Domestic gold price on April 6, 2025

At the time of survey at 2:30 p.m. on April 6, 2025, the domestic gold price closed the week sharply down to nearly 100 million. Specifically:

DOJI Group listed the price of SJC gold bars at 97.1-100.1 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. At the end of the week, the gold price decreased by 1.3 million VND/tael for buying - decreased by 600 thousand VND/tael for selling compared to last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 97.1-100.1 million VND/tael (buy - sell), unchanged in both buying and selling compared to yesterday. At the end of the week, the gold price decreased by 1.3 million VND/tael for buying - decreased by 600 thousand VND/tael for selling compared to the previous week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 99.3-100.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 600 thousand VND/tael for buying and increased by 300 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 97.2-100.1 million VND/tael (buying - selling, unchanged in both buying and selling directions compared to yesterday. At the end of the week, gold price decreased by 1.3 million VND/tael for buying - decreased by 600 thousand VND/tael for selling compared to last week.

SJC gold price in Phu Quy is traded by businesses at 97.3-100.1 million VND/tael (buy - sell), gold price increased by 200 thousand VND/tael for buying - unchanged for selling compared to yesterday. At the end of the week, gold price decreased by 1.1 million VND/tael for buying - decreased by 600 thousand VND/tael for selling compared to last week.

As of 2:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 96.7-100.1 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday. At the end of the week, the gold price decreased by 1.7 million VND/tael for buying - decreased by 600 thousand VND/tael for selling compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 97.5-100.5 million VND/tael (buy - sell); unchanged in both buying and selling directions. At the end of the week, the gold price decreased by 1.4 million VND/tael for buying - decreased by 400 thousand VND/tael for selling compared to last week.

The latest gold price list on the afternoon of April 6, 2025 is as follows:

| Gold price today | April 6, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 97.1 | 100.1 | - | - |

| DOJI Group | 97.1 | 100.1 | - | - |

| Red Eyelashes | 99.3 | 100.8 | +600 | +300 |

| PNJ | 97.1 | 100.1 | - | - |

| Vietinbank Gold | 100.1 | - | ||

| Bao Tin Minh Chau | 97.2 | 100.1 | - | - |

| Phu Quy | 97.3 | 100.1 | +200 | - |

| 1. DOJI - Updated: April 6, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 97,100 | 100,100 |

| AVPL/SJC HCM | 97,100 | 100,100 |

| AVPL/SJC DN | 97,100 | 100,100 |

| Raw material 9999 - HN | 96,500 | 99,200 |

| Raw material 999 - HN | 96,400 | 99,100 |

| 2. PNJ - Updated: April 6, 2025 14:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 97,500 | 100.100 |

| HCMC - SJC | 97,100 | 100.100 |

| Hanoi - PNJ | 97,500 | 100.100 |

| Hanoi - SJC | 97,100 | 100.100 |

| Da Nang - PNJ | 97,500 | 100.100 |

| Da Nang - SJC | 97,100 | 100.100 |

| Western Region - PNJ | 97,500 | 100.100 |

| Western Region - SJC | 97,100 | 100.100 |

| Jewelry gold price - PNJ | 97,500 | 100.100 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Southeast | PNJ | 97,500 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 97,500 |

| Jewelry gold price - Jewelry gold 999.9 | 97,500 | 100,000 |

| Jewelry gold price - Jewelry gold 999 | 97,400 | 99,900 |

| Jewelry gold price - Jewelry gold 9920 | 96,800 | 99,300 |

| Jewelry gold price - Jewelry gold 99 | 96,600 | 99,100 |

| Jewelry gold price - 916 gold (22K) | 89,200 | 91,700 |

| Jewelry gold price - 750 gold (18K) | 72,650 | 75,150 |

| Jewelry gold price - 680 gold (16.3K) | 65,650 | 68,150 |

| Jewelry gold price - 650 gold (15.6K) | 62,650 | 65,150 |

| Jewelry gold price - 610 gold (14.6K) | 58,650 | 61,150 |

| Jewelry gold price - 585 gold (14K) | 56,150 | 58,650 |

| Jewelry gold price - 416 gold (10K) | 39,250 | 41,750 |

| Jewelry gold price - 375 gold (9K) | 35,150 | 37,650 |

| Jewelry gold price - 333 gold (8K) | 30,650 | 33,150 |

| 3. SJC - Updated: April 6, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 97,100 | 100,100 |

