Hoang Anh Gia Lai Joint Stock Company (stock code: HAG), chaired by Mr. Doan Nguyen Duc (Bau Duc), has just announced that it has received a decision to impose an administrative penalty from the Gia Lai Provincial Tax Department.

The reason is that the company made false declarations leading to a shortage of value added tax in 2023, a shortage of personal income tax in 2022 and 2023, a shortage of land rent in 2022 and 2023; false declarations but did not lead to a shortage of corporate income tax in 2022 and 2023... These violations occurred in the accounting years 2022 and 2023.

The company was subject to aggravating circumstances due to repeated administrative violations (for false declarations but not resulting in a shortage of corporate income tax payable).

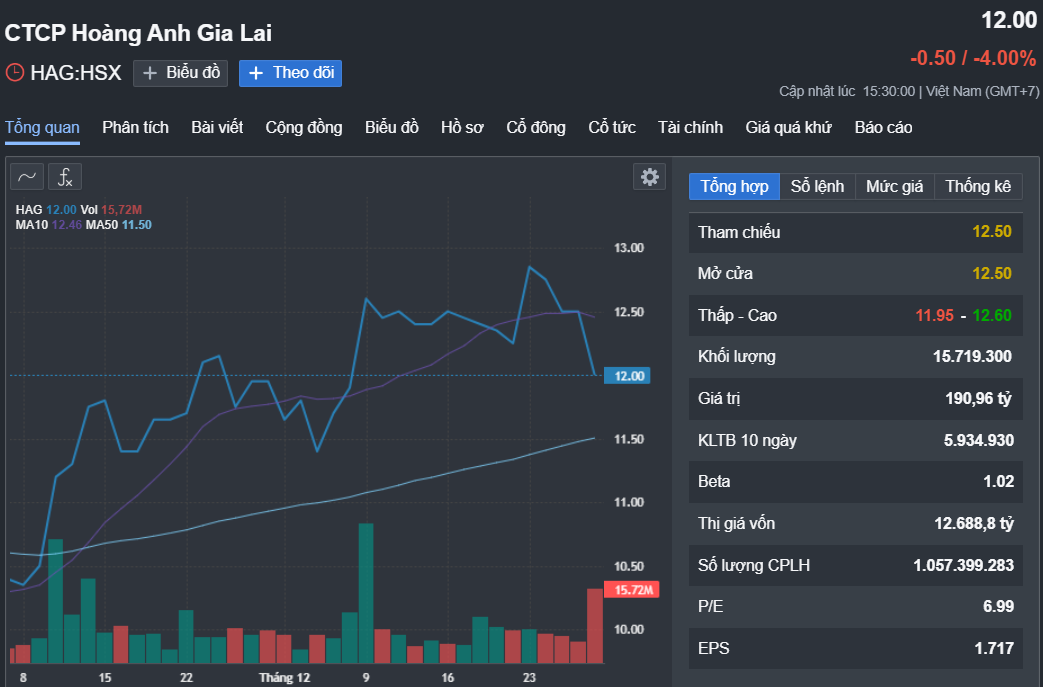

HAG stock fluctuations in the past month. Source: Fireant

Accordingly, the Gia Lai Provincial Tax Department fined Hoang Anh Gia Lai VND159 million. In addition, the company must remedy the consequences, including collecting VND722 million in back taxes and paying nearly VND93 million in late tax payments. A total of VND974 million.

On December 29, Hoang Anh Gia Lai also announced unusual information about the company's bond principal and interest payments.

Specifically, in the fourth quarter of 2024, the company will have to pay interest on the HAGLBOND16.26 bond lot of VND 135 billion (actual payment date is December 30), but the company has not been able to pay on time.

As of December 29, 2024, the accumulated unpaid interest is nearly VND 3,621 billion. Regarding principal, the company still owes VND 1,590 billion after having paid VND 206 billion on time. The total unpaid amount is VND 5,211 billion.

Hoang Anh Gia Lai said the reason for the non-payment was because it had not collected enough money from the debt of Hoang Anh Gia Lai International Agriculture Joint Stock Company (currently, a 3-party debt repayment schedule has been agreed upon) and had not been able to liquidate some of the company's unprofitable assets.

The company expects to pay the remainder in the first quarter of 2025.

Regarding business performance, in the first 9 months of 2024, Hoang Anh Gia Lai recorded revenue of VND 4,193 billion, down 16.7% over the same period. However, thanks to cost reduction, after deducting tax profit, it reached VND 851 billion, up 19.9% over the same period last year.

On the stock market, HAG shares are priced at VND 12,000/share, up slightly by nearly 0.5% compared to early December but down more than 9% compared to early 2024.

Comment (0)