SJC gold price increased sharply again

At 3:00 p.m. on February 28, 2025, the domestic SJC gold price increased again compared to the early morning of the same day. At Saigon Jewelry Company Limited - SJC, the afternoon SJC gold price was listed at 77.3 million VND/tael for buying and 79.3 million VND/tael for selling. The difference between buying and selling gold at this unit was reduced to 2 million VND. However, this is still a high difference, causing buyers to bear many risks.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted up 400,000 VND for buying and up 380,000 VND for selling.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 3:00 p.m. on February 28, 2024 |

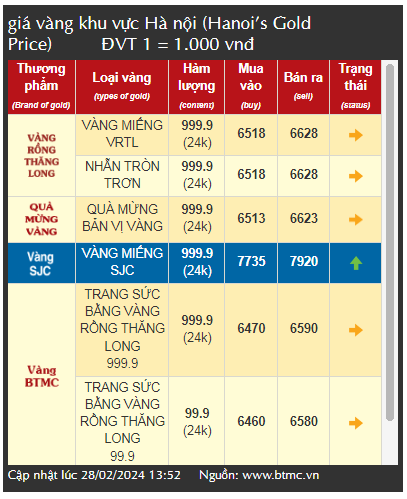

Similarly, at 3:00 p.m. on February 28, 2024, Bao Tin Minh Chau listed the SJC gold price at 77.35 million VND/tael for buying and 79.2 million VND/tael for selling. Compared to the early morning of the same day, the SJC gold price was adjusted by this unit to increase by 150,000 VND for buying and 350,000 VND for selling.

|

| Gold price listed at Bao Tin Minh Chau. Screenshot at 3:00 p.m. on February 28, 2024 |

In the past 1-2 days, the domestic SJC gold price has increased sharply and then decreased immediately after that. The highest increase in the past week was at noon on February 27, when the SJC gold price was sold at 79.5 million VND/tael. Although the domestic SJC gold price fluctuates continuously, according to experts and investors, gold is still a fairly safe investment channel in 2024.

Because among investment channels such as: Securities, real estate... gold is the safest investment channel in the current context even though this investment channel is less profitable. In 2024, domestic gold prices tend to increase due to the influence of world gold prices. Therefore, investors can choose the time to invest to make a profit.

According to Bao Tin Minh Chau representative, today the domestic gold price is still at a high level, so investors and people should consider before trading and regularly monitor gold prices on official channels to make the most correct decision.

In fact, businesses, investors and people are very interested in amending Decree 24/2012/ND-CP dated April 3, 2012 of the Government on the management of gold trading activities.

Economist Can Van Luc said that, in general, the process of anti-goldenization according to the goal of Decree 24/2012/ND-CP has been successful, but this decree was issued 11 years ago and it is time for change. Accordingly, it is necessary to amend it in a direction that is closer to the market context, thereby establishing a balance between supply and demand in the current market.

On the business side, Mr. Nguyen Huu Thuyet, Business Department, Bao Tin Minh Chau Jewelry Company hopes that the amendment of Decree 24 will bring the gold price back to a stable level, no longer much different from the world price. Because, according to Decree 24, the State Bank has a monopoly on the production of SJC gold. At this time, the State Bank controls the production quantity, which can affect the price of SJC gold due to high demand and this is pushing the price up. Meanwhile, gold rings still have domestic supply and demand, so they are close to the world gold price.

How to invest in gold effectively

Gold is considered a good defensive asset and a fairly safe investment channel chosen by many investors in the context of market fluctuations. However, to invest in gold profitably, investors need to monitor geopolitical tensions and economic instability that can greatly affect the demand for gold. Therefore, monitoring global events and fluctuations in the world gold market is necessary, thereby helping investors make informed decisions.

|

| Businesses, investors and people are very interested in the amendment of Decree 24 on the management of gold trading activities. Illustrative photo |

At the same time, investors and people need to balance and divide their investment and consumption portfolios, thereby balancing their money and investing appropriately. Experts always recommend that if you buy gold for investment, you should use idle money to avoid affecting the family economy.

In addition, it is necessary to regularly monitor bank interest rates because interest rates are a factor that investors often ignore when investing in gold. When real interest rates are low, the opportunity cost of holding gold will decrease, making this channel more attractive. On the other hand, investors should monitor the Central Bank's policies and inflation rates to assess the impact on real interest rates and gold prices.

Finally, gold is a long-term investment channel from 6 months to 1 year, investors and people should not buy gold "surfing" to avoid risks.

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)