Domestic gold price today August 21, 2025

As of 10:30 a.m. today, August 21, 2025, the domestic SJC gold price increased sharply, setting a new record. Specifically:

SJC gold price is listed by DOJI Group at 124.4-125.4 million VND/tael (buy - sell), the price decreased and increased by 600 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold was listed by Saigon Jewelry Company Limited - SJC at 124.4-125.4 million VND/tael (buy - sell), an increase of 600 thousand VND/tael in both buying and selling directions compared to the closing price on August 20 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124.8-125.4 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for buying and 600 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 124.4-125.4 million VND/tael (buy - sell), the price increased by 600 thousand VND/tael in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 123.4-125.4 million VND/tael (buy - sell), gold price increased by 600 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 10:30 a.m. on August 21, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117.3-120.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael in the buying direction - an increase of 100,000 VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell); an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 21, 2025 is as follows:

| Gold price today | August 21, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 124.4 | 125.4 | +600 | +600 |

| DOJI Group | 124.4 | 125.4 | +600 | +600 |

| Red Eyelashes | 124.8 | 125.4 | +500 | +600 |

| PNJ | 124.4 | 125.4 | +600 | +600 |

| Bao Tin Minh Chau | 124.4 | 125.4 | +600 | +600 |

| Phu Quy | 123.4 | 125.4 | +600 | +600 |

| 1. DOJI - Updated: August 21, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 124,400 ▲600K | 125,400 ▲600K |

| AVPL/SJC HCM | 124,400 ▲600K | 125,400 ▲600K |

| AVPL/SJC DN | 124,400 ▲600K | 125,400 ▲600K |

| Raw material 9999 - HN | 109.90 ▲300K | 110.90 ▲300K |

| Raw material 999 - HN | 109.80 ▲300K | 110.80 ▲300K |

| 2. PNJ - Updated: August 21, 2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 124,400 ▲600K | 125,400 ▲600K |

| PNJ 999.9 Plain Ring | 117,300 ▲300K | 120,300 ▲300K |

| Kim Bao Gold 999.9 | 117,300 ▲3 00K | 120,300 ▲3 00K |

| Gold Phuc Loc Tai 999.9 | 117,300 ▲3 00K | 120,300 ▲3 00K |

| PNJ Gold - Phoenix | 117,300 ▲3 00K | 120,300 ▲3 00K |

| 999.9 gold jewelry | 116,500 ▲400K | 119,000 ▲400K |

| 999 gold jewelry | 116,380 ▲400K | 118,880 ▲400K |

| 9920 jewelry gold | 115,410 ▲400K | 117,910 ▲400K |

| 99 gold jewelry | 115,410 ▲400K | 117,910 ▲400K |

| 916 Gold (22K) | 106,600 ▲360K | 109,100 ▲360K |

| 750 Gold (18K) | 81,900 ▲300K | 89,400 ▲300K |

| 680 Gold (16.3K) | 73,570 ▲270K | 81,070 ▲270K |

| 650 Gold (15.6K) | 70,000 ▲260K | 77,500 ▲260K |

| 610 Gold (14.6K) | 65,240 ▲240K | 72,740 ▲240K |

| 585 Gold (14K) | 62,270 ▲240K | 69,770 ▲240K |

| 416 Gold (10K) | 42,150 ▲160K | 49,650 ▲160K |

| 375 Gold (9K) | 37,280 ▲150K | 44,780 ▲150K |

| 333 Gold (8K) | 31,920 ▲130K | 39,420 ▲130K |

| 3. SJC - Updated: 8/21/2025 10:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 124,400 ▲600K | 125,400 ▲600K |

| SJC gold 5 chi | 124,400 ▲600K | 125,420 ▲600K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 124,400 ▲600K | 125,430 ▲600K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 117,300 ▲500K | 119,900 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 117,300 ▲500K | 119,800 ▲500K |

