ANTD.VN - Although no late-payment bonds occurred in October 2024, this number could increase to 33% in November, according to a report by VIS Rating.

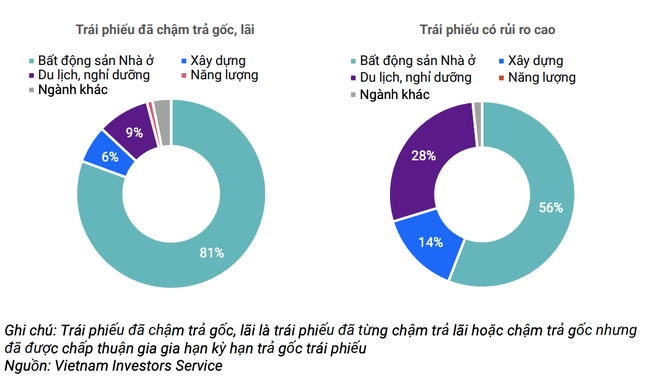

56% of weak credit issuers are real estate and construction businesses.

The October 2024 corporate bond market report by credit rating agency VIS Rating said that the amount of newly issued corporate bonds in October 2024 reached VND 28,100 billion, lower than the VND 56,200 billion in September 2024.

Commercial banks issued a total of VND15,800 billion, continuing to account for the majority of new issuances last month.

Of the bonds issued by banks in October 2024, 20% are subordinated bonds eligible for Tier 2 capital, issued by VietinBank, TPBank, LPBank and BacA Bank. These Tier 2 capital bonds have maturities ranging from 7 to 15 years and interest rates ranging from 6.5% to 7.9% in the first year.

The remaining bonds are unsecured bonds with a term of 3 years and fixed interest rates from 5.0% to 6.0%.

October 2024 recorded one issuer in the infrastructure industry group and one issuer in the banking group issuing to the public with a total value of VND 1,800 billion.

|

Banks remain the dominant issuers of corporate bonds. |

During the month, the number of issuers with credit profiles at the “below average” or weaker level accounted for 11%, an improvement from the previous month (24%). Issuers with weak credit profiles were in the non-financial group.

These entities have Leverage and Debt Coverage Ratios of "Extremely Weak", reflecting that their operations do not generate sufficient earnings and cash flows to repay principal and interest on their loans.

In the first 10 months of 2024, the total amount of new bonds issued reached VND 366,000 billion, higher than the total issuance in 2023. Of which, 11.5% of the total amount of newly issued bonds came from public issuances, the rest were private bonds.

Over the past 10 months, 56% of issuers with weak credit profiles were in the real estate, housing and construction sector. More than half of issuers with weak credit profiles were newly established companies without core business operations.

In addition, several financial institutions issuing bonds in 2024 have weak credit profiles. This group includes small banks, finance companies, and securities companies, with Solvency and Liquidity both at “Below Average” or lower.

33% of bonds maturing in November are at risk of late payment

According to VIS Rating, no new overdue bonds were announced last month.

In the first 10 months of 2024, the total value of newly issued overdue bonds was VND 16,600 billion, VND 137,600 billion lower than the same period last year. The cumulative overdue rate at the end of October 2024 was stable compared to the previous month, at 14.9%. The Energy group had the highest cumulative overdue rate at 45%, while the residential real estate group accounted for 60% of the total overdue bonds.

|

Real estate and construction are the industries with the highest rate of late payment. |

According to VIS Rating, there are still 14 out of 42 bonds maturing in November 2024 with high risk of not being able to repay principal on time. Most of these bonds have been late in paying bond interest before.

33% of bonds maturing in November 2024 are at risk of late principal payment, higher than the rate of 10.5% of bonds late principal payment in 10 months of 2024.

In the next 12 months, there will be about VND109,000 billion of bonds maturing in the residential real estate sector, accounting for nearly half of the total value of maturing bonds. Of this, an estimated VND30,000 billion of bonds are at risk of late principal repayment.

Regarding the handling of overdue corporate bonds, in October, 13 overdue issuers in the fields of residential real estate, energy, and tourism and resorts returned a total of VND269 billion in principal to bondholders.

Of which, 50% of the total outstanding debt repaid in the month came from Yang Trung Wind Power JSC. This energy company has delayed bond interest payments in 2022 and 2023.

The late collection rate of overdue bonds increased by 0.1% to 21.5% at the end of October 2024.

Source: https://www.anninhthudo.vn/khoang-33-trai-phieu-dao-han-thang-11-co-nguy-co-cham-tra-post595062.antd

![[Photo] Solemn opening of the 9th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/ad3b9de4debc46efb4a0e04db0295ad8)

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/bbb34e48c0194f2e81f59748df3f21c7)

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

Comment (0)