| SJC gold 5 chi | 97,100 | 100,120 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 97,100 | 100,130 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 97,000 | 100,000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 97,000 | 100,100 |

| Jewelry 99.99% | 97,000 | 99,700 |

| Jewelry 99% | 95,712 | 98,712 |

| Jewelry 68% | 64,952 | 67,952 |

| Jewelry 41.7% | 38,729 | 41,729 |

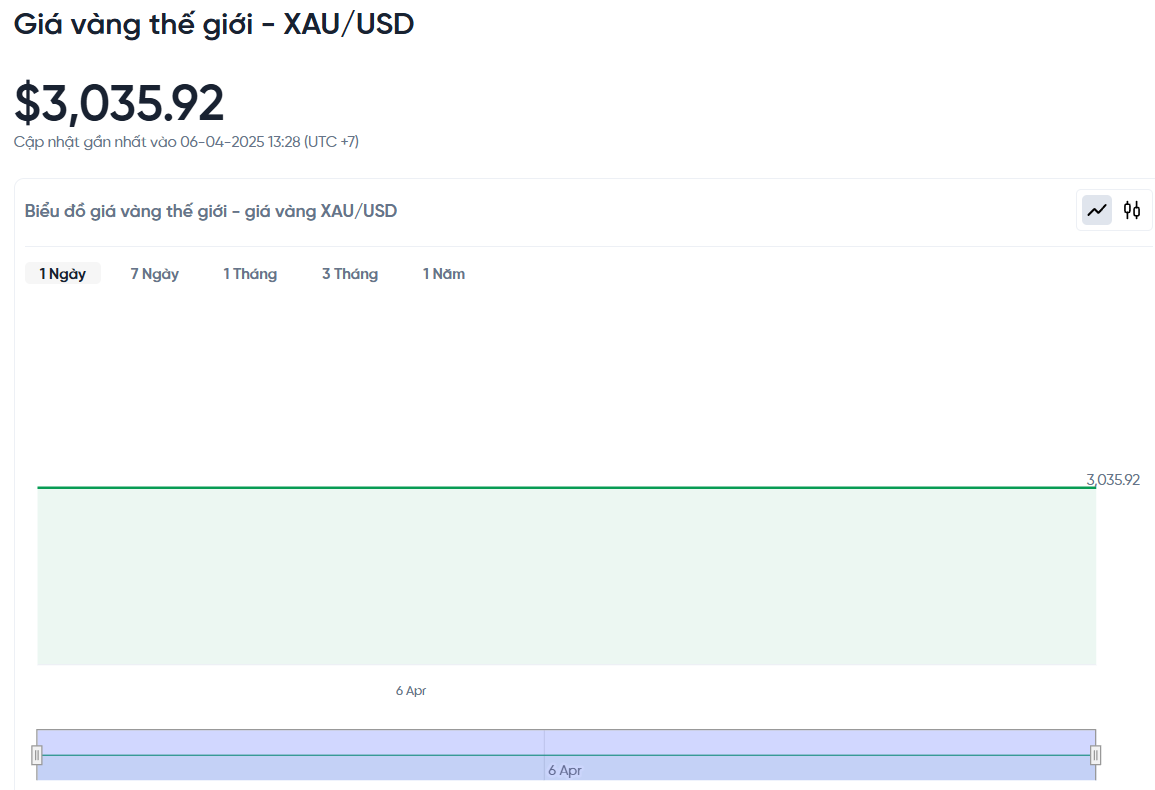

World gold price on the afternoon of April 6, 2025 and chart of world gold price fluctuations in the past 24 hours

According to Kitco, the world gold price recorded at 2:30 p.m. today, Vietnam time, was 3,035.92 USD/ounce. Today's gold price is unchanged from yesterday. Converted according to the USD exchange rate at Vietcombank (25,960 VND/USD), the world gold price is about 95 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 5.1 million VND/tael higher than the international gold price.

