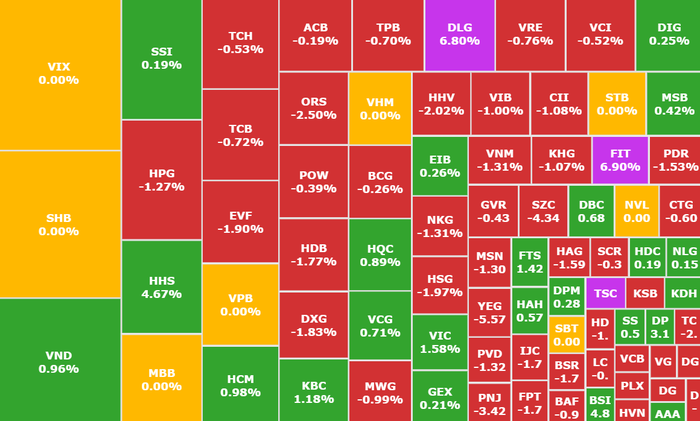

VN-Index lost the 1,320 point mark

The market continued its volatile trading week with constant selling pressure. After five challenges, the VN-Index lost the 1,320-point mark under pressure from blue-chip stocks.

Of which, the group of information technology stocks is the group with the strongest decline in the market, mainly coming from codes FPT (FPT, HOSE), CMG (CMC Corp, HOSE), SMT (SAMETEL, HNX) and HPT (HPT Information Technology, UPCoM).

"Red" also dominated the banking stock group with TCB (Techcombank, HOSE), ACB (ACB, HOSE), TPB (TPBank, HOSE),... all decreasing points, only some codes such as MSB (MSB, HOSE), LPB (LPBank, HOSE), BID (BIDV, HOSE) increasing points.

VN-Index "struggles", strong differentiation between industry groups

The real estate group showed green in large-cap stocks: VIC (Vingroup, HOSE), BCM (BECAMEX, HOSE), KDH (Khang Dien House, HOSE) and KBC (Kinh Bac Urban Area, HOSE). However, the number of stocks that decreased in points accounted for the majority with faces such as VRE (Vincom Retail, HOSE), DXG (Dat Xanh Real Estate, HOSE),...

Securities were a "bright spot" as they quickly recovered and traded actively with HCM (Saigon Securities, HOSE) and VND (VNDirect Securities, HOSE) both increasing by 1%, SSI (SSI Securities, HOSE) increasing slightly by 0.2%,...

Market liquidity increased slightly compared to the previous trading session, with the trading volume of VN-Index reaching more than 636 million shares, equivalent to a value of more than VND 14.3 trillion.

Foreign investors continued to net sell more than 427 billion VND on the HOSE floor, focusing on codes PNJ (PNJ, HOSE), VNM (Vinamilk, HOSE), FPT (FPT, HOSE) and VCB (Vietcombank, HOSE).

Diamond stocks lose steam

The stock market has shown many positive signs since the beginning of 2025, surpassing 1,300 points. Although it has slowed down in the past 2 weeks, the index has still recorded an increase of about 4% since the beginning of the year. However, VNDiamond has decreased by more than 5% since the beginning of the year, mainly due to the correction in the past 2 weeks.

VNDiamond (the "diamond" index) is one of the most notable stock indexes in the market. In the composition of the VNDiamond index, banking stocks are the group with the largest proportion of about 40%. This index has had many periods showing its superiority over the VN-Index.

However, recently, VNDiamond's performance has been far behind VN-Index, mainly due to FPT (FPT, HOSE), MWG (Mobile World, HOSE), PNJ (PNJ, HOSE) losing their form recently. Of which, FPT has been the center of attention recently when it has continuously decreased sharply under pressure from both foreign and domestic investors. From the historical peak in mid-January, FPT's market price has lost 20% and is at its lowest level since August 2024.

PNJ is even at a 1-year low after falling nearly 16% since the beginning of 2025. Supply shortages, gold market problems, and slow recovery in demand for non-essential goods have affected one of the "giants" in the gold and jewelry industry. Meanwhile, MWG has been erratic, almost flat since the beginning of the year.