| Jewelry 99.99% | 117,300 ▲500K | 118,900 ▲500K |

| Jewelry 99% | 113,222 ▲495K | 117,722 ▲495K |

| Jewelry 68% | 73,810 ▲340K | 81,010 ▲340K |

| Jewelry 41.7% | 42,536 ▲208K | 49,736 ▲208K |

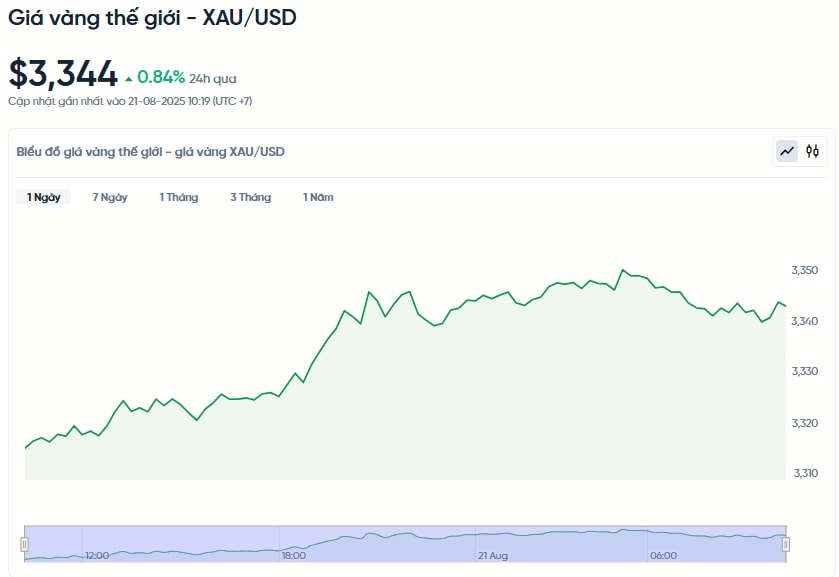

World gold price today August 21, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 10:30 a.m. on August 21, Vietnam time, was 3,344 USD/ounce. Today's gold price increased by 27.93 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,5320 VND/USD), the world gold price is about 106.97 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.43 million VND/tael higher than the international gold price.

Gold prices rose nearly 0.8% in Thursday trading. The main reason was the weakening of the US dollar. When the US dollar weakens, investors using other currencies will find it easier to buy gold because gold is priced in US dollars.

Specifically, spot gold prices increased by 0.84%, after hitting their lowest level since August 1. US gold futures for December delivery also increased by 0.9%, to $3,387.10/ounce.

Minutes from the Fed’s July meeting will be released just two days before Fed Chairman Jerome Powell speaks at the Jackson Hole conference on Friday. The Fed left interest rates unchanged at its previous meeting, but two central bankers wanted to cut rates to protect the labor market from further weakness. The decision is drawing attention from investors, as it could impact gold prices.

Gold prices fell yesterday, so many traders see this as an opportunity to buy ahead of the Fed minutes. If Powell's speech shows the Fed is inclined to cut interest rates, gold prices could rise further, according to Bob Haberkorn, a market expert at RJO Futures.

Currently, gold prices are under considerable pressure as many investors want to sell to make a profit. The main reason comes from new developments in the foreign policy of US President Donald Trump. He is making important steps in finding ways to end the conflict in Ukraine and gradually completing trade agreements with many countries.

In another development, US Treasury Secretary Scott Bessent said in a television interview that the US is satisfied with its current tariff policies towards China. He said the current situation is working well and does not need to change. The Trump administration has recently toned down its confrontational rhetoric towards China, aiming to hold a summit with Chinese Premier Xi Jinping and reach a trade deal.

Traders now see an 85% chance that the Fed will cut interest rates by 0.25 percentage points in September, according to the CME FedWatch tool. Separately, President Donald Trump today called on Fed Governor Lisa Cook to resign, following an allegation of mortgage fraud by the head of the Federal Housing Finance Agency.

Besides gold, spot silver rose 1% to $37.73 an ounce. Platinum rose 2% to $1,331.70 an ounce. Palladium was almost unchanged at $1,115.92 an ounce.

Gold Price Forecast

Technically, gold for December delivery has the near-term advantage. The next target for gold is a break above the strong resistance level at $3,500. On the downside, the key support level is the July low at $3,319.20. The nearest resistance level is $3,400 and this week's high is $3,403.60. The nearest support level is $3,353.40, followed by $3,350.

Gold is a non-yielding asset, so it tends to become more attractive when interest rates fall. Haberkorn said gold should break above $3,350 an ounce and could test $3,400 again if the Fed signals a positive move.

Investors are paying particular attention to two important upcoming US economic indicators: the National Employment Report (NFP) and the Consumer Price Index (CPI). Many are concerned that if the US economy continues to show signs of strength and the Federal Reserve (Fed) cuts interest rates too soon, this policy could backfire and cause inflation to last longer.

Despite facing many pressures in the short term, many experts remain optimistic about the long-term prospects of gold. Some organizations predict that gold prices could even reach $3,500 an ounce by the end of this year, provided the Fed maintains its monetary policy easing path.

Ole Hansen, head of commodity strategy at Saxo Bank, said Fed Chairman Jerome Powell's upcoming speech at the Jackson Hole conference on Friday will be a key signal.

He also noted that there is a lot of speculation about who will succeed Powell in May, even as the US Treasury Secretary calls for a total of 1.5% interest rate cuts. For gold, this uncertainty, combined with the market’s usual summer lull, has kept prices in a fairly narrow range, hovering around $3,350 an ounce for the past three months. Fortunately, prices have been supported by steady investment demand.

Technically, gold futures have fallen below their 100-day moving average, a signal that typically signals a possible reversal in the downtrend. However, spot gold is still holding above this average, a level that has held since January 6.

This development needs to be closely monitored, because if gold prices fall below the important support level at $3,309, selling pressure from technical investors could increase sharply, pushing prices further down.

Source: https://baonghean.vn/gia-vang-hom-nay-21-8-gia-vang-sjc-tao-ky-luc-moi-vang-the-gioi-va-vang-nhan-tang-nhe-10304833.html

Comment (0)