The world gold price fell 1.8% this week, ending a five-week streak of consecutive increases, but gold still showed much better resilience than the stock market. Currently, the spot gold price still holds support around $3,000/ounce, although analysts warn that it could continue to fall to $2,800 if selling pressure increases.

Everett Millman, an expert at Gainesville Coins, said the recent price drop was due to investors selling gold and silver to cover losses in their portfolios. He said this usually happens when the stock market drops sharply and investors need cash.

Millman added that there is no clear support for gold if the stock market continues to decline. For gold to stabilize, the market needs policy signals, such as a commitment from the Fed to cut interest rates or launch a new stimulus package. He did not rule out the possibility of gold falling to $2,900 if the situation continues to deteriorate.

Meanwhile, Kevin Grady of Phoenix Futures and Options said the market is in turmoil. He said many people are selling profitable positions to replenish their margin as the stock market plunges. He said big banks were on the sidelines before Mr. Trump announced the tariffs and are now waiting to see what happens.

Grady said he doesn’t see a big rally in gold next week. Many people are struggling to cover margin calls, and commodities are taking profits after a strong rally earlier this year. He also stressed that it will take time for the market to stabilize and find a clear direction.

Grady is also concerned about the risk of a global recession, which could hurt demand for commodities, including gold. He said many investors are now turning to cash because they don't know where to invest.

Experts at CPM Group advise investors to hold their current positions and wait for a buying opportunity when prices fall further. They attribute the recent volatility to concerns about the negative impact of President Trump's new tax policy. Gold rose to nearly $3,196 but quickly fell back to $3,073 as markets sold off.

According to CPM, Trump's tax policy has increased concerns about inflation and recession, making gold a safe-haven asset. However, they currently do not recommend buying or selling, but only consider buying when gold falls to around $3,050 or lower.

Next week, markets will focus on inflation data and policy signals from the Federal Reserve. The minutes of the March FOMC meeting will be released on Wednesday, followed by CPI on Thursday and PPI on Friday. Additionally, the University of Michigan's preliminary consumer sentiment index will be released on Friday morning, reflecting Americans' feelings about the economic outlook.

Gold Price Forecast

This week, of the 16 experts participating in Kitco's survey, 31% predicted gold prices would increase next week, 50% said prices would continue to decrease and 19% predicted gold would go sideways.

Kitco’s online survey of 273 retail investors found that 61% of investors believe gold prices will rise, 26% see them falling and 13% see them staying the same. Overall, investors remain bullish despite the volatility in the market.

Marc Chandler of Bannockburn Global Forex believes that gold prices could continue to fall in the short term. He notes that while central banks may be buying, retail investors have recently viewed gold as a risk asset. Despite a weaker dollar and lower interest rates, gold has been sold off along with stocks. If gold breaks below $3,054, he says, it could fall to $3,030 or $3,000.

Rich Checkan, president of Asset Strategies International, said he expects gold prices to rebound. He said the recent sell-off was just investors raising cash to meet margin calls as stocks tumbled on retaliatory tariffs. He expects strong buying pressure next week.

HSBC said central banks will continue to buy gold this year and next, but the pace of purchases may be slower than the peak period in 2022-2024. Demand for gold may decline if prices rise above $3,000 an ounce, but will rebound if prices fall below around $2,800.

The bank said: "If the gold price falls sharply and continuously below $3,000/ounce, for example near or below $2,700/ounce, it could trigger a sell-off from speculators but at the same time stimulate demand for physical gold and encourage central banks to increase purchases."

Jim Wyckoff, senior analyst at Kitco, predicts that gold prices will move sideways and fluctuate wildly next week. According to him, both buyers and sellers are hesitant, leaving the market lacking clear direction.

Michael Moor of Moor Analytics predicts that gold prices are still in a long-term uptrend since 2015, but may be in the final stages. In the shorter term, he believes prices could continue to correct without significant new buying pressure.

James Stanley from Forex.com also commented that gold is still in an uptrend. He assessed that buying power will remain strong if gold prices adjust to around $3,000.

Source: https://baonghean.vn/gia-vang-chieu-6-4-2025-gia-vang-trong-nuoc-va-the-gioi-cham-dut-chuoi-tang-5-tuan-lien-tiep-10294575.html

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)