Related information, on April 21, VNDiamond will restructure its portfolio for the second quarter of 2025.

BIDV Securities (BSC) forecasts that CTD (Cotecons Construction, HOSE) shares may be included in the basket for the first time because they have satisfied the conditions of the index. On the contrary, VRE (Vincom Retail, HOSE) and VIB (VIB, HOSE) may be removed from the index because they do not satisfy the FOL conditions.

Vietnam Airlines and Vietjet Air to invest in 4 hangars for Vietnam's largest airport

According to Notice No. 139 of the Government Office, the Prime Minister highly appreciated the efforts of the Vietnam Airports Corporation (ACV, UPCoM) in implementing Component Project 3, Long Thanh International Airport Project.

The Head of Government requested all investors, contractors and relevant ministries and branches to thoroughly grasp the spirit of maintaining the original goal: Basically completing the Project in 2025 and putting it into commercial operation in the first half of 2026. In particular, regarding Component Project 4, the Prime Minister requested the Ministry of Construction to study the option of selecting investors in special cases according to regulations, so that Vietnam Airlines (HVN, HOSE) can invest in the construction of Hangars 1 and 2, and VietJet Air (VJC, HOSE) can invest in Hangars 3 and 4.

Long Thanh Airport (Photo: Government Newspaper)

The selection of investors must put national interests first, absolutely not allowing "lobbying", "asking - giving", corruption or waste. The two airlines assigned the task must compete to implement, determined to complete on schedule in 2025 as committed. In case of failure to complete, they will be handled according to the law.

In addition, the Prime Minister also requested the Ministry of Construction to promptly complete the dossier adjusting the Long Thanh International Airport Project Phase 1 and submit it to the Prime Minister for approval to have a full basis for implementation according to the requirements of the National Assembly and the Government.

The Long Thanh International Airport project is being built in Long Thanh district, Dong Nai province, with a total investment of more than 16 billion USD and divided into 3 phases. Currently, the project is entering phase 1, expected to be put into operation from 2026 with a capacity of 25 million passengers/year and an investment capital of 5.45 billion USD. Phase 2 (2028–2032) will increase the capacity to 50 million passengers/year. Phase 3 will be implemented after 2035, increasing the total capacity of the airport to 100 million passengers/year, making Long Thanh the largest airport in Vietnam.

Novaland loses nearly 4,400 billion VND in 2024 due to provisioning

No Va Real Estate Investment Group Corporation - Novaland (NVL, HOSE) has just announced its audited financial statements for 2024. Accordingly, the Group's after-tax loss increased by 43 billion compared to the self-made report to 4,394 billion VND.

This is the first year of loss in NVL's operating history. The main reason is due to the provision for the 2024 semi-annual reporting period, according to the auditor's opinion, related to financial obligations arising at the Lakeview City project.

Many Novaland projects are being resolved, expected to flourish this year (Photo: Internet)

Novaland's total consolidated revenue in 2024 from sales and service provision is VND9,073 billion. Of which, net revenue from sales reached nearly VND8,356 billion, up 104% over the same period last year, recorded from handovers at projects.

In 2024, Chairman Bui Thanh Nhon's company handed over 1,422 products from the projects Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram, Sunrise Riverside, Lakeview City, Palm City... and at the same time removed obstacles and awarded hundreds of Certificates of Land Use Rights to customers at many different projects.

In 2025, Novaland aims to hand over more than 3,000 products and issue pink books for more than 7,000 products in a series of projects.

Notably, on April 1, Resolution No. 170/2024/QH15 of the National Assembly on specific mechanisms and policies to remove difficulties and obstacles for projects and land in the inspection and examination conclusions in Ho Chi Minh City, Da Nang and Khanh Hoa province will officially take effect. Accordingly, the problems related to land use fees at NVL's Lakeview City project will be officially resolved.

