New regulations on management of newly printed money series

The State Bank of Vietnam issued Circular 01/2024/TT-NHNN dated March 29, 2024 regulating the management of newly printed money series.

This Circular stipulates that the management of newly printed money series for State Bank banknotes is carried out from the time the series is issued, the use of the series in the money printing process until the newly printed money is released into circulation.

The Circular clearly states the principles of serial printing in the money printing process: For the types of money announced by the State Bank for issuance before 2003, the serial includes the serial number and a natural number sequence of 07 digits printed from 0000001 onwards; for the types of money announced by the State Bank for issuance from 2003 onwards, the serial includes the serial number and a natural number sequence of 08 digits, in which the two digits adjacent to the serial number are the last two digits of the year of production of the banknote, the next 06 digits are the natural number sequence printed from 000001 onwards; each banknote has its own serial number.

Principles of serial management in the printing process of money at printing and minting establishments:

Printing and minting establishments shall print banknote series according to the above principles. In case a damaged banknote is discovered after the serial printing stage, the printing and minting establishment shall use a banknote with a sub-rhyme to replace it.

The principle of using alternative sub-rhymes is implemented according to the regulations of the printing and minting establishments; the printing and minting establishments organize the storage and management of serial information of each type of money (including sub-rhymes) to ensure the accuracy and completeness of the elements recorded on the seals of newly printed envelopes, packages, bundles of money or other packaging specifications prescribed by the State Bank, including elements such as printing and minting establishments, types of money, serial rhymes, and year of production.

The Circular also regulates the management of newly printed money series during the process of money delivery and receipt as follows:

Printing and minting establishments deliver newly printed money to the State Bank (Department of Issuance and Treasury); deliver and receive newly printed money between Central Treasurys; deliver and receive newly printed money between the Central Treasury and the Transaction Office and State Bank branches; deliver and receive newly printed money between State Bank branches.

The party delivering newly printed money must make a list of the serial numbers of the money types according to regulations, attached with the money delivery and receipt minutes or delivery note.

The recipient is responsible for checking and comparing the contents of the list with the actual delivery; in case of detecting any errors, the recipient must notify the delivery party to agree on adjustments, ensuring that they match the actual delivery.

When transferring newly printed money from the Issuance Reserve Fund to the Issuance Operation Fund at the State Bank branch and vice versa, the warehouse keeper on the delivering side shall make a list of the serial numbers of the money types according to regulations.

The receiving warehouse keeper is responsible for checking and comparing the contents of the list with the actual delivery; in case of detecting errors, the receiving party must notify the delivering party to agree on adjustments, ensuring that they match the actual delivery.

The serial list is signed by the delivering party's warehouse keeper and must accurately show the following elements: Delivering party, receiving party, currency type, quantity, serial number, year of manufacture, symbol of the package, bundle of money or other packaging specifications as prescribed by the State Bank. This list is made in 02 copies, each delivering and receiving party keeps 01 copy.

The Circular takes effect from May 14, 2024.

Mechanism for adjusting new average retail electricity price

The mechanism for adjusting the average retail electricity price was issued by the Prime Minister in Decision 05/2024/QD-TTg, effective from May 15, 2024.

Illustration

Decision 05/2024/QD-TTg clearly states that in case the calculated average electricity price decreases by 1% or more compared to the current average electricity price, Vietnam Electricity Group (EVN) is responsible for reducing the average electricity price by the corresponding level. In case the average electricity price needs to be adjusted to increase by 3% to less than 5% compared to the current average electricity price, EVN decides to adjust the average electricity price up by the corresponding level.

In case the average electricity price needs to be adjusted to increase from 5% to less than 10% compared to the current average electricity price, EVN is allowed to adjust the average electricity price to increase at the corresponding level after reporting and being approved by the Ministry of Industry and Trade.

In case the average electricity price needs to be adjusted to increase by 10% or more compared to the current average electricity price or affect the macroeconomic situation, based on the electricity price plan submitted by EVN, the Ministry of Industry and Trade shall preside over the inspection, review and send it to the Ministry of Finance and relevant ministries and agencies for comments.

