projects here are mainly due to speculators hoarding goods waiting for prices to increase, not serving real housing needs, and not being convenient for business exploitation, so they are not attractive.

Commenting on the operating situation in the second quarter of 2023, many research units forecast that supply will continue to trend sideways and market demand will hardly fluctuate due to general difficulties in the economic situation. The secondary market will also not have many sudden changes in liquidity. Long An is forecast to continue to be the area that accounts for the majority of the supply of new land and townhouses, followed by Binh Duong and Ho Chi Minh City.

Source

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)