Regarding the progress of legal settlement in key projects, Novaland is achieving many positive changes, aiming to achieve important legal milestones from the second quarter of 2025. In addition, the project cluster in Ho Chi Minh City will continue to achieve many steps of legal settlement to issue certificates, as well as deploy new projects.

New bullish momentum for stocks in April

According to Pinetree Securities Company, last week was still a difficult week for trading after a period of strong growth since the beginning of the year. Investor sentiment was somewhat more cautious as the VN-Index could not conquer the 1,340-point zone. Investors tended to stay on the sidelines to protect the achievements made since the beginning of the year.

Regarding this week's trend, the Vietnamese market will focus on the reciprocal tax policy on trade partners of the US President Donald Trump's administration on April 2. The scenario is that the VN-Index will move sideways within the range of 1,315 - 1,326 points while waiting for the market to send out new signals.

Estimated figures for the first quarter of 2025 business results are gradually being revealed. April is the season for shareholders' meetings when businesses announce their business plans... which will be a new driving force for stock prices. In a more negative scenario, a shakeout may occur before the market recovers, the VN-Index may fall further to 1,302 points but the possibility of breaking through this threshold is difficult.

Experts assess that VN-Index is ending a period of strong price increase that has lasted for the past 8 weeks and is under pressure to correct and retest support zones. The short-term trend is moving into a correction and accumulation phase with the nearest support zone at 1,315 points and stronger support at 1,300 points.

If the market retreats to the support zone around 1,300 points, it will open up opportunities for disbursement at good capital prices for medium and long-term goals, especially in industries with positive prospects this year such as banking, securities, residential real estate, electricity, and public investment.

Comments and recommendations

Mr. Pham Minh Tien, Investment Consultant, Mirae Asset Securities , assessed that the Vietnamese stock market last week had an adjustment period and recorded a "strong differentiation" between industry groups, liquidity tended to decrease, showing a cautious sentiment.

However, the market still has factors supporting a positive trend, including: The State Bank maintains stable interest rates at a low level (operating interest rates around 4.5-5%/year). As of March 25, 24 domestic commercial banks have adjusted deposit interest rates down, with reductions ranging from 0.1-2%/year. This is an ideal condition for the stock investment channel in terms of attractiveness when compared to other investment channels.

The story of market upgrading will promote foreign capital flows expected to return when the Vietnamese market

In addition, there are expansionary fiscal policies, solving many bottlenecks in real estate from the Government.

In the short term, the industries that benefit include:

Banks : First quarter profits of many banks increased strongly thanks to positive credit growth.

Stocks: Benefit from improved market liquidity and the upcoming market upgrade story. In addition, the possibility of the KRX system being put into operation in May.

Real estate: With preferential credit packages and legal assistance for previous projects, many projects have begun construction and sales.

BSC Securities maintains a positive view in the medium term. Next week, important international information will be released that may open up trading opportunities. This may be an opportunity for investors to consider increasing their holdings during volatile sessions.

TPS Securities expects the next trading session to see a technical recovery from the support level of 1,316 points. In a positive scenario, the VN-Index could head towards the 1,336-point area. On the contrary, if the support level of 1,316 points is lost, the index could fall to 1,293 points.

Dividend schedule this week

According to statistics, there are 5 businesses that have decided to pay dividends for the week of March 31 - April 4, of which 4 businesses pay in cash and 1 business pays in shares.

The highest rate is 15%, the lowest is 5%.

1 company pays by stock:

An Giang Food and Vegetable Joint Stock Company (ANT, UPCoM) closed the ex-right trading date at 3/4, rate 10%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| KHS | HNX | 31/3 | April 14 | 15% |

| TMW | UPCOM | 2/4 | 15/5 | 10% |

| HSG | HOSE | 2/4 | April 28 | 5% |

| NAV | HOSE | 3/4 | April 18 | 5% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-31-3-4-4-vn-index-dieu-chinh-co-hoi-nang-cao-ty-trong-20250331074336385.htm

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

![[Photo] Panorama of the parade celebrating the 50th anniversary of the Liberation of the South and National Reunification](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/affbd72e439d4362962babbf222ffb8b)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

Comment (0)