Completion of the new Decree on salary reform

On January 5, Resolution 01 on tasks and solutions to implement the Socio-Economic Development Plan and State Budget Estimates for 2024 was issued. In which, the Government has resolved many important contents.

Regarding policies for cadres, civil servants, public employees, and workers, the Government assigned the Ministry of Home Affairs to complete the Decree regulating the new salary regime for cadres, civil servants, public employees, and armed forces in May 2024.

This is the basis for implementing salary policy reform from July 1, 2024.

Preferential policies and support for industrial cluster development

Many preferential policies and support for the development of industrial clusters (ICs) are stipulated in Decree No. 32/2024/ND-CP issued on March 15, 2024 by the Government.

The Decree stipulates investment incentives for: Industrial parks are areas with difficult socio-economic conditions; investment in building technical infrastructure for industrial parks is an industry or profession with special investment incentives.

The application of incentives to investment projects in the construction of technical infrastructure of industrial parks and investment projects in production and business in industrial parks shall be implemented in accordance with the provisions of the law on land, the law on tax, the law on credit and other relevant provisions of law. In cases where the law stipulates different levels of incentives, the highest level of incentives shall apply.

The Decree stipulates that the local budget balances support for investment and development of technical infrastructure systems inside and outside industrial parks in the area. In particular, priority is given to supporting investment in environmental protection infrastructure works of industrial parks that have come into operation; supporting investment in essential common technical infrastructure works of industrial parks in areas with difficult or especially difficult socio-economic conditions, industrial parks developing in the direction of industry linkage, specialization, support, ecology, preservation of traditional crafts...

The State supports no more than 30% of the total investment capital of the project to invest in the construction of technical infrastructure in industrial parks. The support fund is not included in the total investment of the project to calculate the land lease price and infrastructure usage price for investment projects in industrial parks.

The investor in the construction of technical infrastructure of the industrial park is responsible for managing, repairing and regularly operating the supported technical infrastructure works to serve the general operations of the industrial park.

The Provincial People's Committee reports to the People's Council of the same level for decision or decides according to its authority and legal regulations on supporting investment in building technical infrastructure for industrial parks in the area.

The Decree will officially take effect from May 1, 2024.

Regulations on the loss level of national reserve rice and paddy

On March 22, 2024, the Ministry of Finance issued Circular No. 19/2024/TT-BTC stipulating economic and technical norms for preserving national reserve goods and loss norms for national reserve rice and paddy directly managed by the General Department of State Reserves.

According to this circular, the loss rate for sealed rice is as follows: storage time under 12 months is 0.050%; storage time from 12 to 18 months is 0.058%; storage time over 18 months is 0.066%.

This Circular takes effect from May 10, 2024.

New regulations on importing rice and dried tobacco leaves from Cambodia in 2023 and 2024

On April 4, 2024, the Ministry of Industry and Trade issued Circular No. 06/2024/TT-BCT regulating the import of rice and dried tobacco leaves originating from Cambodia under tariff quotas in 2023 and 2024. This Circular takes effect from May 20, 2024 to December 31, 2024.

This Circular stipulates import tariff quotas for rice and dried tobacco leaves originating from the Kingdom of Cambodia that enjoy special preferential import tax rates when imported into Vietnam in 2023 and 2024.

The subjects of application are traders importing under tariff quotas rice and dried tobacco leaves originating from the Kingdom of Cambodia and other related organizations and individuals.

Minh Hoa (according to VietNamNet, Vietnam+, Giao Thong newspaper)

Source

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

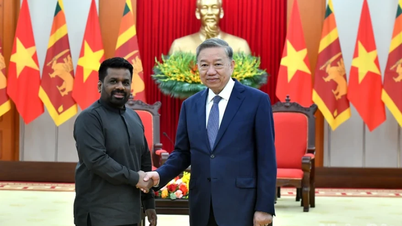

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)