Most of the business segments are profitable.

Agribank's audited consolidated financial statements show that by the end of 2024, Agribank's total assets will reach more than VND2.2 million billion, up 9.3% compared to the end of 2023. Customer deposits will reach more than VND1.9 million billion, up 5.3%. Customer loans will reach VND1.72 million billion, up 11%.

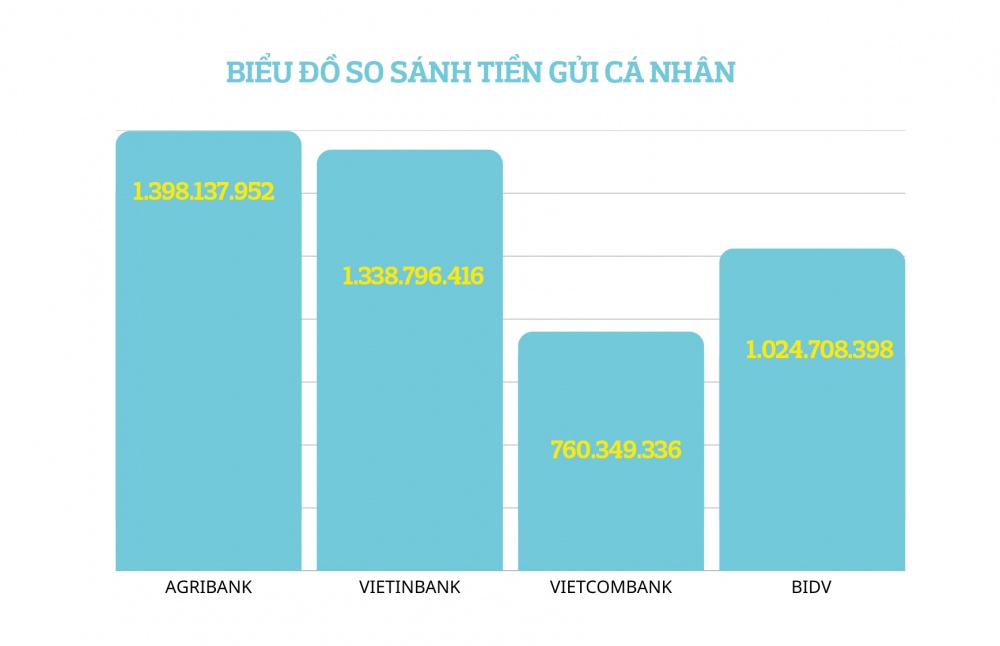

With these figures, Agribank is currently ranked second in the system in terms of market share in mobilization and lending (after BIDV). However, if separated by target, Agribank's deposits from individuals and organizations (excluding credit institutions) are always at the top of the market.

According to the bank's explanation, Agribank reduced customer deposits at the end of 2024 to control capital growth rate, restructure capital sources to contribute to reducing input costs, allocate resources to reduce lending interest rates to support customers and stimulate economic growth in the last months of 2024.

According to the latest information as of the end of the first quarter of 2025, to meet the lending needs of the economy in 2025, customer deposits at Agribank have reached nearly 2.1 million billion VND, continuing to rise to the position of the bank with the most deposits in Vietnam.

Regarding business results, except for investment securities trading, all other business activities of Agribank are profitable and growing well.

Agribank's total operating income in 2024 reached VND 86,496 billion; an increase of nearly 14% over the previous year. Of which, net interest income reached VND 66,554 billion, an increase of 19.3% over the previous year. Net interest income increased mainly thanks to the bank's good control of input capital, both in terms of growth rate and interest rates (in 2024, Agribank's credit increased by 11% while capital mobilization increased by only 5.3%). During the year, although the bank's interest income and similar income decreased by 8.5% (in 2024, Agribank reduced loan interest rates 4 times to support customers), while the bank's interest expenses and similar expenses decreased by nearly 25%, helping net interest income grow well.

Agribank's best growth area in 2024 is gold and foreign exchange trading (99% of income comes from foreign exchange trading, gold accounts for only 1%). Net profit from this activity increased by 126%, reaching VND 4,538 billion. Net profit from services reached VND 5,025 billion, up 10%. Net profit from trading securities reached VND 14.9 billion, 3 times higher than last year. Net profit from other activities was VND 10,454 billion (mainly collected from processed principal debt), equivalent to the same period last year...

In 2024, Agribank's operating expenses increased slightly by 4.3% to VND 32,263 billion, but the positive point is that the CIR index decreased to 37.3% (CIR at the end of 2023 was 40.7%), showing an improvement in operating performance.

