This morning, March 29, the price of SJC gold bars was simultaneously raised by SJC, PNJ, and DOJI businesses to a new high, around 98.4 million VND/tael for buying and 100.7 million VND/tael for selling, an increase of 500,000 VND/tael compared to the end of yesterday.

In just 1 week, gold price increased by more than 4 million VND/tael.

Similarly, SJC Company also increased the price of 99.99 gold rings and jewelry gold to 98.2 million VND/tael for buying and 100.4 million VND/tael for selling - an increase of 200,000 VND/tael compared to the end of yesterday.

Since the beginning of the week, the price of gold rings has also increased rapidly by about 3.5 million VND/tael.

Despite the strong fluctuations in gold prices, businesses only kept the difference between buying and selling prices at around VND2-2.2 million/tael. This is much lower than the difference of VND3-4 million/tael during periods of strong gold price fluctuations.

SJC gold bar price continues to set new peak

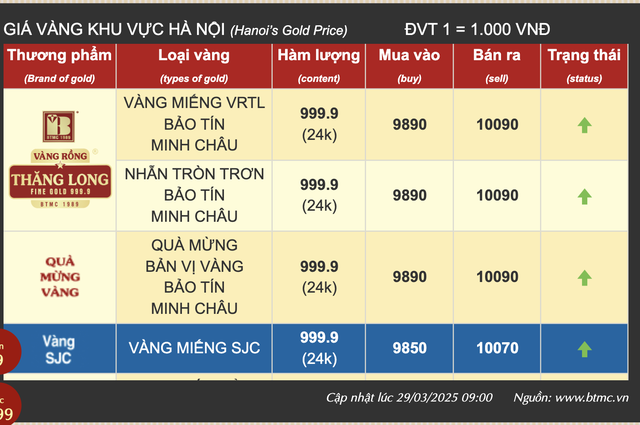

Domestic gold prices also differ between brands. Gold bars of the Vang Rong Thang Long brand of Bao Tin Minh Chau Company are sold for up to 100.9 million VND; plain gold rings of this company are also sold at similar prices. Domestic gold prices are approaching the 101 million VND/tael mark, the highest mark in history.

Some other businesses such as Mi Hong Company traded SJC gold bars for 99.8 million VND/tael in the afternoon sale; plain gold rings for 99 million VND/tael.

Domestic gold prices continued to rise, following the global upward trend. In the international market, the precious metal ended the weekend trading session at a new peak that surpassed all previous records – $3,085/ounce, up about $35/ounce compared to yesterday.

Meanwhile, wine futures prices jumped to $3,126 an ounce.

Gold futures price on world market

Despite repeated warnings that gold prices are rising rapidly, the precious metal continues to break records as cash flows from individual and institutional investors continue to choose the precious metal as a safe haven.

The highest mark of domestic gold price is approximately 101 million VND/tael

According to analysts, the factors driving gold prices are the demand for safe havens amid concerns that the global trade war could intensify due to US President Donald Trump's import tax policy, higher-than-expected US inflation, and plunging international stocks, prompting investors to seek gold. Recently, some banks have continued to raise their gold price forecasts.

Bank of America has raised its gold price forecast to $3,500 an ounce by 2027; Goldman Sachs expects gold prices to reach $3,300 an ounce by the end of this year. However, gold prices do not go up vertically but fluctuate up and down, so experts also recommend that investors and people consider the right time to buy gold, avoid "chasing the peak" and encountering risks.

Currently, the world gold price converted according to the listed exchange rate is about 95.8 million VND/tael.

Source: https://nld.com.vn/gia-vang-trong-nuoc-len-gan-101-trieu-dong-luong-196250329091438842.htm

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

Comment (0)