According to the World Gold Council, Vietnam's jewelry industry has the capacity and workforce to compete with regional counterparts.

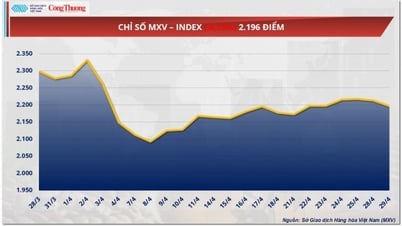

World gold prices have increased by 25.5% in 2024

Commenting on the developments in the world gold market in 2024 with the press recently, Mr. Shaokai Fan, Director of Asia-Pacific (excluding China) and Director of Global Central Banks at the World Gold Council (WGC) said, according to the quote from "Gold has achieved its best performance in the past 14 years" with comments by Mr. Taylor Burnette, Head of Research for the Americas of the World Gold Council, since 2010, gold has had an exceptionally good performance in 2024, outperforming all major asset classes and showing that gold is an important tool in diversifying investment portfolios.

|

| Mr. Shaokai Fan, Regional Director for Asia-Pacific (excluding China) and Global Head of Central Banks at the World Gold Council (WGC) |

Over the past year, the London Bullion Market Association's daily afternoon gold price index (LBMA Gold Price PM) has set 40 new record highs, the latest of which was $2,777.80 per ounce on October 30.

Gold prices have increased by 25.5% by 2024, possibly due to gold acting as an effective hedge against increased geopolitical uncertainty and market volatility during the year.

According to the WGC’s gold yield allocation model, gold’s positive performance is linked to the following key factors: Strong demand from central banks and investors, offsetting weaker consumer demand; heightened geopolitical risks due to escalating conflicts and multiple elections around the world; and periods of opportunity cost as markets see lower yields and a weaker US dollar.

Market consensus forecasts call for gold's performance in 2025 to be more modest, but there are likely to be bullish catalysts as the new year begins.

For the Vietnamese market, Mr. Shaokai Fan said that the biggest highlight is the increase in gold prices in Vietnam. On January 2, 2024, the price of a tael of gold rings was 63 million VND and the price of SJC gold bars was 73 million VND/tael. On January 2, 2025, the price of 24K gold rings was 84.8 million VND/tael and the price of SJC gold bars was 85 million VND/tael, only 200,000 VND higher than the price of gold rings.

The next highlight is the increase in the price of SJC gold bars. At the most recent time, on May 24, 2024, the price of SJC gold bars reached 90 million VND per tael. At that time, the difference between the price of SJC gold bars and the international gold price was nearly 20%. That is why the Prime Minister asked the State Bank of Vietnam to find ways to reduce the difference between the price of Vietnamese gold bars and the international gold price.

The State Bank of Vietnam announced on November 8 that from April 19 to October 29, the State Bank sold nearly 14 tons of gold through four major state-owned commercial banks to narrow the gap between domestic and world gold prices.

The two highlights of the Vietnamese gold market in 2024 are the increase in gold prices and the difference between domestic and international gold prices.

Is the relationship between gold and the US dollar not as strong as before?

Although higher gold prices have dampened buying demand and prompted some selling at some points in 2024, the increase in buying activity in October 2024 suggests that central banks remain interested in accumulating gold in their reserve portfolios.

|

| The gold market is always vibrant - Illustration photo |

Commenting on whether this trend will continue in 2025 and create momentum to push gold prices higher, Mr. Shaokai Fan said that central banks will likely continue to buy gold net in 2025. We conduct an annual survey of central banks and although the most recent survey was conducted half a year ago, the results still show that central banks have a huge demand to buy more gold.

The WGC also found that, despite gold prices rising throughout last year, central banks continued to buy gold even as prices rose, with gold hitting around 30 new record highs last year.

"Of course, price is a factor in central banks' decisions to buy gold, but I think it's just a tactical factor," said Shaokai Fan, adding that typically, central banks will make a decision at a strategic level that they want to buy gold.

They then leave that decision to reserve managers, who can avoid times when gold prices are high and look for buying opportunities when prices are lower. But overall central banks will still be net buyers of gold.

According to Shaokai Fan, from an economic perspective, the level of interest rates in the US will have some impact. Currently, the Fed does not seem to want to lower interest rates as quickly as we initially thought. So this will be a hindrance for the gold market, because traditionally, gold does not perform well when interest rates are higher.

However, over the past year, we have seen that relationship begin to weaken a little bit. "The relationship between gold and interest rates and the relationship between gold and the US dollar is not as strong as it used to be. One reason is that a lot of people are buying gold for reasons that have nothing to do with the US dollar or US interest rates," said Shaokai Fan.

Citing evidence, Mr. Shaokai Fan said that in the first half of last year, Chinese retail buyers played a huge role in gold demand because they thought gold was a good way for them to invest and maintain their purchasing power. This had nothing to do with US interest rates or the strength of the US dollar. They bought gold purely for domestic reasons that suited them.

Another segment is central bank gold buying, which was very strong last year and we will be releasing the full year numbers in the next few weeks. These central banks are buying gold for a variety of reasons, including geopolitical risks and the desire to manage risk in their portfolios. That is, they are not buying gold specifically because of the US interest rate environment or because of the US dollar.

Vietnam jewelry industry has competitive potential

Further assessing the manufacturing level as well as the ability to export gold jewelry of Vietnam, Mr. Shaokai Fan stated that recently, We visited Phu Nhuan Jewelry Joint Stock Company (PNJ), one of the largest jewelry companies in Vietnam with over 6,000 employees and a publicly listed company. The company currently has two manufacturing plants and will have a third in the near future. The company has exported its products to customers from 15 countries around the world.

If Thailand, Malaysia and Indonesia can export tens of billions of dollars worth of gold jewelry each year, why can't Vietnam? "Vietnam's jewelry industry has the capacity and workforce to compete with regional partners, but the government needs to have mechanisms and facilitate this industry," Mr. Shaokai Fan emphasized.

According to Mr. Shaokai Fan, in 2024, Vietnam's trade surplus will reach more than 24 billion USD, total FDI capital will be 25 billion USD and remittances will be 16 billion USD. Therefore, last year, Vietnam earned 65 billion USD in foreign currency.

If Vietnam's trade sector requires gold imports, the maximum demand for raw gold is only about 20 tons of gold, worth about 1.7 billion USD. "Therefore, if Vietnam imports 20 tons of gold worth 1.7 billion USD, with an income of 65 billion USD, spending nearly 2 billion USD is still reasonable," Mr. Shaokai Fan commented.

According to the Vietnam Gold Business Association and research from Metal Focus, the demand for gold jewelry in Vietnam ranges from 15 to 20 tons per year. Therefore, Vietnam needs to import raw gold to produce 20 tons of this jewelry.

"When we visited the largest jewelry factory in Vietnam, we asked the factory director about the demand for raw gold in a year. With a maximum production capacity of 7 tons of products per year, they need at least 3.5 tons of raw gold, and this number only accounts for 15% of the total jewelry gold production in Vietnam," said Mr. Shaokai Fan.

| According to Mr. Shaokai Fan: In Asia, China will still be the largest gold consuming market. Besides, gold consumption in India will also be very large. In addition, Vietnam and Indonesia have many optimistic signals. |

Source: https://congthuong.vn/nganh-trang-suc-viet-nam-co-the-canh-thanh-voi-cac-doi-tac-trong-khu-vuc-370937.html

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

Comment (0)