Thanks to its stable business operations, Agribank has made strong provisions for risks. In 2024, Agribank's risk provisioning expenses were VND 26,658 billion, an increase of 37.4% over the previous year. After making provisions for risks, in 2024, Agribank achieved VND 27,574 billion in pre-tax profit and VND 22,067 billion in after-tax profit, an increase of 7.5% over the previous year.

With positive business results, in 2024, the average income of each officer and employee of Agribank is 33.42 million VND/person/month, a slight increase of 2.26% compared to the previous year. However, the income of Agribank employees is still the lowest in the Big 4 group (fluctuating between 37-38 million VND/tael) and much lower than many private commercial banks such as Techcombank, HDBank, ACB, TPBank...

At the end of 2024, Agribank had 42,278 employees, an increase of 195 people compared to the previous year, this is the lowest increase among banks in 2024.

By the end of 2024, Agribank had a total of 42,278 employees, an increase of 195 people compared to the previous year, the most modest increase among banks in 2024. This reflects the specificity of Agribank's operations, with a branch network covering 63 provinces and cities, from highlands to remote islands. As the demand for capital increases, it is necessary to expand the staff to meet lending requirements. Currently, in many places, especially in remote mountainous areas, an Agribank credit officer is in charge of dozens to hundreds of customers with a very large workload.

In parallel, in 2024, Agribank actively implemented restructuring and streamlining its branch network, especially in Hanoi and Ho Chi Minh City to improve efficiency and productivity.

In 2024, Agribank actively implemented restructuring and streamlining its branch network, especially in Hanoi and Ho Chi Minh City to improve efficiency and productivity. |

Top 4 banks with the highest bad debt coverage ratio in the system

As of December 31, 2024, Agribank's bad debt scale is VND 29,007 billion, a ratio of 1.68%. Compared to the previous year, Agribank's bad debt decreased both in absolute terms (down VND 425 billion) and relative terms (in 2023, Agribank's bad debt was 1.89%).

Notably, in 2024, Agribank's bad debt in groups 3 and 4 will both decrease sharply (bad debt in group 3 will decrease by 44.1%, bad debt in group 4 will decrease by 30.4%). In particular, Agribank's bad debt in group 5 will increase by 16.2% in 2024 (an increase of VND 3,163 billion), mainly due to debt group transfer.

Agribank's increase in bad debt group 5 is not surprising but is part of the general trend of the banking system.

Previously published financial reports of banks showed that in 2024, bad debt group 5 of 27 banks increased by 39.3%. Some banks such as Techcombank and ABBank even had a growth rate of group 5 debt of over 100%. In the group of big 4 banks, the growth rate of bad debt group 5 in 2024 at Vietcombank was 30%, VietinBank was 49%, BIDV was 55%.

Thus, although Agribank’s bad debt group 5 has increased sharply, it is still much lower than that of other banks in the system. This also reflects the difficulty of the banking industry in recovering and handling bad debt.

Due to active risk provisioning, by the end of 2024, Agribank's bad debt coverage ratio will reach 132%, a slight increase compared to 129% at the end of 2023. Thus, currently, along with BIDV, Vietcombank, Vietinbank, Agribank is one of the 4 commercial banks with the highest bad debt coverage ratio in the market.

As of December 31, 2024, Agribank has a charter capital of VND 51,638 billion, ranking 7th in the system. Currently, Agribank is the state-owned commercial bank with the lowest charter capital in the big 4 group and is lower than many joint stock commercial banks.

At the working session between the banking sector and the Prime Minister, Mr. Pham Toan Vuong, General Director of Agribank, said that Agribank was assigned a credit growth target of 13% in 2025, equivalent to injecting more than VND 200,000 billion into the economy. According to the calculation of Agribank's General Director, if the annual outstanding debt increases by VND 200,000 billion, Agribank needs to add VND 15,000-17,000 billion in equity capital. Therefore, Agribank proposed that the National Assembly and the Government consider a separate mechanism for state-owned commercial banks, including considering providing additional charter capital from Agribank's annual actual profits, at least VND 10,000 billion/year, starting from 2025.

According to the bank's latest information as of the end of the first quarter of 2025, the bank's credit growth reached more than 3%, showing the bank's great efforts in supporting economic growth. And the issue of increasing capital has become even more urgent for Agribank to ensure sufficient capital supply for the economy.

Source: https://thoibaonganhang.vn/agribank-tiep-tuc-giu-vung-vi-tri-ngan-hang-duoc-gui-tien-nhieu-nhat-viet-nam-162293.html

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)